BayWa: Transitioning To Project-Based Business Model

Edison | Aug 11, 2019 04:12AM ET

Baywa AG Vink. NA O.N. (DE:BYWGnx) is changing its business model so that a higher proportion of revenues are derived from projects, thus adding value and reducing the exposure to fluctuations in demand for agricultural inputs/outputs, heating and fuel oil or building materials. The change is most marked in the Energy segment, with renewables activity – predominantly the sale of wind and solar projects – constituting 42% of group FY18 EBIT. Management is replicating this in other segments, with a JV developing greenhouses in UAE and two housing construction projects in Bavaria. As part of the transition it is selling non-core activities including a stake in Kartoffel-Centrum Bayern, a potato trader and Tessol, its petrol station business.

Energy segment drives H119 results

Group revenues rose by 1.7% year-on-year to €8.4bn driven by customers taking advantage of cheaper heating oil prices. Group EBIT increased by €20.1m to €52.2m, close to the historic average. Strong heating oil sales and international expansion of photovoltaic component sales supported a €10.8m rise in Energy EBIT to €12.1m. Agriculture EBIT rose by €1.2m to €53.6m as improved trading of produce in Germany and above-average margins for fertiliser and seed offset weaker international trade in grain and oilseed. The results from the Building Materials and Innovation/Digitalisation segments were similar to H118. There was also a c €7m benefit at the EBIT level from the switch to IFRS 16.

Strong renewables pipeline

Management has not provided any guidance for FY19 because the exact result is dependent on the weather. However, it is confident that both the Agriculture and Energy segments will show a significant year-on-year increase in earnings, with Building Materials’ earnings remaining at prior year levels. Importantly, the Renewable Energies business is working on projects totalling over 2.7GW globally, 660MW of which are scheduled for sale during FY19, predominantly in Q419. The pipeline was augmented in May 2019 by the acquisition of Forsa Energy’s UK business which secured access to a 350MW pipeline of onshore wind parks in Scotland. Segmental growth is being supported by the issuance of an unrated €500m green bond in June 2019. Additionally, management is planning a private placement in renewable energy subsidiary, BayWa r.e., details as yet undisclosed.

Valuation: Dependent on renewables financing

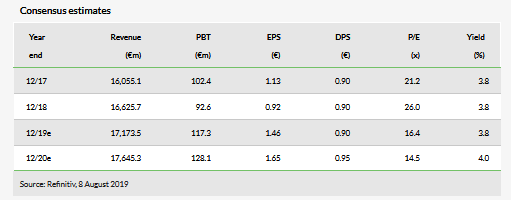

The proposed private placement in BayWa r.e. precludes our forming a view on valuation until further details of the financing arrangements are available.

Business description

Two-thirds of BayWa’s revenues come from the trade of agricultural produce and equipment within Europe and globally. It also trades oil and lubricants in Germany and Austria, has an international renewable energy business focused on solar and wind farms and is a retailer of building materials in Germany.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.