Australasian Market And Economic Roundup: RBA Cash Rate Fixed At 2.5%

Matt Simpson | Jun 03, 2014 04:15AM ET

ASIA ROUNDUP:

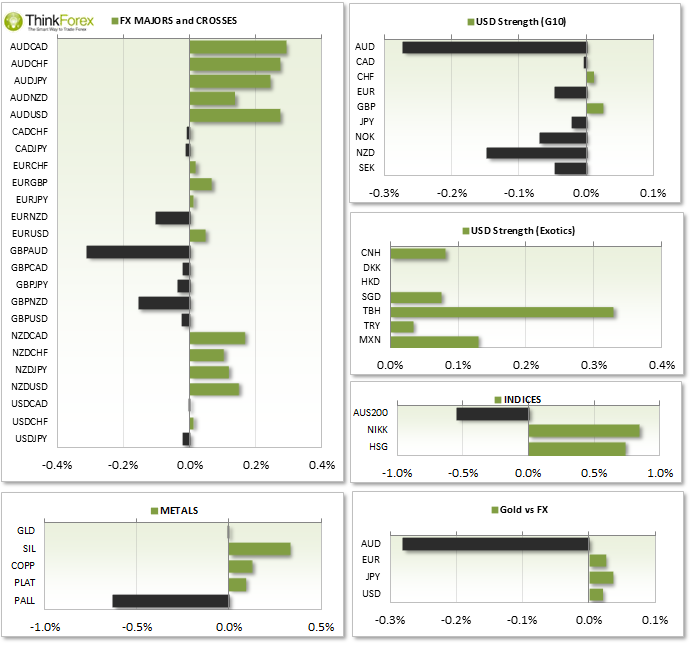

- AUD/USD traded within a 20pip range awaiting the Cash Rate decision, despite red news data from AUD and CNY leading up to the release. AUD retail sales came in less than expected at 0.2% vs 0.3% forecast. Current Account Defecit is at an 11-month low at -5.7Bn vs -7.1Bn forecast to show AUD is riding in demand.

- RBA keep Cash rate fixed at 2.5% .

- CNY Non-Manufacturing came in higher at 55.5 vs 54.8 expected and Final PMI came in slightly lower at 49.4 vs 49.7 expected.

- NZD Overseas Trade Index saw a 3rd consecutive at 1.8% vs 1.9% expected, a 5-month low. NZD currently holding above 0.8435 support at a 3-month low.

UP NEXT:

- EUR CPI is one of the many key indicators ECB monitor for inflation expectations so any short-fall here will add further pressure to take 'drastic action' on Thursday

- US Factory orders are forecast lower for a 2nd consecutive month so number at or above expectations should be USD bullish

TECHNICAL ANALYSIS:

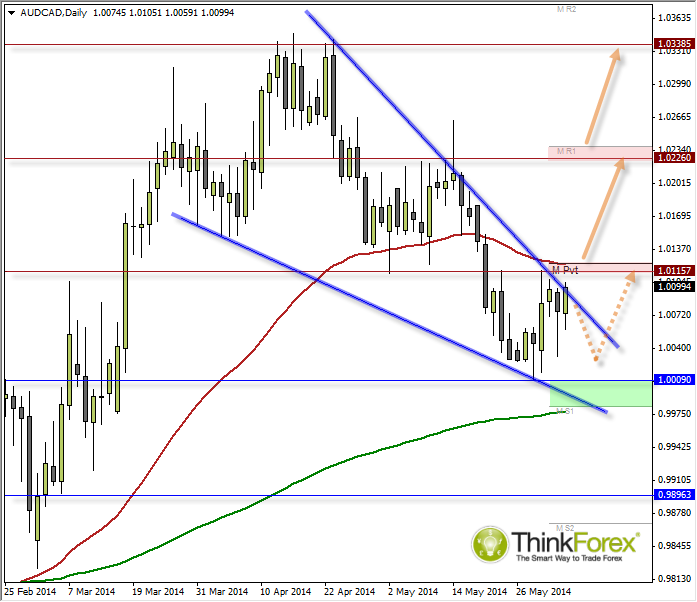

AUD/CAD: 20-week cycle low confirmed?

The Bullish Hammer which respected the 1.0009 support level was the first clue of the cycle low taking place. The following candle was a Bullish Engulfing which promptly tested 1.0115 resistance and trading has taken part in the higher half of this candle range since. Yesterday produced another Bullish Hammer whose lower wick has formed a higher low, with a break above 1.0115 resistance confirming a change in trend.

This area is a significant level because it is the Monthly pivot, 50 day eMA and horizontal S/R so a break above here can be 'assumed; to be a bullish trend continuation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.