Bank Of Canada Preview: And Hold…

ING Economic and Financial Analysis | Sep 04, 2018 12:53AM ET

The Bank of Canada meets again this Wednesday. Although a surprise rate hike can’t be ruled out completely, a 2Q GDP print fractionally undershooting the consensus and Nafta uncertainty gives us enough reason to favour a pause until October.

The Bank of Canada’s policy tightening journey on hold

We expect the Bank of Canada (BoC) to pause its tightening cycle and maintain the policy rate of 1.5% at the September meeting this Wednesday. But our prediction of a 4Q rate hike still stands - coming as soon as October, although contingent on domestic data staying firm.

We’ve been confident for some time now that the BoC will follow July’s rate hike with another in the second half of 2018, supported by a summer of high inflation and strong growth, but we don’t expect this to come at the September meeting. Two consecutive rate hikes would not be out of character – we saw this just last year – but the 2.9% 2Q GDP figure, which was a touch disappointing amid a deceleration in business investment, suggests the odds for a September hike are low.

Bumper inflation? Not to worry

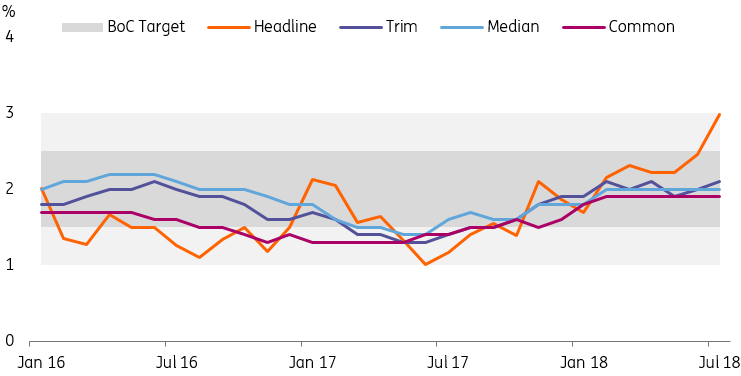

July’s 3% inflation touched what the BoC considers to be the upper bound for CPI, tempting some to back a September hike. However, Governor Stephen Poloz’s most recent statement – although vague – calmed the waters stating, “Our measures of core inflation, which extract all the noise from the data, are all right around two per cent — so, very close to target”, emphasising that policymakers aren’t too concerned about current price levels, which are likely related to the fact that headline CPI has been driven mostly by volatile components.

Core measures show stability, but headline data touches the BoC's upper bound

Typical Trump talk clouds Nafta outlook – again

Promising signs were shown only last week as Canada re-joined Nafta talks, but negotiations concluded on 31 August with no agreement and ‘Trump talk’ fired up again over the weekend, albeit through a series of tweets, dampening the optimism behind a trilateral deal.

A lot of jawboning against Canada was evident in the tweets on Saturday, emphasising that there is "no political necessity to keep Canada in the new NAFTA deal”. This does pose further risks in regard to finalising a deal, but ‘Trump talk’ is generally used as a negotiating tactic – in this case to push for Nafta advancements and unless we see a serious breakdown in the discussions, the BoC’s outlook for another hike in late 2018 should remain intact.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here .”

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.