Boardwalk Pipeline Partners’ Distributable Cash Flow

Ron Hiram | Dec 05, 2012 10:50AM ET

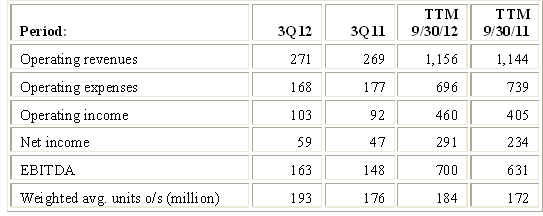

On October, 2012, Boardwalk Pipeline Partners, LP (BWP) reported results of operations for 3Q 2012. Revenues, operating income, net income and earnings before interest, depreciation and amortization and income tax expenses (EBITDA) for 3Q12, 3Q11 and for the trailing 12 months (“TTM”) are summarized in Table 1:

Table 1: Figures in $ Millions, except weighted average units outstanding

In February 2012, BWP acquired from Loews Corporation (L), the parent of BWP’s general partner, the remaining 80% equity interest in Boardwalk HP Storage Company, LLC for $285 million. . Boardwalk HP Storage operates seven high deliverability salt dome natural gas storage caverns in Forrest County, Mississippi, having approximately 29 billion cubic feet (“Bcf”) of total storage capacity, of which approximately 19 Bcf is working gas capacity. It also owns undeveloped land suitable for up to six additional storage caverns. Boardwalk HP Storage contributed ~$37 million of revenues to the TTM ended 9/30/12 (its results for the nine months period ended 9/30/12 are included as if the acquisition had occurred on 1/1/2012). Revenues from parking and lending (“PAL”) services and from firm transportation contracts also increased. But overall revenue growth was minimal due to the offsetting effects of lower natural gas prices on fuel retained in kind (as payment for transportation services) and of lower interruptible transportation service revenues due to a decrease in basis spreads between locations on the pipelines. See article dated 6/4/12, I said I would not be surprised to see additional partnership units being issued later this year. Indeed, in August BWP issued 11.6 million units at $27.80 per unit generating net proceeds of ~$318 million; and in October 2012 it issued 11.2 million units at $26.99 per unit generating net proceeds of ~$298 million. The most recent equity issuance was in connection with a major transaction that occurred subsequent to the end of the third quarter. In October 2012, BWP took a major step in implementing its strategy to diversify from its core business (natural gas pipelines and storage) into the midstream energy businesses by acquiring PL Midstream LLC (now renamed Boardwalk Louisiana Midstream) from PL Logistics LLC for $625 million in cash. Boardwalk Louisiana Midstream provides ~53.5 million barrels of salt-dome storage capacity, 240 miles of pipeline transportation, fractionation and brine supply services for producers and consumers of petrochemicals, natural gas liquids and natural gas. BWP intends to spend an additional $75 million on expansion projects related to this acquisition.

BWP’s major organic growth project is the Southeast Market Expansion. This ~$300 million project involves constructing an interconnection between BWP’s Gulf South Pipeline Company, LP (Gulf South) and Boardwalk HP Storage, adding additional compression facilities and constructing approximately 70 miles of 24” and 30” pipeline in southeastern Mississippi. It

is expected to be placed in service in 4Q 2014 and is fully contracted with a weighted average contract life of ~10 years.

BWP is required to maintain a ratio of consolidated debt to EBITDA of no more than 5:1. Excluding the $100 million of affiliated debt, BWP’s total long-term debt stood at $3.2 billion as of 9/30/12, a multiple of 4.52x EBITDA for the TTM ending 9/30/12. This is an improvement over the 5x ratio in 2Q12 and ~5.5x in 1Q12. There is room for additional debt to finance the remaining ~$116 million of growth capital expenditures planned for 2012 (~$84 million has been spent through 9/30/12).

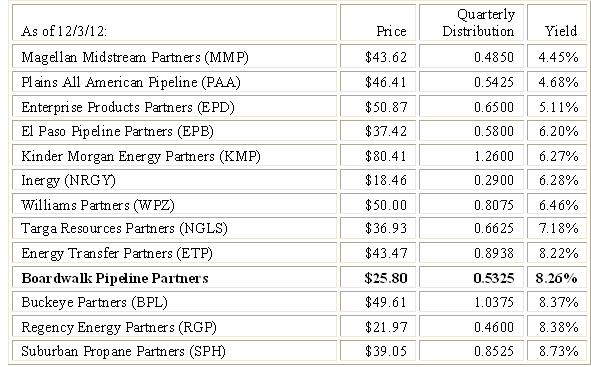

BWP’s current yield compares favorably with many of the other MLPs I follow, as seen in Table 5 below:

However, there has been minimal distribution growth over the TTM ending 9/30/12. Given uncertainty regarding customer contract renewals and its assessment of current market conditions, management decided it would not be prudent to increase distributions. I believe this is a sound decision. But even at their current level, distributions are being funded, in part, by issuing equity. Adding the thin coverage ratio and relatively high leverage to this concern, I still conclude that investors willing to add to their positions should consider other MLPs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.