Bloomberg Explains How Draghi Can “Free Up” $900 Billion; Mish Explains

Mike (Mish) Shedlock | Mar 08, 2016 01:36AM ET

ECB president Mario Draghi is under self-imposed pressure to do something dramatic on March 10 to ward off fictitious problems that he associates with consumer price deflation.

To that end, the market expects Draghi will crawl further down the rabbit hole by cutting its benchmark rate by 10 basis points (0.1 percentage points) to -0.4%.

Will that provide the drama Draghi seeks?

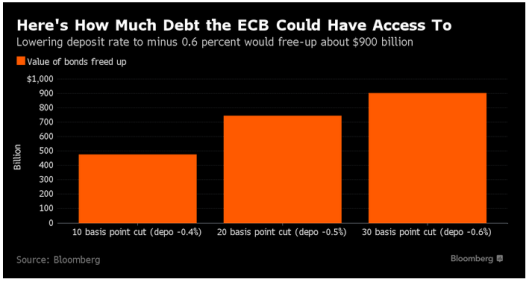

In its post Here’s How Draghi Can Free Up $900 Billion of Debt for QE , Bloomberg estimates Draghi could “free up” $478 billion worth of QE eligible bonds by cutting the rate to -0.4% and $903 billion with a cut to -0.6%.

About $900 billion of sovereign debt that meets maturity criteria for the European Central Bank’s quantitative-easing plan yields less than its deposit rate, putting the securities out of reach of the program. A 10 basis-point cut to minus 0.4 percent at this week’s meeting, the median estimate of economists, would free up about $478 billion, according to the Bloomberg Eurozone Sovereign Bond Index, with 20 and 30 basis-point cuts bringing another $268 billion and $157 billion into play respectively. The risk is the benefits may be short-lived — yields have fallen further since the ECB, led by President Mario Draghi, cut its deposit rate in December.

Freed Up for What?

By “freed up”, Bloomberg means the ECB could cut rates deeper into negative territory so that the ECB’s benchmark rate is lower (more negative) than some $900 billion in bonds that already trade with a yield less than 0.30%.

Bonds trading at yields higher (less negative) than the ECB’s benchmark rate would be eligible for QE.

Ludicrous Example

Got that? Some $900 billion in bonds yield between -0.3% and -0.6%.

The following weekly chart of German 2-year bonds shows yields have been negative since August 23, 2014.

Ludicrous Discussion

It’s clearly ludicrous for bonds to have negative yields, but here we are. And Draghi is expected to increase the degree of ludicrousness on March 10.

Would that “free up” anything?

I expect not. Bond rates are ahead of the ECB, thanks to its telegraphing every move in advance. Here’s a beautiful example, also with Germany 2-year bonds. This time, a daily chart highlights recent action.

.

That big green candle is from the ECB’s last meeting on December 3. At that time, the market threw a hissy fit but Draghi quickly stepped in to promise more action, and the market responded in advance.

Given that ECB asset purchases are run about $60 billion a month, it would take 15 months for the ECB to burn through $900 billion in stimulus.

15 months from now, who knows how deep the rabbit hole will be?

How to Free Up €14 Trillion

A quick check of ECB’s Euro Denominated Securities Report shows the ECB might be able to “free up” €14 trillion ($15.4 trillion) with the right policy move now.

Since that’s where we are ultimately headed, Draghi may as well make that announcement on March 10 and do it all at once.

By the way, I am not sure if such a move a would cause the least bit of consumer price inflation. Instead, it might crash the system.

However, the benefit of such a move is obvious. We could finally get the bazooka proponents to shut up.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.