Best And Worst ETFs And Mutual Funds: Mid-Cap Value Style

David Trainer | Oct 23, 2012 07:16AM ET

The mid-cap value style ranks tenth out of the twelve fund styles as detailed in my style rankings for ETFs and mutual funds. It gets my Dangerous rating, which is based on aggregation of ratings of 12 ETFs and 176 mutual funds in the mid-cap value style as of October 22, 2012.

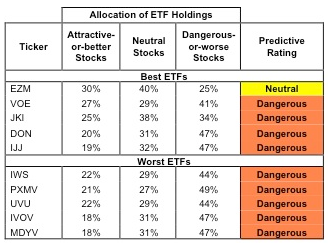

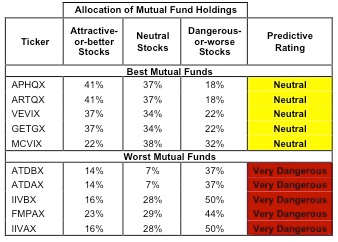

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all mid-cap value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 662), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the mid-cap value style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors should not buy any ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs with the Best and Worst Ratings – Top 5

* Best ETFs exclude ETFs with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

First Trust Mid Cap Value AlphaDEX Fund (FNK) and Rydex S&P Midcap 400 Pure Value (RFV) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best and Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Six mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

WisdomTree MidCap Earnings Fund (EZM) is my top-rated mid-cap value ETF and Artisan Partners Fund, Inc.: Artisan Mid Cap Value Fund (APHQX) is my top-rated mid-cap value mutual fund. Both earn my Neutral rating.

SPDR S&P400 Mid Cap Value ETF (MDYV) is my worst-rated mid-cap value ETF and Transamerica Funds: Transamerica Small/Mid Cap Value (IIVAX) is my worst-rated mid-cap value mutual fund. Both earn a Dangerous-or-below rating.

Figure 3 shows that 386 out of the 1,513 stocks (over 29% of the total net assets) held by mid-cap value ETFs and mutual funds get an Attractive-or-better rating. However, none of the 12 mid-cap value ETFs or 176 mid-cap value mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and mid-cap value ETFs hold poor quality stocks.

Figure 3: Mid-cap Value Style Landscape For ETFs, Mutual Funds and Stocks

Sources:

New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors ”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering mid-cap value ETFs and mutual funds, as no ETF or mutual funds in the mid-cap value style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Investors should focus on individual stocks instead. Here are two very different stocks that are held by mid-cap value mutual funds.

The Progressive Corp (PGR) is one of my favorite stocks held my mid-cap value funds. PGR receives my Very Attractive rating. PGR has generated positive economic earnings eleven out of the past fourteen years. In 2011 they produced an economic earnings margin of 10.5%. This ranks in the 89th percentile of all 3000+ companies in our coverage universe. This level of profitability places PGR among the elite, however the market prices its stock amongst the cheapest.

PGR currently trades at a price-to-economic book of 1.0; this implies the company will never grow its after-tax operating earnings (NOPAT) beyond current levels. Over the past ten years, PGR has grown its after-tax operating earnings 9% compounded annually. Given the company’s past, the market appears overly pessimistic about its future. The market’s low stock price coupled with PGR’s high profitability make it a Very Attractive stock.

Equity Lifestyle Properties, Inc. (ELS) is one of my least favorite stocks held by mid-cap value funds. It receives my Very Dangerous rating. ELS is a value-destroyer. Over the past fourteen years, ELS has never produced positive economic earnings. Many investors have flocked into REITs as they offer high dividend yields in this low interest rate environment.

In seeking this income, they have bid up the price of REITs to the point where they have put their principal at risk. To justify ELS’s stock price of $67.58, the company would have to grow its after-tax operating earnings (NOPAT) at 15%, compounded annually, for the next fourteen years. It is not worth purchasing shares of ELS for its 2.60% dividend yield when the downside risk is so large.

Figures 4 and 5 show the rating landscape of all mid-cap value ETFs and mutual funds.

Our style rankings for ETFs and mutual funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Sources:

New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Sources:

New Constructs, LLC and company filings

Disclosure: I do not own any of the stocks, ETFs or mutual funds in this report. I receive no compensation to write about any specific stock, sector, style or theme.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.