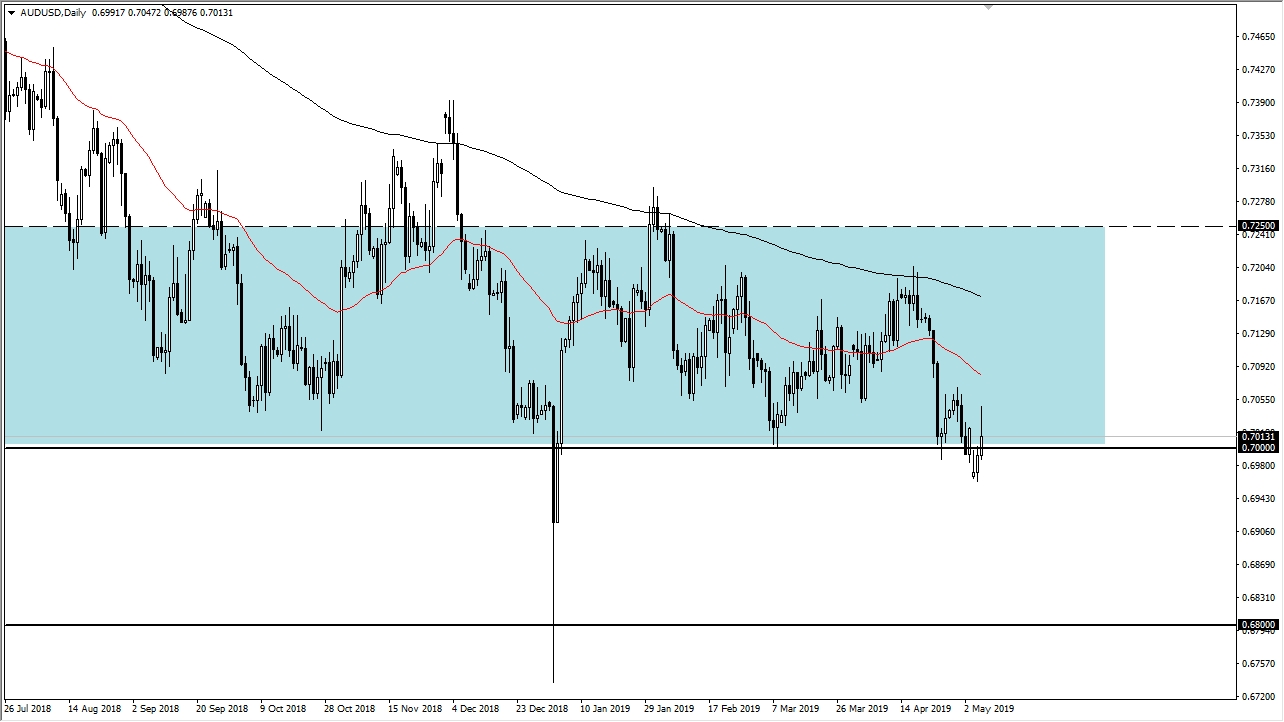

Australian Dollar Rallied Pushing Above 0.70

Forex4you | May 07, 2019 09:01AM ET

The Australian dollar rallied quite nicely during the day on Tuesday and continued to push above the 0.70 level early on. This, of course, is a bullish sign, as the 0.70 level continues to be very crucial on the longer-term charts. With that in mind, the fact that we have moved above to the 0.7050 level is a good sign.

Because of this, it looks as if we are going to continue to see buyers on dips, and as a result, this is probably going to continue to be a short-term basing pattern that we are trying to form. The market has a significant support level all the way down to the 0.68 level, so there are 200 pips worth of support waiting to be taken advantage of. If that’s going to be the case, then look for buying opportunities between here and there. Simply put, this is about the US dollar and not necessarily the Australian dollar. In other words, it comes down to risk appetite.

Take a look around the Forex world, if the US dollar is falling in value then it makes sense to start buying this pair. However, if the greenback is strengthening against most other currencies, then it’s probably best to leave this market alone as there is so much in the way of support. This isn’t to say that we can break down, but quite frankly buying the greenback against other currencies will probably be much easier than trying to short the Aussie here, simply because there’s so much structural support underneath. It’s about relative strength, and of course if the greenback strength and you want to punish some of the weaker currencies out there such as the British pound or possibly the Swiss franc. The Australian dollar has far too much in the way of support underneath it to try to fight that battle.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.