Best And Worst ETFs (And Mutual Funds): Small-Cap Growth

David Trainer | Jul 22, 2012 06:21AM ET

The small-cap growth style ranks ninth out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on aggregation of ratings of 12 ETFs and 478 mutual funds in the small-cap growth style as of July 19, 2012.

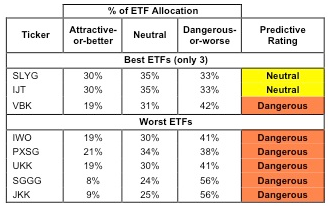

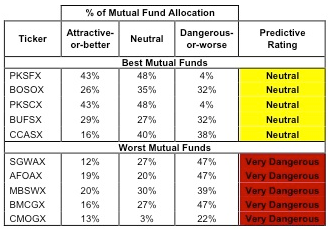

Figure 1 ranks from best to worst the eight small-cap growth ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated small-cap growth mutual funds. Not all small-cap growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 26 to 1170), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the small-cap growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors should not buy any small-cap growth ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Four ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Seven mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

SPDR S&P 600 Small Cap Growth ETF (SLYG) is my top-rated small-cap growth ETF and Virtus Equity Trust: Virtus Small-Cap Core Fund (PKSFX) is my top-rated small-cap growth mutual fund. Both earn my Neutral rating.

iShares Morningstar Small Growth Index Fund (JKK) is my worst-rated small-cap growth ETF and CM Advisors Family of Funds: CM Advisors Opportunity Fund (CMOGX) is my worst-rated small-cap growth mutual fund. Both earn a Dangerous-or-worse rating.

Figure 3 shows that 386 out of the 2043 stocks (20% of the total net assets) held by small-cap growth ETFs and mutual funds get an Attractive-or-better rating. This low allocation to investment worthy stocks is the reason no small-cap growth ETFs or mutual funds are worth buying. None of the 478 mutual funds are justifying their total annual costs.

The takeaways are: small-cap growth mutual fund managers allocate pick poor stocks and small-cap growth ETFs offer exposure to poor quality stocks.

Figure 3: Small-cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors ”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors should not buy any small-cap growth ETFs and mutual funds. None of the small-cap growth ETFs or mutual funds allocate enough value to Attractive-or-better-rated stocks to earn an Attractive-or-better ratings. Investors seeking exposure to mid-cap growth stocks are better of buying Attractive-or-better-rated mid-cap growth stocks.

RLI Corporation (RLI) is one of my favorite stocks held by small-cap growth ETFs and mutual funds and earns my Very Attractive rating. I’m bearish on the Financials sector but RLI is an exception. RLI has generated a return on invested capital (ROIC) over its weighted average cost of capital (WACC) in each of the 14 years in my model and produced positive economic earnings each year. The company’s ROIC of 16% at fiscal year end 2011, places the company in the 87th percentile of all Russell 3000 companies. In spite of strong past performance, the market has a pessimistic view of RLI’s future cash flows. The company’s stock price (~$70.40) implies that after-tax profits (NOPAT) will permanently decrease by 20%. This downturn in performance seems unlikely given that the company has grown profits by an average of 19% over the past 14 years.

TIVo Inc. (TIVO) is one of my least favorite stocks held by small-cap growth ETFs and mutual funds and earns my Very Dangerous rating. Unlike RLI, TIVO has never generated positive economic earnings during the 14 years in my model. To make matters worse, the company is disclosing accounting earnings that are positive and rising. Investors need to be aware of this accounting window dressing. In addition to poor economic earnings, the company’s free cash flows (FCF) have been negative and decreasing in each of the past three years. With a current stock price of (~$7.94) the market believes that TIVO will achieve a drastic improvement in profitability, but all indicators are pointing to the opposite. TIVO offers investors a poor risk/reward tradeoff.

Figures 4 and 5 show the rating landscape of all small-cap growth ETFs and mutual funds.

Figure 4: Separating the Best ETFs From the Worst Funds

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Sources: New Constructs, LLC and company filings

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.