Bitcoin: Complex Correction To Low $40K Most Likely In Play

Dr. Arnout ter Schure | May 14, 2021 02:35PM ET

In my update about Bitcoin from two weeks ago, I concluded:

“Now may be a good time to be patient and let the market tell us where and when to place a low-risk, high-reward trade.” Because “using the (EWP) combined with technical analysis, there has been a 3-3-5 [waves] move since the late February high. This means two things: … a run to new all-time highs is under way (red path). Or, these smaller five waves are only the start of a more extensive five-wave down sequence (green route). How do we know which option is operable? Simple: If the price of BTC stalls at around $60,000 +/- 1000 and then starts to decline, the green path is operable. But if the price continues to rally past the upper end (>$61K), then the red course is most likely, and BTC should be on its way to $90K+.”

What has happened since then?

First, Bitcoin stalled in the ideal (red) bounce target zone (at $59,587 to be exact vs. my $60K+/-1K forecast).

Second, it revolved around its 50-day simple moving average for most of the time. It appeared investors were waiting for a catalyst to determine the outlined red path vs. green path. On Wednesday, Tesla (NASDAQ:TSLA) suspended vehicle purchases using Bitcoin. There was the trigger, and BTC dropped to as low as $47,000. The red path was negated. Remember, markets are all about probabilities of possibilities, and when one door closes, another one opens.

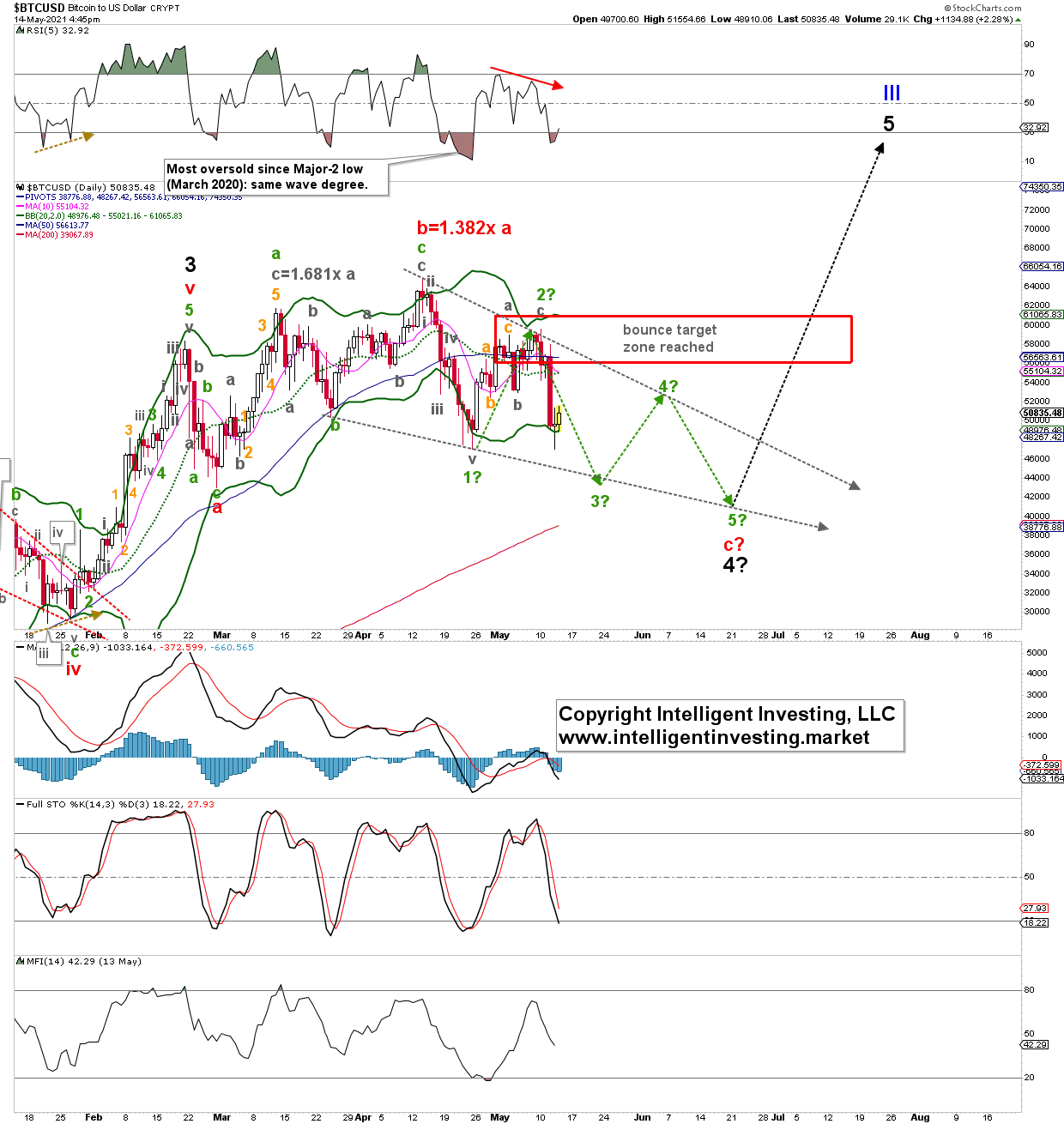

Here I would like to focus on the green path, as shown in Figure 1 below.

Figure 1. Daily Bitcoin candlestick chart, with EWP count and technical indicators

Although I do not have enough price information, given the anticipated short-term rally (green arrow to “2?”) was correct in time and price, I continue to view the current decline as part of an ending diagonal (grey downward pointing arrows) until proven otherwise. Diagonals, or wedges, are terminal patterns: in this case, red intermediate wave-c of black major wave-4. Once a diagonal completes, the rally coming out of it will be swift. In this case, a major wave 5. Unfortunately, ending diagonals are often complex overlapping price structures. Thus, for now, I view green minor wave-3 is under way, subdividing into smaller waves. If BTC stays below $55,100, this is the most viable option.

Bottom line: For now, Bitcoin took the green path as outlined two weeks ago. Therefore, I continue to anticipate a complex price move down to the low $40,000s before the next more significant rally to as high as $90,000+ starts. I will have to change my point of view when BTC rallies back above $59,000 from current levels with a severe warning to the bears on a rally back above $55,100.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.