Are We On The Verge Of Stocks Pullback?

Monica Kingsley | Apr 07, 2021 12:42PM ET

S&P 500 is still consolidating Monday's sharp gains. Yet, it seems that eking out further gains is getting harder as the price action took the index quite far from its key moving averages. If I had to pick one sign of stiffer headwinds ahead, it would be the tech sector's reaction to another daily retreat in Treasury yields. The sector didn't rally, and neither did the Dow Jones Industrial Average. Value stocks saved the day, and it appears we're about to see them start doing better again, relatively speaking.

Yes, the risk-reward ratio for the bulls is at unsavory levels in the short run. What about being short at this moment then? It all depends upon the trading style, risk tolerance and time horizon. I'm not looking for stocks making a major top here as the bull run is intact .

My prognosis for yesterday's session materialized, and we have seen quite a record number (around 95%) of stocks trading above their 200-day moving averages , which is similar to the setup right after the post-dotcom bubble bear market 2002/3 lows, or 1-2 years after the bull market run off the March 2009 lows. Hard to say which one is more hated, but I see the run from March 2020 generational low as the gold medal winner, especially given the denial accompanying it since.

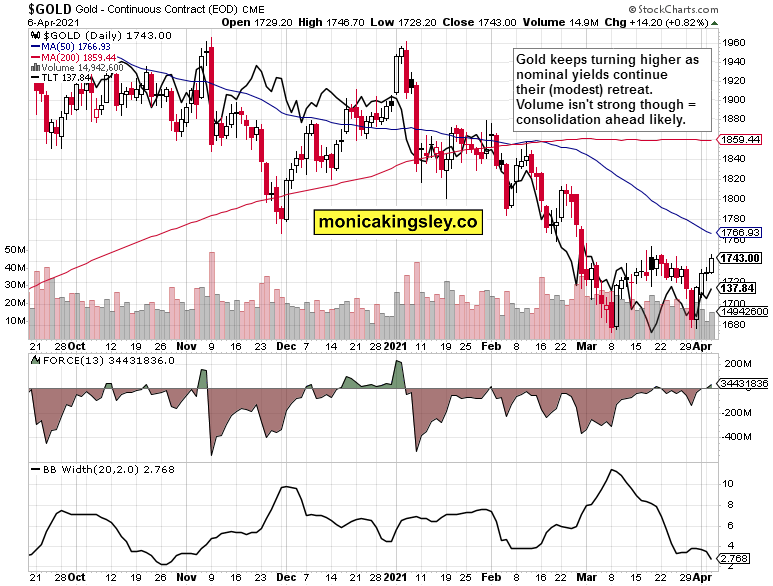

Gold made a run above $1,740 in line with retreating yields and copper not giving up much gained ground, but the immediate run‘s continuation to the key $1,760s or even better above $1,775 looks set to have to wait for a few sessions. I don't expect today's FOMC minutes release to change that. While the metals are likely to take their time, the healthy miners' outperformance supports its continuation once the soft patch we appear entering, is over.

The dollar downswing is playing out, putting a floor below the commodities, which are undergoing a much needed correction from their late February top. It's not over yet, and the shy AUD/USD upswing is but one clue. Given the oil price meandering around $60 (by the way, not even the unlikely decline to $52 would break black gold's bull run), the USD/CAD performance as of late is disappointing, as the greenback got mostly stronger since mid March. More patience in the commodities arena appears probable as we're waiting for both Treasury yields and inflation expectations to start rising again.

Let's move right into the charts (all courtesy of www.stockcharts.com ).

Gold And Silver

Gold‘s Force index finally crossed into positive territory, but the yellow metal isn't taking yet advantage of retreating yields in a visually outstanding way. Quite some resistance in the $1,740s needs to be cleared first, which would likely take a while, but the rally's internals are still on the bulls' side.

Gold miners keep strongly outperforming the yellow metal, with the seniors (GDX (NYSE:GDX) ETF) doing particularly great – better than gold juniors or silver miners. Seeing signs of the silver sector getting too ahead, wouldn‘t likely be bullish at all unless sustained – at the current stage, I can‘t underline these words enough in the ongoing physical silver squeeze.

Gold To Silver Ratios

Since the gold bottom was hit in early March (that's still the leading hypothesis), the precious metals' leadership has moved to the yellow metal – and it's visible in both the gold-to-silver ratio and gold miners to silver miners one. The time for the white metal to (out)shine would come, but clearly isn't and won't be here any day now.

Summary

Precious metals are likely to run into short-term headwinds before clearing out the next major set of resistances above $1,760s. The upswing though remains healthy and progressing, and will be led by the gold sector.

S&P 500 is likely to keep consolidating gained ground, and (shallow) bear raids wouldn'‘t be unexpected here – in spite of solid corporate credit markets performance. Yet, it's the extraordinary nature of VIX trading and put/call ratio moves, that point to the bull market run as intact and merely in need of a breather.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.