Beyond Magnificent 7 - Stocks That Could Surprise With Hefty Long-Term Returns

Investing.com | Apr 02, 2024 03:57AM ET

- The S&P 500 index surged in the first quarter, with nearly half of this growth attributed to select top-performing stocks like Nvidia.

- Amid this trend, it's crucial to consider the cyclical nature of the market and its impact on investor sentiment and price trends over the next few years.

- Today's high valuations may translate to lower expected future returns, prompting investors to consider alternative investment opportunities beyond popular choices.

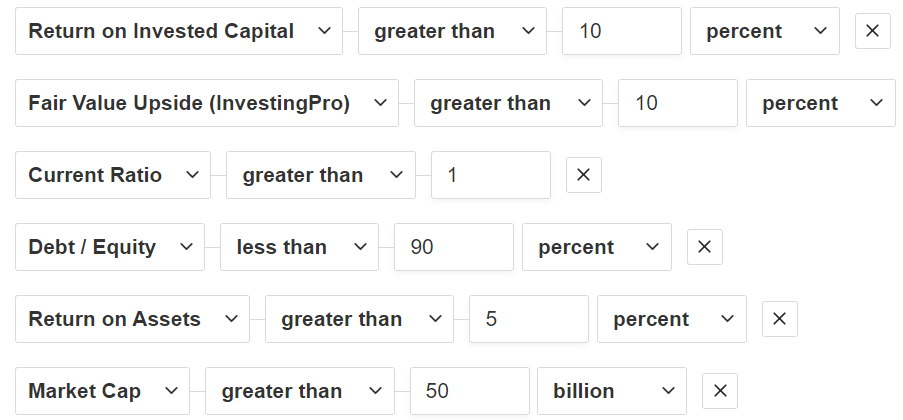

- Return on Invested Capital (ROIC) greater than 10%

- Bullish potential of at least 10%

- Current Ratio exceeding 1

- Debt-to-Capital Ratio below 0.9

- Return on Assets (ROA) surpassing 5%

- Market Capitalization exceeding 50 Billion

- PayPal Holdings (NASDAQ:PYPL)

- Alibaba Group (NYSE:BABA)

- Berkshire Hathaway (NYSE:BRKa)

- Total Energy Services (TSX:TOT)

- Rio Tinto (NYSE:RIO)

- Stellantis NV (NYSE:STLA)

- Cisco Systems (NASDAQ:CSCO)

- ProPicks, stock portfolios managed by artificial intelligence and human expertise

- ProTips, simplified information and data

- Fair Value and Financial Health, 2 indicators that provide immediate insight into the potential and risk of each stock

- Stock screeners and

- Historical Financial Data on thousands of stocks, and many other services!

The S&P 500 index rose by 10.6% in the first quarter. Nearly half of these gains, 4.8% to be specific, came from top-performing stocks like Nvidia (NASDAQ:NVDA).

While many expect this trend to persist for some time, looking ahead 3-5 years from now is essential. The market operates in cycles, with periods of growth and decline impacting both investor sentiment and price trends.

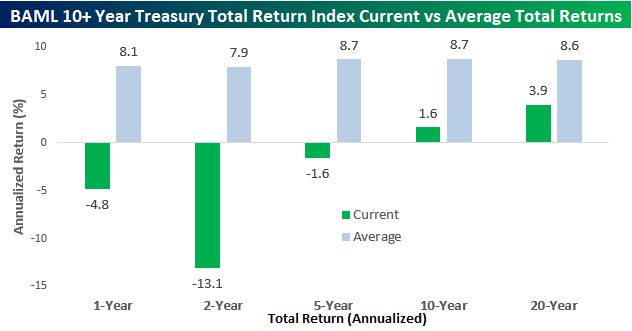

Every investor must remember the golden rule: "Today's high valuations often mean lower expected future returns tomorrow" and vice versa. To validate this rule, one can examine various asset classes, including 10+ Treasuries, among others.

Looking Beyond the Magnificent 7 for Outperformance

The Magnificent 7 have been delivering outstanding returns since 2023 and 2024.

This is quite a turnaround from 2022 when hardly anyone showed interest in them. I recall buying Meta Platforms (NASDAQ:META) during its low points, but back then, many were skeptical about its success due to competition from TikTok.

Now that we've established some solid facts, let's explore some companies that could follow a similar trajectory.

Here's a list of 7 potential stocks that meet specific criteria similar to those used with InvestingPro:

Source: InvestingPro

7 Picks Poised to Outperform

The companies you see listed below are 7 well-known stocks with all of the characteristics above, along with a P/E rating of less than 17 (historical average S&P 500 area)

Many of these companies have faced challenges for a while now, mainly due to falling prices rather than fundamental weaknesses. Typically, they're initially criticized and then overlooked.

Not all of them will bounce back statistically, but we can start assessing those with better odds of delivering higher returns to investors in the future.

While not every stock can be outstanding, potential greatness may hide within each one.

Here's to the next opportunity!

***

DON'T forget to take advantage of the InvestingPro+ discount on the annual plan (click ), and you can find out which stocks are undervalued and which are overvalued thanks to a series of exclusive tools:

That's not all, here's a discount on the annual plan of InvestingPro! click

Disclaimer: The author holds long positions in Paypal, S&P 500 and Nasdaq. This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.