Aussie: Here’s What You Can Expect From RBA

Kathy Lien | Nov 04, 2019 04:19PM ET

Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup November 4, 2019

The Australian dollar is in focus this week with a number of market-moving economic reports and a monetary policy announcement on calendar. Having traded to 3-month highs last week, A$ retreated ahead of Monday’s Reserve Bank of Australia monetary policy announcement. No changes to interest rates are expected from the RBA, which cut borrowing costs 3 times in the last 5 months. When it lowered interest rates at its last meeting, the RBA left the door open to additional easing but no one expects another move this year. Interest-rate futures show only a 24% chance of a fourth cut in 2019, which explains why the Australian dollar recovered throughout October.

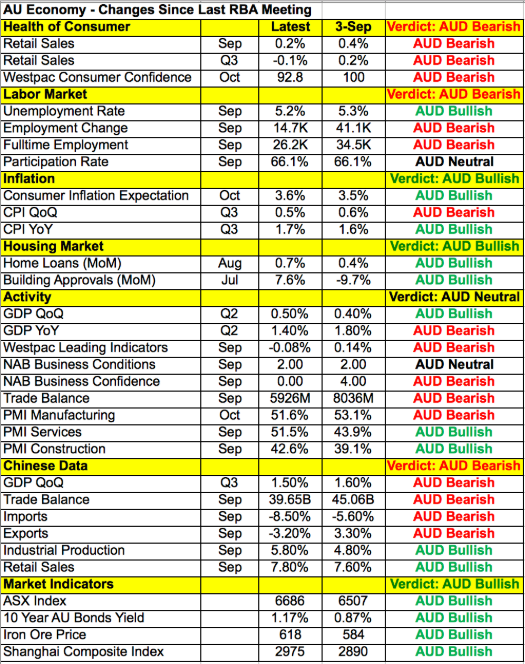

Unfortunately, since the last policy meeting we’ve seen further weakness in Australia’s economy. Sunday night, retail sales missed expectations, growing only 0.2% in September and contracting by -0.1% in the third quarter. Although the labor market is the strongest part of the economy, job growth is slowing. Business confidence and manufacturing activity also weakened as exports and imports in China declined. The only improvements were in the housing market and inflation but according to RBA Deputy Governor DeBelle, the worse is yet to come for Australia’s housing slump.

With RBA Governor Lowe reminding us that he’s prepared to ease rates further late last month, there’s no question that the central bank will maintain a cautious outlook. Despite the rumblings of a phase-one trade deal being close to complete, there’s still significant uncertainty around U.S.-China trade relations and the upcoming December tariffs that will keep the RBA cautious. We don’t expect any major changes to the RBA statement – the tone will remain dovish, which should be enough to trigger additional profit taking in the currency. We expect AUD/USD to pull back to at least .6850 but further losses will hinge on the trade balance, PMIs and China’s trade report.

The New Zealand and Canadian dollars also followed A$ lower. New Zealand has labor-market numbers scheduled for release in the next 24 hours and the risk is to the downside. Meanwhile, we continue to look for the loonie to catch up with other currencies. USD/CAD should be trading above 1.32 and Tuesday’s trade balance report could do the trick by finally shifting USD/CAD momentum to the upside. Euro tumbled despite upward revisions to final manufacturing PMI.

Finally, the main theme Monday was renewed demand for U.S. dollars. The greenback traded higher against all of the major currencies extending its gains above 108.50. U.S. factory orders and durable goods numbers were weaker than expected but between the record high in U.S. stocks and the fact that it still pays to be long dollars, the greenback was the best-performing currency. U.S. trade data is scheduled for release along with non-manufacturing ISM – it will be interesting to see how much softer numbers impact the currency.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.