Bitcoin Analysis: Is It Still a Safe Haven as Market Cap Hits 2021 Levels?

MarketPulse | May 07, 2025 05:01AM ET

- Bitcoin's market share hits a 4-year high, sparking debate about its role as a safe haven asset.

- On-chain data and technical analysis suggest $93,000-$95,000 is a critical price range.

- Bitcoin ETFs are seeing increased inflows, particularly BlackRock's IBIT, signaling potential bullish movement.

- Crypto regulation remains complex, with some states like New Hampshire moving forward while others stall.

Bitcoin prices have been consolidating since April 25, just below the 95000 mark, with a brief foray higher being met by selling pressure. The world's largest cryptocurrency continues to defy market dynamics as it now accounts for around 65% of the entire crypto market cap, the highest level since 2021.

Bitcoin has enjoyed a rollercoaster ride over the past four months, which largely mirrors the overall market dynamic. As usual, the naysayers were once again in full voice as price dipped toward the 75000 mark in early April after markets dealt with the shock of US President Donald Trump's universal tariff announcement.

Since then, however, Bitcoin has risen to a high of around 97900 a gain of around 30% from the early April lows. This is at a time when risk assets have struggled, and safe-haven assets saw significant inflows. Is this another sign that markets are starting to see the world's largest crypto as a safe haven or diversification hedge against uncertainty? I believe it is, but many may disagree.

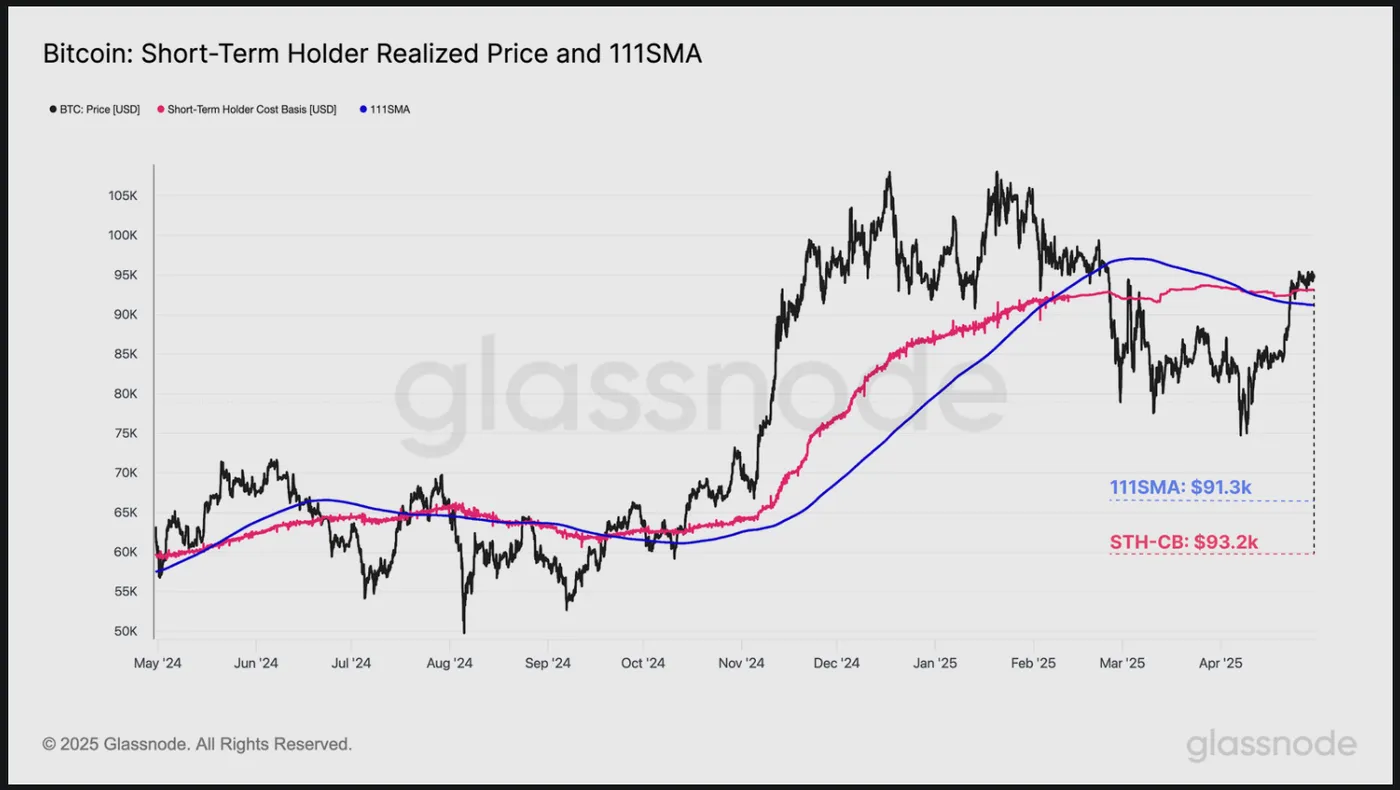

Looking ahead, though, there are differing takes on where Bitcoin may be headed. I have been looking through some data from GlassNode, and there are some interesting takeaways that paint an interesting picture. Let us break these down below.

Glassnode On-Chain Analytics

According to Glassnode, the current price range between 93000 and 95000, where the price found support multiple times between November 2024 and February 2025, may hold the key.

