Are Your Pension(s) Safe? Part 2 – Revisiting CalPERS

Elliott Morss | Jul 22, 2015 11:18AM ET

Introduction

In the first part of this two part series, I explained how the pension investment industry worked and why pension holders should keep an eye on them. I pointed out:

- “Pensions” often get sold a bill of goods by companies wanting to manage their assets.

- The structure of the pension industry invites corruption.

I used the California Public Employees’ Retirement System (CalPERS), the second largest pension in the US, as the “poster child” for both problems. And in January 2015, its problems were highlighted when Alfred J.R. Villalobos (pictured above), a former CalPERS board member committed suicide. Villalobos faced trial on federal corruption and bribery charges for allegedly earning about $50 million as a middleman in winning CalPERS investments for private equity clients.

And sadly, Pensions and Investments (P&I) reports that CalPERS is again in the news for the wrong reasons. CalPERS reported it does not know how much it is paying private equity companies for performance. Before getting to this latest “problem”, some background on this pension investment giant is in order.

The CalPERS Investment Structure

CalPERS has investments of just over $300 billion, second only in size in the US to Federal Retirement Thrift (TSP), the Federal government workers’ pension.

Most pensions have investment committees that do all they can to avoid being held responsible for the performance of their investments. How is this done? Typically, it includes hiring a financial consultant to recommend financial institutions to make investments for the pension. This allows the pension committee to blame the consultant and the financial institutions they help pick for bad performance.

CalPERS uses this approach in a unique way.

Source: CalPERS

The Missing Private Equity Performance Fees

CalPERS has invested $32 billion (10.5% of its funds) in 264 private equity companies. As Table 1 indicates, CalPERS negotiates two fees for most managers: a flat fee in the 1% to 2% range and a performance fee ranging from 10% to 20% of gains above an agreed-upon amount. Overall in 2014, the performance fees it paid out were more than two times larger than its flat fee payments.

CalPERS reports that in 2014, it paid $440 million in fees to private equity firms. But P&I reports: “Interviews with CalPERS officials, along with meeting videos and CAlPERS documents show officials do not know what the fund pays in carried interest [performance fees] to private equity firms….” Another CalPERS spokesman was quoted by P&I: “It [private equity performance fees] is not explicitly discussed or accounted for. We can’t track it today.”

WHAAT?

Apparently, having a staff of 2,727 is not enough to allow CalPERS keep track of its private equity performance fees. Another CalPERS spokesman said he believes having a smaller number of private equity firms would allow CalPERS to capture the performance data. Pathetic.

Investing $100 million in a private equity firm should be plenty to get the firm to provide data on performance fees. Arguments that performance fees are complex do not hold up. The financial industry is replete with use of “fair value” accounting. But beyond that, CalPERS is big enough to insist that any private equity company employ performance fee definitions that are readily understandable and verifiable.

The CalPERS and the Federal Retirement Thrift (TSP) Management Models Compared

It is interesting to compare CalPERS management with how the TSP funds are managed. The latter currently has a contract with BlackRock to invest its assets. Its funds are invested so as to replicate the risk and return characteristics of certain benchmark indices. For example, its “C” Fund is invested in a stock index fund replicating the Standard and Poor’s 500 (^GSPC) while its “F” fund replicates a fixed income index.

FRT has a 0.03% expense ratio[2] So stock picking is a pretty random bet, unless you can get new information before anyone else. And as an individual, I know cannot compete with the big investment houses paying millions of dollars to get new information a half a millionth of a second before anyone else. But CalPERS can pay people to get that information before anyone else. With all that it pays out, it should be able to get itself “at the front of the line” for information and outperform TSP using benchmark indices.

Performance

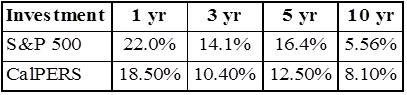

Has it paid off for CalPERS? Table 2 gives compounded growth rates of the S&P 500 and the overall performance of CalPERS. For the 1, 3 and 5 years, the S&P 500 has outperformed CalPERS while the latter was better for the last decade. One might say that is not appropriate to compare CalPERS overall to the S&P because it used other sector allocations than just equity. My response is that CalPERS sets its sector allocations.

Table 2. – Compound Annual Growth Rates ending June 30, 2014

Sources: Yahoo (NASDAQ:YHOO) Finance and CAlPERS Reports

Looking at CAlPERS against TSP, it appears TSP outperformed CAlPERS on equity investments (all but the most recent year) while CAlPERS fixed income performance was superior.

Table 3. – CalPERS and TSP Compared

Sources: TSP and CAlPERS Reports

And how about CalPERS’ private equity performance? The performance of the PowerShares Global Listed Private Equity ETF (NYSE:PSP) is compared against CalPERS in Table 4 and once again, there is no clear winner.

Table 4. – Private Equity Comparisons

Sources: Yahoo Finance and CAlPERS reports

Conclusions

The corruption, the huge amount of money spent on investment decisions, and the apparent ineptitude of CalPERS suggest that the Governor of California should hire a special prosecutor with all the power needed to “turn things around.” And the jury is still out on whether the CalPERS approach of large payments to investment managers is superior to investing in indices as TSP does.

https://www.tsp.gov/investmentfunds/fundsoverview/expenseRatio.shtml

[2] Paul A Samuelson, “Proof That Properly Anticipated Prices Fluctuate Randomly”, Industrial Management Review, 6:2, 1965 (Spring) and Burton G. Malkiel, A Random Walk Down Wall Street, W.W Norton & Co., Inc., 2007.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.