AUD/JPY: Fun With Fibonacci

Neal Gilbert | Mar 09, 2015 03:36PM ET

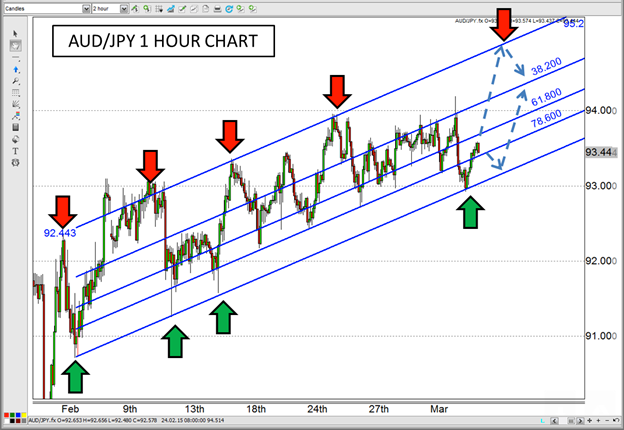

Much of the attention in late North American trade was focused squarely on Apple (NASDAQ:AAPL) as they introduced “the most advanced timepiece ever created” and a two pound golden laptop, as equity markets enjoyed some welcome strength after last week's NFP-initiated drubbing. In concert with equities, the JPY crosses were also making their way higher as they correlated nicely with the stock market. The AUD/JPY in particular has been trending higher since February and has been bouncing off some familiar Fibonacci related levels in the process.

Typically we utilize Fibonacci retracements and extensions from highs to lows or vice versa, but it can also be used within a trend channel to find where potential levels of support and resistance within the channel might lie. Following that doctrine, you can see from the chart below how those levels have fared thus far. If the channel continues to propagate higher, these levels could be relevant for an extended period of time.

Fundamental factors could be conspiring to buoy this pair as well. Japanese GDP was revised down to 0.4% from 0.6% and calls for more easing from the Bank of Japan could be getting louder sooner rather than later. Australia's Business Confidence figures -- which have trended higher over the last couple of releases -- were due out Monday evening. And easier lending policies from the Reserve Bank of Australia may have had a positive effect on businesses in the area. If both the technical and the fundamental forces align for this pair, the question may not be whether it heads higher, but from which Fibonacci line will it bounce.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.