Big Dollar In Demand Ahead Of July 4th Break

MarketPulse | Jul 03, 2019 06:22AM ET

Wednesday July 3: Five things the markets are talking about

With volumes low and markets skittish, global sovereign bonds have managed to extend their month’s gains ahead of July 4 celebrations stateside tomorrow on the back of weaker economic data. Equities have traded mixed in the overnight session as U.S ten-year Treasury note yields fall to their lowest yields in three-years on fading hopes over the Sino-U.S trade deal and the possibility of fresh tariff hostilities with Europe.

Providing strength to the markets ‘dovish’ tone is the nomination of Christine Lagarde to take the reins of the ECB later this year with many believing that she is willing to provide further market stimulus.

Expect today to be a very quiet day stateside with U.S private hiring, factory orders and the services sector being delivered before an early close. The highlight of this week will be this Friday’s non-farm payroll (NFP) report.

Elsewhere, oil has come off its lows after an industry report showed a contraction in U.S crude stockpiles last week and gold rallied to print a one-week high helped by a ‘subdued’ dollar as renewed concerns over global trade encourages safe-haven demand.

On tap: U.S markets will close early today and all day tomorrow. U.S and Canadian job reports are due Friday.

1. Stocks mixed results.

In Japan, stocks fell overnight, pressured by a stronger yen (¥107.70) and profit taking amongst exporter stocks ahead of July 4th celebrations and jobs data. The Nikkei share average ended -0.5% lower while the broader Topix dropped -0.7%.

Down-under, Aussie stocks ended higher as mining stocks continue to benefit from stronger commodity prices, while a surge in real estate stocks have also lent support. The S&P/ASX 200 index rose +0.5%. In South Korea, the Kospi stock index fell -1.23% as investors worried over grim growth outlooks.

Note: South Korea cut 2019 economic growth target to a seven-year low as the prolonged U.S-China tariff war hit global demand for their manufactured goods.

In China and Hong Kong, stocks dropped as hopes for progress in Sino-U.S trade negotiations weakened. The Shanghai Composite index was down -0.9%, while blue-chip CSI300 index was down -1.1%. At the close of trade, the Hang Seng index was down -0.07%.

In Europe, regional bourses are trading higher and are happy to continue with their positive momentum on the back of record low yields across the region.

U.S stocks are set to open higher (+0.82%).

Indices: Stoxx 600 +0.72% at 392,08, FTSE +0.59% at 7.603,75, DAX +0.76% at 12.622,07, CAC-40 +0.61% at 5.610,66, IBEX-35 +0.85% at 9.360,01, FTSE MIB +1.32% at 21.674,50, SMI +0.55% at 10.076,50, S&P 500 Futures +0.82%

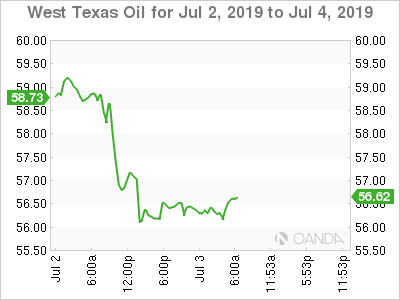

2. Oil steady on U.S stockpile drop

Oil prices are steady after yesterday’s steep fall, supported by extended output cuts by OPEC+ and this despite concerns that a slowing global economy could hurt demand. Global prices are also supported by U.S data showing a larger-than-expected drawdown in inventories.

Brent crude futures for September delivery are trading up +12c, or +0.2%, at +$62.52 a barrel, while U.S crude futures for August are up +16c, or +0.3%, at +$56.41 a barrel.

Note: Both benchmarks fell more than -4% yesterday on investor worries about a slowing global economy.

OPEC+ agreed Tuesday to extend oil supply cuts until March 2020 as members overcame differences to try to prop up prices.

API data yesterday showed that that U.S crude inventories fell by -5M barrels last week, more than the expected decrease of -3M barrels. Expect investors to take their cues from today’s API report at 10:30 am.

Ahead of the U.S open, gold prices have climbed over +1% in the overnight session to hit a one-week high, helped by a subdued ‘big’ dollar on renewed concerns over global trade which have encouraged safe-haven demand. Spot gold has rallied +1.1% at +$1,433.50 per ounce, while U.S gold futures are up +2.1% at +$1,437.7 an ounce.

3. German Bund yields hit record low after ECB nomination

German 10-year government Bund yields slid to a record low of -0.40% earlier this morning on expectations that the European Central Bank’s (ECB) likely new president, Christine Lagarde, will pursue more easy-money policies.

The market is anticipating that Lagarde will oversee further quantitative easing, following her statement after the G-20 meeting that “the global economy has hit a rough patch, with trade as the primary risk.”

Other bond yields are also under pressure across Europe as the market bets on more interest-rate cuts and bond buying as the region is expected to suffer low growth and low inflation rates. Italy’s 10-year bond yields have fallen to +1.741%.

Elsewhere, the yield on 10-year Treasuries has declined -3 bps to +1.95%, the lowest in more than two years, while in the U.K, the 10-year Gilt yield has dipped -2 bps to +0.699%, the lowest in almost three-years.

Earlier this morning, Sweden Riksbank left interest rates unchanged and reiterated its forward guidance that it expected to raise rates at the end of this year or the beginning of next year.

4. Dollar in demand ahead of break

EUR/USD (€1.1270) remains on “soft” footing as ECB would likely loosen monetary policy in the coming months after announcements that IMF’s Lagarde was set to succeed Mario Draghi as the ECB’s President. Dealers noted that Lagarde was likely seen to continue the ECB’s easy-money policy stance.

GBP/USD (£1.2574) is softer by -0.2% in the aftermath of Bank of England’s (BoE) Governor Carney cautious comments on growth yesterday. PMI Services data (see below) for last month also missed expectations and barely stayed in expansion territory. Markets are currently pricing in a BoE rate cut by August 2020.

EUR/SEK (€10.5158) is lower after Sweden’s Riksbank maintained its forward guidance that the next rate move would be higher despite concerns of the global economy. The policy statement also reiterated that inflation was close to +2% target and if conditions changed then monetary policy would be adjusted.

5. UK economy slows as Brexit uncertainty stalls services

Data this morning showed that the U.K economy slowed sharply in the three-months through June as businesses remained uncertain about when and how the country will leave the EU.

The U.K Purchasing Managers Index (PMI) fell to 50.2 in June from 51.0 in May, pointing to stagnation.

Note: Surveys for manufacturing and construction released earlier this week signaled declines in activity in both sectors during June.

IHS Markit said the readings across all sectors point to a slight contraction in the economy. “The latest downturn has followed a gradual deterioration in demand over the past year as Brexit-related uncertainty has increasingly exacerbated the impact of a broader global economic slowdown,” said Chris Williamson, chief business economist at IHS Markit.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.