AUD/JPY Rebound Faces First Hurdle

Dailyfx | Jul 15, 2015 03:05AM ET

Talking Points

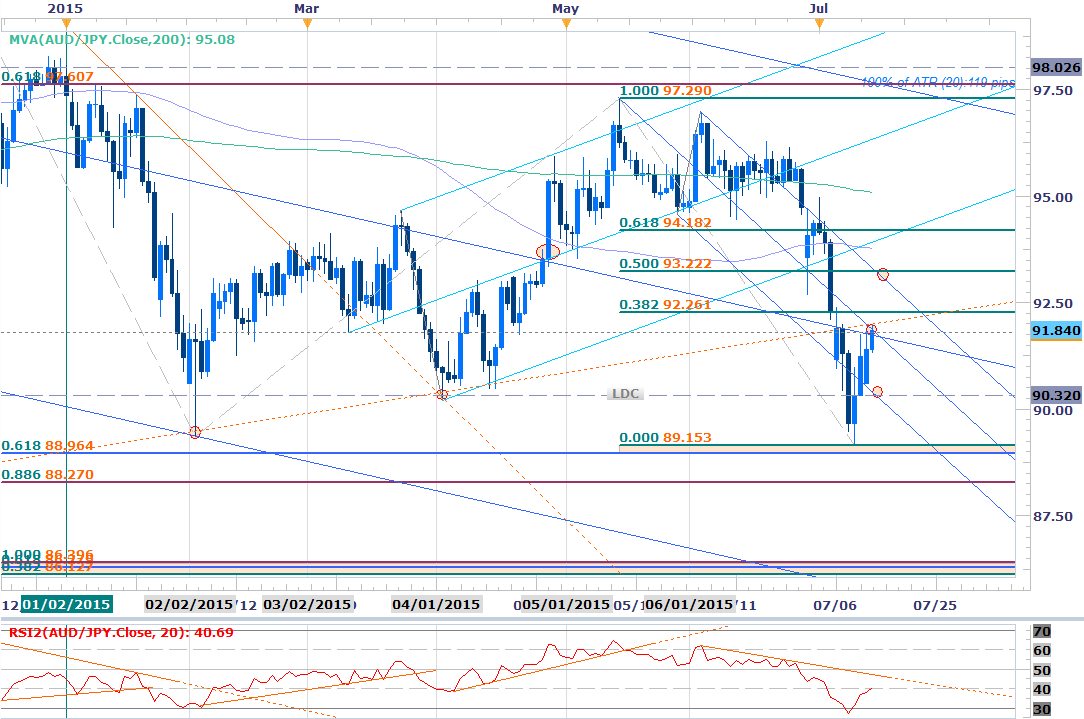

- AUD/JPY testing key near-term resistance confluence- immediate long bias at risk below

- Updated targets and invalidation levels

AUD/JPY Weekly

AUD/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- AUD/JPY approaching resistance confluence ahead of 92.00

- Breach targets 92.26 and the upper median-line parallel / 93.22

- Broader bearish invalidation at 94.18

- Support at 90.32 backed by 88.96-89.15 & 88.27

- Daily RSI approaching 40 resistance- Pending resistance trigger in play

- Event Risk Ahead: China 2Q GDP & BoJ tonight

AUD/JPY 30min

Notes: AUD/JPY has been trading within the confines of a well-defined ascending median-line formation off last week’s lows with the rally now approaching former daily support turned resistance. The rally is at risk here near-term sub-92, but the trade remains constructive while within this formation with a breach higher targets objectives at 92.26, 92.66 and 93.22.

Interim support rests at Friday’s close at 91.24 backed by the lower MLP (bullish invalidation). A break below looks for more significant support at 90.32/45 which is defined by the weekly low and the 2015 low-day close. A quarter of the daily average true range yields profit targets of 29-31pips per scalp. Event risk from the respective economies is somewhat limited but be on the lookout for the BoJ and China data tonight with the releases likely to fuel added volatility in risk sensitive pairs.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.