Believe It Or Not: USD/CHF At Parity, Up On The Year

Matthew Weller | Mar 10, 2015 03:52PM ET

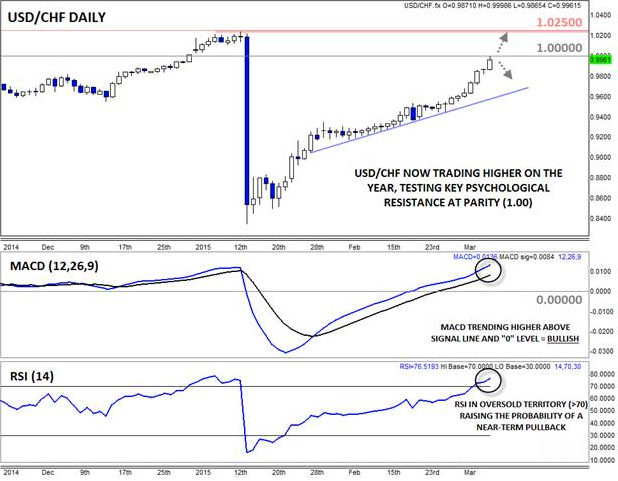

Less than two months after the Swiss National Bank shocked the market by dropping its cap on the franc -- leading to an immediate 20% appreciation in the currency against the US dollar -- the USD has clawed its way back to trade above the yearly open at 0.9936. If someone had predicted that after the SNB’s decision in mid-January, they would no doubt be locked in a mental institution by now. But that fact just serves to underscore the current dollar-bullish environment.

We last checked in with USD/CHF last week , concluding that “bulls should maintain the upper hand as long as rates hold above the bullish trend line near .9530,” but even as USD/CHF bulls, we have been surprised by the ferocity of the rally over the last four trading days. According to our prices, the pair has put in a daily high at .9999 -- close enough to parity (1.00) for government work.

While the USD/CHF bullish train continues to chug along as fast as ever, there is some evidence that it may be getting overcrowded. Beyond key psychological resistance at 1.00, the pair’s RSI indicator is now peeking into overbought territory, increasing the probability of a short-term dip. For now, the MACD is still trending higher above both its signal line and “0” level, showing bullish momentum.

The current technical setup creates a relatively clear outlook for the rest of the week: If USD/CHF can clear the resistance hurdle at 1.00, a bullish continuation toward the year-to-date high at 1.0250 is possible. On the other hand, if prices are unable to pierce that barrier, a pullback toward the medium-term bullish trend line in the .9600s is definitely in play. With no major data beyond Thursday’s US Retail Sales figures scheduled, the pair may continue to trade on technical, rather than fundamental, considerations.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.