Are You Safe With A Balanced Portfolio?

Chris Ciovacco | May 08, 2014 02:15AM ET

The Roosevelt Institute :

A bond vigilante is a bond market investor who protests a country’s fiscal policies by selling off its bonds and refusing to buy them. This happens when the bond investors perceive the policy to be inflationary, and can act as a check on a government that is over-spending. The proof of vigilante action is high interest rates, as yields rise when investors perceive risk; this makes a government’s cost of borrowing rise.

Bond vigilantes can also come out of the woodwork to protest low-interest rate policies from the Fed. Bond vigilantes worry that excessive money printing will eventually spark inflation, which erodes the purchasing power of interest payments made to bond holders.

Are You Safe With A Balanced Portfolio?

A stock-and-bond-only strategy, often referred to as a balanced portfolio, could have trouble in certain corrective periods. For example, what happens if the next bear market is caused by the Fed losing control of interest rates? The Fed has artificially suppressed rates for years. If all the printed money in the system eventually leads to inflation, bond vigilantes could sell bonds, causing interest rates to spike. Rising interest rates can be a drag on economic growth. Under that scenario, both stocks and bonds could get hit hard simultaneously. A balanced portfolio has no place to hide when stocks and bonds are both declining in value.

A Spike In Rates, Is A Spike In Rates

Can stocks and bond fall in unison? Sure they can. It becomes more expensive to borrow as interest rates rise, which can impact corporate profit margins. The negative impact of higher rates on economic growth comes regardless of the “why” behind a sell-off in bonds. Therefore, any period in history when bonds and stocks sold off simultaneously can provide a glimpse of what a bear market caused by the Fed losing control of rates might look like.

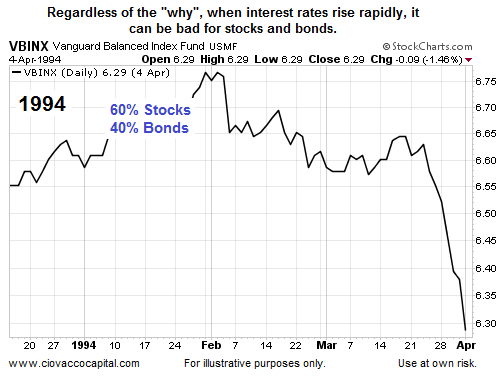

1994: Rates Went Up And Stocks Went Down

The Vanguard Balanced Index (VBINX) basically invests in a mix of 60% stocks and 40% bonds, meaning it can serve as a proxy for a balanced portfolio. The chart below shows the performance of the fund during a 1994 spike in interest rates.

Manipulated Markets Mean Higher Risk

When we use the term manipulated we are not talking about Area 51-like scenarios or complex conspiracies. The Fed manipulates/distorts markets all the time. When you artificially suppress interest rates, it impacts the pricing mechanisms of both the stock and bond markets, along with countless others.

The chart above is like a spring that has been compressed by Fed policy. If inflation expectations pick up in the coming years, the spring could be released by the bond vigilantes.

Investment Implications – Fixed Allocations Can Be Dangerous

Could a static mix of stocks and bonds perform well in the coming years? Sure it could. Could the same balanced portfolio get hammered under the inflation/vigilante/Fed-losing-control-of-rates scenario outlined above? It is well within reason, meaning the risk is something to think about.

Wait a minute…aren’t you basically holding stocks (SPY), bonds (TLT), and cash right now? Yes, we have a mixed allocation to align with the current indecisive market profile. The difference between our market model and a balanced portfolio is we make adjustments as conditions change. If stocks and bonds become unattractive, the model can allocate to cash, currencies, commodities, precious metals, etc. We have places to run and hide. A balanced portfolio does not.

Can We Stock Pick Our Way Out?

A fair question may be can’t we just invest in individual stocks during the next bear market or stock-pick our way to success? It is possible, but very difficult to do in the real world since the vast majority of stocks decline in value during a bear market. For example, could we have invested in blue chips in the wake of the dot-com bust and minimized the damage? For the answer, see the chart below.

This entry was posted on Wednesday, May 7th, 2014 at 7:06 pm and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.