Best And Worst ETFs (And Mutual Funds): Energy Sector

David Trainer | Oct 11, 2012 02:20AM ET

The Energy sector ranks fifth out of the ten sectors detailed in my sector rankings for ETFs and mutual funds. It gets my Neutral rating, which is based on aggregation of ratings of 20 ETFs and 79 mutual funds in the Energy sector as of October 10, 2012.

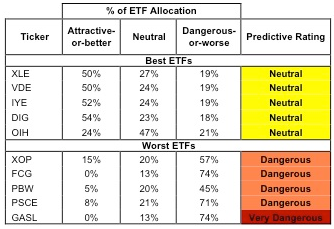

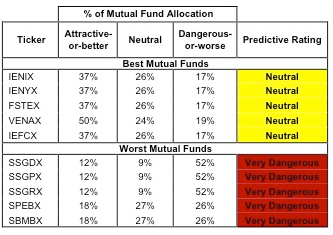

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. Not all Energy sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 23 to 173), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Energy sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

Investors should not buy any Energy ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

PowerShares Dynamic Energy E&P (PXE) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ICON Funds: ICON Energy Fund (ICENX, ICEEX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Energy Select Sector SPDR (XLE) is my top-rated Energy ETF and AIM Sector Funds: Invesco Energy Fund (IENIX) is my top-rated Energy mutual fund. Both earn my Neutral rating.

Direxion Daily Natural Gas Related Bull 3x Shares (GASL) is my worst-rated Energy ETF and Saratoga Advantage Trust: Energy and Basic Materials Portfolio (SBMBX) is my worst-rated Energy mutual fund. Both earn my Very Dangerous rating.

Figure 3 shows that 58 out of the 286 stocks (over 42% of the total net assets) held by Energy ETFs and mutual funds get an Attractive-or-better rating. However, no Energy ETFs or Energy mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Energy ETFs hold poor quality stocks.

Figure 3: Energy Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors ”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Energy ETFs and mutual funds, as no ETFs or Energy mutual funds in the Energy sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. Focus on individual stocks instead.

Chevron Corporation (CVX) is one of my favorite stocks held by Energy ETFs and mutual funds and earns my Attractive rating. CVX currently trades at a steep discount to its no-growth value; its price-to-economic book value is .60, which implies that the market believes CVX’s profitability will permanently decline by 40%. Over the past ten years, CVX’s invested capital has grown 131%. At the same time, CVX’s NOPAT has grown 397%. Growth in operating profits (NOPAT) coupled with asset efficiency creates value for equity holders. Rather than investing in an energy fund where only a portion of the investment will go towards Attractive stocks like CVX, investors should focus on allocating to the specific stocks that earn an Attractive or better rating.

Range Resources Corp (RRC) is one of my least favorite stocks held by Energy ETFs and mutual funds and earns my Dangerous rating. RRC’s ROIC of 3.5% places it in the bottom third of the 3000+ companies we cover. This relatively low ROIC means RRC has had a negative economic earnings margin twelve out of the past fourteen years. To justify RRC’s current stock price, RRC must grow its NOPAT 20% compounded annually for the next 25 years. These high market expectations along with low real earnings power make RRC a Dangerous stock.

170 stocks of the 3000+ I cover are classified as Energy stocks, but due to style drift, Energy ETFs and mutual funds hold 286 stocks.

Figures 4 and 5 show the rating landscape of all Energy ETFs and mutual funds.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Disclosure:

I receive no compensation to write about any specific stock, sector or theme.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.