Bank Reserves Still Down On The Year; Should Ramp Up Shortly

Sober Look | Dec 16, 2012 01:26AM ET

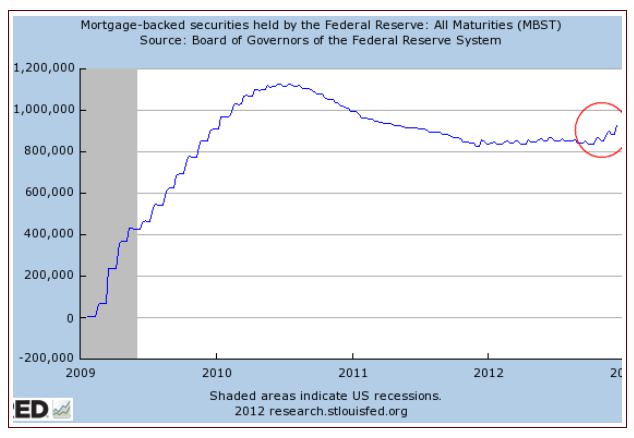

Some MBS settlements have now been reflected on the Fed's balance sheet, as agency paper holdings increase.

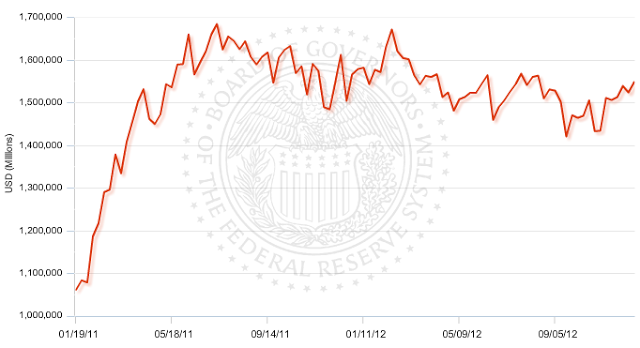

Bank reserves are also gradually moving up, though still down for the year. So far the growth in reserves has been underwhelming.

With the newly announced Treasury purchases, this should pick up steam. And the settlement schedule will be much less "lumpy" than agency MBS.

One thing worth mentioning here is that the US Treasury will be borrowing $45bn a month effectively interest free. That's because the Fed passes interest income back to the Treasury (less its own expenses) via earnings distribution once a year. This certainly helps reduce pressure on Washington to cut spending quickly - the can will be kicked down the road once more.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.