Aussie Dollar Drops On Coal Ban

MarketPulse | Feb 21, 2019 06:47AM ET

Thursday February 21: Five things the markets are talking about

Euro equities are struggling for direction, unlike most of its Asian counterparts in the overnight session. The ‘big’ dollar has edged a tad higher after Wednesday’s FOMC minutes, while the Chinese yuan extended gains ahead of Sino-U.S trade talks amongst senior officials. Down-under, the AUD (A$0.7108) dropped as much as -1.1% in the overnight session after a news report said China’s Dalian port authorities had banned imports of Australian coal.

Hawkish U-turn

Yesterday’s highly anticipated January Fed minutes did not disappoint. They showed officials see “tighter financial conditions” as one of the biggest risks to the U.S economy. They cited “slower global growth and deteriorating consumer and business sentiment as risks to the outlook.”

Their December statement said the risks were “roughly balanced,” but in the January statement, they dropped this language and instead emphasized that “global economic and financial conditions” called for the Fed to be patient in evaluating the economic outlook. This suggests the Fed has put its plans for rate hikes on hold, despite officials signalling that a rate increase remains on the table.

On tap: The European Central Bank (ECB) releases its monetary policy minutes this morning (07:30 am ET), while Bank of Canada (BoC) Governor Stephen Poloz will also speak on Thursday (12:35 pm ET) and ECB President Mario Draghi speaks on Friday (10:30 am ET), a day after Reserve Bank of Australia (RBA) Governor Philip Lowe gives his parliamentary testimony (05:30 pm ET).

1. Stocks mixed results

In Japan, the Nikkei reversed course and ended higher overnight on investor optimism over Sino-U.S trade talks supporting companies which have large exposure to China. The Nikkei share average ended +0.2% higher, for a fourth consecutive session of gains. The broader Topix ended flat at the close.

Down-under, Aussie stocks traded higher overnight after Australian conglomerate, Wesfarmers (+7%), reported a jump in profit and wider margins, while robust January jobs data boosted overall sentiment. The S&P/ASX 200 Index at the close was +0.7% higher. In S. Korea, the Kospi index recouped losses to end flat overnight following reports that the U.S and China were outlining agreements on the “stickiest trade issues.” The index lost -0.05%.

In Hong Kong, stocks ended higher as signs of progress in trade talks between the U.S and China boosted investor hopes. The Hang Seng index settled +0.41% higher, while the Hang Seng China Enterprises index rose +0.68%.

The outlier was China, were stocks surrendered gains to end lower overnight, as enthusiasm over progress in U.S trade talks gave way to concerns that the PBoC would not resort to aggressive interest rate cuts to boost growth. At the close, the Shanghai Composite index fell -0.34%, while the blue-chip CSI300 index declined -0.27%.

In Europe, regional bourses are trading under caution despite continued trade talk optimism and the promise of patience by the Fed.

U.S stocks are set to open in the ‘black’ (+0.12%).

Indices: Stoxx600 -0.11% at 3, FTSE -0.63% at 7,183.25, DAX +0.17% at 11,421.85, CAC 40 -0.06% at 5,192.70, IBEX-35 0.00% at 9,180.87, FTSE MIB -0.36% at 20,231.50, SMI +0.52% at 9,363.70, S&P 500 Futures +0.12%

2. Oil hovers atop of year highs on cuts, gold little changed

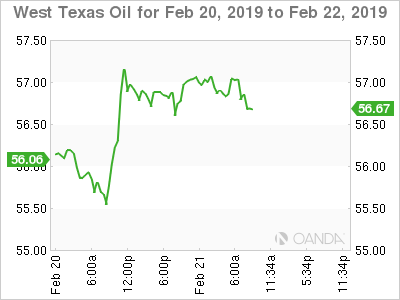

Oil prices hovered atop of this year’s highs this morning, supported by OPEC+ led supply cuts and U.S sanctions on Venezuela and Iran, however, crude prices are capped by slowing growth in the global economy.

