Bear Market Risk – A Realistic Assessment

Chris Ciovacco | Mar 23, 2015 03:37PM ET

Bad Weather To Blame?

Recent economic numbers and earnings projections have come in on the soft side. If the rationale below holds water, we have nothing to worry about. From MarketWatch:

Once again, the U.S. economy appears to have slowed in the first quarter. And once again the fault has fallen on several major snowstorms and periods of frigid temperatures that afflicted much of the country in late January and February. That kept consumers away from retail stores during typically busy shopping hours and prevented builders from starting new construction projects, among other things.

Objective View Of Market Risk

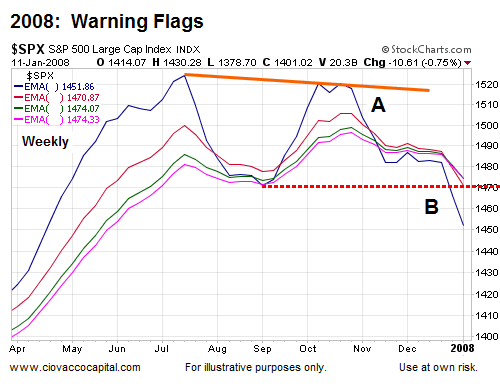

There are many ways to attempt to quantify risk in the stock market. Regardless of whether or not you believe in technical analysis, we know one thing with 100% certainty…we cannot start a new bear market until stocks make a lower high and a lower low. For example, the weekly moving averages shown below made a discernible lower high (near point A) followed by a discernible lower low (near point B) when the S&P 500 was still trading over 1,400 (it eventually fell to 666).

How Does The Same Chart Look Today?

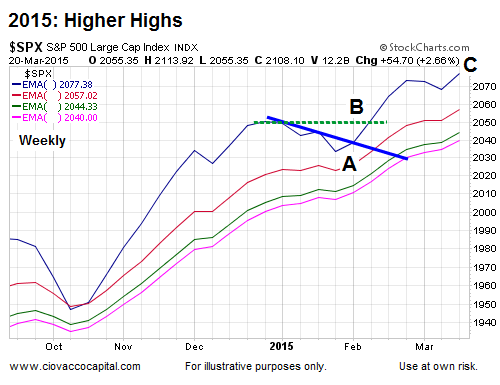

Instead of making a lower low, the same moving averages recently broke above a downward-sloping trendline (near point A), made a higher high (point B) and last week posted another higher high (point C). Recent market action tells us the aggregate opinion of all market participants is much more favorable today than it was in late 2007.

A More Detailed Look

This week’s video looks at the stock market from numerous perspectives to assess risk and potential reward.

Investment Implications – The Weight Of The Evidence

Our market model will begin to reduce equity exposure when the hard data and observable evidence begins to deteriorate. The lower low in December 2007 is an example of observable bearish evidence. Based on the evidence in hand, we continue to hold an equity-heavy allocation. With inflation data, durable goods and GDP coming later this week, we will observe with a flexible and open mind.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.