AUD/CAD At A Bullish-Bearish Crossroad

Matt Simpson | Apr 28, 2014 06:27AM ET

Asian Market Roundup:

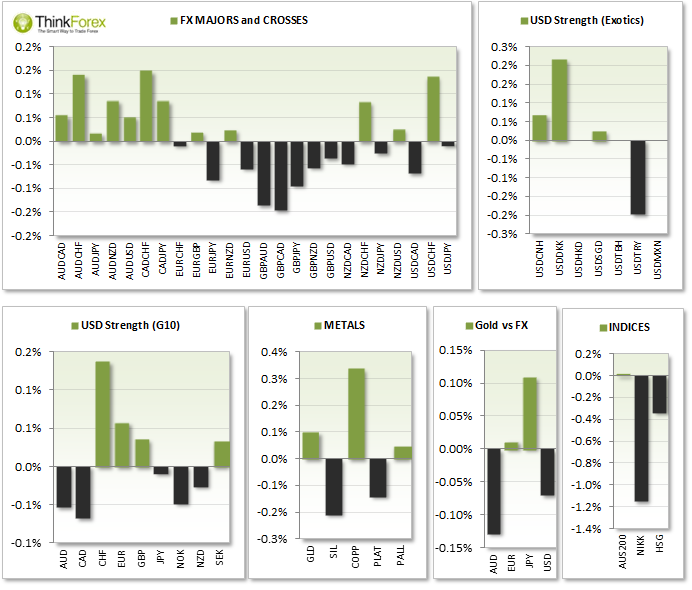

- Japan Retail sales beat expectations and are up 11% y/y and +16.1% ytd; AUDJPY rallied 21 pips; The Yen continued to be one of the stronger currencies of the session as money flowed into safe havens whilst awaiting further news of the Ukraine situation.

- AUS200 held onto multi-year highs after an intraday low tested 5510 support

- Hang Seng was relatively subdued following Friday's abrupt sell-off, ranging near the weekly lows

Upcoming Events:

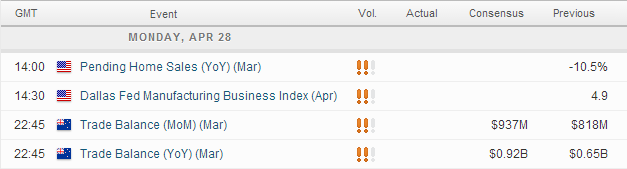

Quiet on 'red news tonight' so albeit any shock news announcements we may find moves fairly limited. Conditions may be better suited for EOD (End of Day Traders) and day-traders, particularly scalpers.

Technical Analysis:

Finding trade setups today has been particularly difficult. Whilst I am sure there are always opportunities, it was tricky finding price action setups that had momentum, supported the price action and ticked my boxes for a trade. For this reason I have selected a very near-term intraday setup and an EOD (End of Day) price action setup to monitor.

EUR/USD: Dead Cat bounce below 1.3825

Whilst we have seen narrow-range trading following the sell-off at open the past 4 candles have tested 1.3825 to the pip. As long as this area caps as resistance and we see a break below the daily pivot then the immediate target is the monthly pivot (and current daily low).

A break above 1.3825 targets 1.383.

You can use these levels to trade towards on lower timeframes such as M5, M15 etc. seeking trends on route to target.

AUD/CAD: Sits at a crossroad between bullish and bearish

For the bearish bias to work out I would like to see 1.0255 cap as resistance and see a clear break below 1.0200 horizontal support and bullish trendline. The 1st target would be 1.010-13, however you could wait for a retracement towards 1.020-22 before seeking bearish trade signals.

However, a break above 1.0255 would favour a swing low to be in place and for a resumption of the bullish trend. Lower timeframes can be traded to target 1.0315 and 1.3045 highs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.