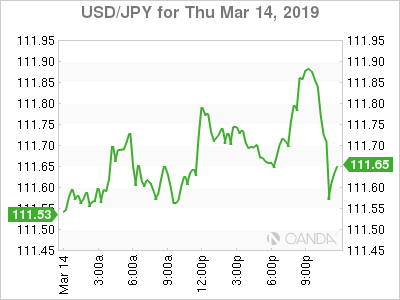

Bank Of Japan Expected To Become More Dovish; Yen Declines

MarketPulse | Mar 15, 2019 01:08AM ET

Tonight’s Bank of Japan (BOJ) rate decision is expected see no policy changes and a downgrade of their assessment of the economy. The Japanese yen has declined on growing expectations that the Bank will become more dovish; current expectations for tonight’s decision is a 44.4% that the BOJ will cut rates by 10 basis points.

The BOJ can’t ignore the terrible data prints on core machine orders, trade and inflation. The global economy remains fragile, especially after markets may have been overly optimistic that a trade deal was going to be reached between China and U.S.

If the BOJ significantly downgrades their outlook that would signal fresh measures will be coming soon. The question would be will they stick to going more deeply negative with rates, adjust their QQE yield control, or increase their asset purchases. Fresh stimulus could continue to weigh on the Japanese yen, but the risk aversion risks could keep safe-haven assets like the yen strong. The BOJ may try to hold off on doing anything and wait and see if see global growth concerns ease over the next couple months.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.