To understand the current market momentum, we can look at how it reacts to key technical and on-chain indicators. When these two align, they give a stronger, clearer signal.

For this analysis, we’re focusing on the 111DMA, a commonly used technical average for measuring Bitcoin momentum, and the Short-Term Holder cost basis, a pricing level that often separates bullish and bearish market trends.

111DMA is at $91.3K, and the Short-Term Holder cost basis is at $93.2K. The price recently moved above both levels and is now trying to stay within this range. This shows a solid upward trend. However, these levels need to be broken and maintained to see further price growth. If the price falls below this zone, it could turn bearish again, leaving investors with significant unrealized losses.

Source: Glassnode

For now price has been holding above these levels with any attempt to break lower being met with significant buying pressure. However, in order for the bulls to take charge a break and consolidation above the 95000 handle will likely be needed.

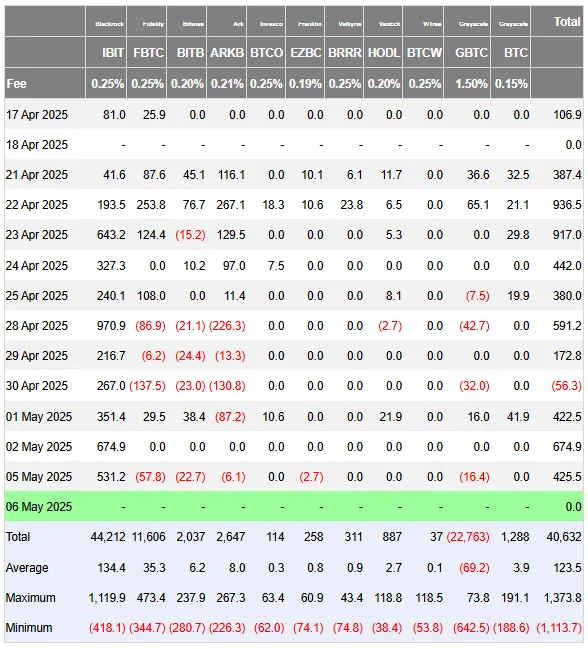

ETF inflows return

Bitcoin ETFs are enjoying a renaissance of late with Blackrock's iShares Bitcoin Trust ETF (NASDAQ:IBIT) trust delivering inflows on Friday, May 2 of $674.91 million. No other Bitcoin ETF saw inflows on Friday

However, ETF flows have been strong since mid-April. The last 3 days however, have seen flows of around $1.52 billion, a sign that a bullish breakout may be incoming?

Source: Farside Investors

Another positive for ETF flows around Bitcoin comes from BlackRock (NYSE:BLK) once more. BlackRock's iShares Bitcoin Trust (IBIT) has brought in more money this year than the biggest gold-backed ETF.

On May 6, Bloomberg’s Senior ETF analyst Eric Balchunas shared that IBIT is now the sixth-highest fund in the US based on year-to-date inflows.

The data shows that IBIT has attracted over $6.9 billion since January, beating SPDR Gold Shares (NYSE:GLD), which brought in about $6.5 billion despite a 23% rise in returns.

Is Regulation Still Coming?

Crypto regulation in the US has been a major talking point in 2025. There had been hopes that regulation would finally get the clarity many had been hoping for. So far, there has been a lot of movement at the SEC and on the regulatory front but it appears that every step forward is followed by two steps back.

Bitwise CIO Matt Hougan worries Congress might mess up key crypto regulations at the last moment. The GENIUS Act, once a bipartisan stablecoin win, lost critical support due to concerns about Trump’s role in crypto. This could stall other crypto bills too.

Still, Hougan believes crypto can hit new highs, with bitcoin possibly soaring past $200K, if Congress passes stablecoin and market structure bills. "The next weeks are critical," he said.

"Legislation failure could mean a tough summer for crypto, but success could spark an unstoppable bull run."

A positive announcement did materialize today, however, with New Hampshire becoming the first U.S. state to approve a "Strategic Bitcoin Reserve" bill, allowing its treasury to invest in digital assets.

Other states, like Arizona, Illinois, Maryland, Michigan, and Texas, are considering similar laws inspired by a plan from a pro-Bitcoin nonprofit.

On the other hand, Florida has put its bills, House Bill 487 and Senate Bill 550, on hold, stopping plans to allow certain public funds to invest in bitcoin.

All in all, a mixed bag and sentiment at present, one could say. There does appear to be more optimism than pessimism at this point, so one can only hope that crypto regulation arrives in time and provides a summer crypto boost that many enthusiasts are hoping for.

Technical Analysis - BTC/USD

Bitcoin (BTC/USD) from a technical standpoint has found support at the 93000 handle, which has held firm since April 25.

Today's daily candle is on course for a close above the 95000 key level and may close as a hammer candlestick.

This could set the stage for further gains, although it is important to remember that the previous foray above this level was met with significant selling pressure at 97000. The next area of resistance rests at the recent high at 97900 before the 100000 level comes into focus.

As long as the 93000 handle holds the bulls will remain interested.

If the 93000 handle makes way then support may be found at 91804 and the psychological 90000 handle.

Bitcoin (BTC/USD) Daily Chart, May 7, 2025

Read More: Trading the FOMC Meeting: Key Levels & Analysis for EURUSD and USDJPY

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.