Brent crude futures have eased by -14c, or -0.2%, to +$66.94 after touching a 2019 high yesterday at +$67.38, while U.S West Texas Intermediate (WTI) crude oil futures are at +$57.14 a barrel, down -2c, but close to a 2019 high of +$57.55 reached Wednesday.

The supply curbs led by OPEC have helped crude prices rally more than +20% in 2019.

Note: OPEC member Nigeria signaled yesterday that it would limit output after its production climbed last month.

The main factor keeping oil prices from rising even further is soaring U.S output, which rose by more than +2M bpd last year to a record +11.9M bpd.

The increase in production has resulted in rising U.S oil inventories. Data from API yesterday showed that U.S crude oil stocks rose by +1.3M (NYSE:MMM) MMM barrels to +448.5M barrels in the week to Feb. 15.

Expect traders to take direction from this morning’s production data report which is due from the U.S Energy Information Administration (EIA) at 11.00 am ET.

Note: OPEC last week lowered its forecast for growth in world oil demand this year to +1.24M bpd – however, there are some analysts who believe that number “could be weaker still.”

Ahead of the U.S open, gold is trading a tad shy of its 10-month peak as the ‘big’ dollar has gained some support on rate ‘hawks’ optimism that the Fed has another rate hike on their agenda this year. Spot gold is steady at +$1,338.76 per ounce, having touched +$1,346.73 per ounce in the previous session, its highest level since April 2018. U.S gold futures are down -0.5% at +$1,341.80 an ounce.

Note: Investors are also keeping a close eye Sino-U.S trade talks.

3. Eurozone yields back up as PMI’s signal growth

Eurozone bond yields backed up +2-3 bps along the curve after surveys showed business activity was surprisingly firm this month, particularly in France, though poor manufacturing readings across the bloc kept a lid on the move.

French PMI’s showed that French business activity rose more than expected as manufacturing growth helped offset slack in services and this despite the “yellow vests protests.”

In Germany, Europe’s strongest economy, the PMI number was more of a mixed picture, with the services sector accelerating to a five-month high, compensating for a second successive monthly contraction in manufacturing.

Germany’s 10-year Bund yield was +1 bps higher at +0.11%, having hit a one-week high of +0.124% earlier, just after the French PMI survey.

Elsewhere, the yield on U.S 10-year notes climbed +1 bps to +2.66%, while in the U.K, the 10-year Gilt yield advanced +1 bps +1.19%, reaching the highest in two weeks on its fifth straight advance.

4. Aussie dollar drops on coal ban

The AUD (A$0.7108) dropped as much as -1.1% in the overnight session after a news report said China’s Dalian port authorities had banned imports of Australian coal. Apparently, they imposed the indefinite ban covering five harbors at the start of February. Coal was Australia’s second-biggest export in the year through June 2018, making up +15% of exports.

EUR/USD (€1.1342) saw its initial gains erode after the major European PMI data registered mixed readings. Germany’s export-heavy manufacturing sector fell deeper into contraction territory, while Eurozone registered its first contraction in over five years. Investors now wait for this morning’s ECB minutes.

GBP/USD (£1.3064) has drifted off its highs after EU’s Juncker stated that “Brexit was a disaster” and that he was suffering from Brexit fatigue. Could not exclude the possibility of a no deal with terrible consequences. Earlier Chancellor of the Exchequer Hammond had noted that he saw some movement from EU side on backstop issue.

5. U.K posts record budget surplus

Data this morning showed that the U.K. government posted its largest budget surplus for a single month in January.

The ONS said the government brought in +£14.9B more in tax and other revenues during the month than it spent, the largest surplus for a single month since records began in 1993.

Note: January historically tends to be a strong month as it’s the month in which many people settle their tax bills.

The large surplus would suggest that U.K government could still meet its +£25.5B borrowing target, despite a slowing economy.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.