Are Stocks Discounting A Massive China Devaluation?

Phoenix Capital Research | Aug 25, 2019 02:53AM ET

The dirty little secret is that China is running a massive US dollar shortage both on a corporate and a national level.

All told, Chinese companies have roughly $2 trillion US dollar-denominated in debt owed to international investors.

Because this debt is denominated in US dollars, this means the companies need to pay both the principal AND the interest payments to their lenders in US dollars.

However, China cannot print US dollars. Which means these firms either need to sell assets for US dollars or go bust.

That process has already begun on a corporate level.

Unbeknownst to most investors, China had its first major bank failure in 20 years earlier this year. On top of this, as of mid-July, Chinese firms have defaulted on nearly $5 billion in debt this year, which exceeds the previous FULL YEAR record set in 2016.

At some point this situation will come to a head. When it does, China will forced to sell its FX reserves (some $3 trillion) to get access to US dollars to help prop up systemically important firms.

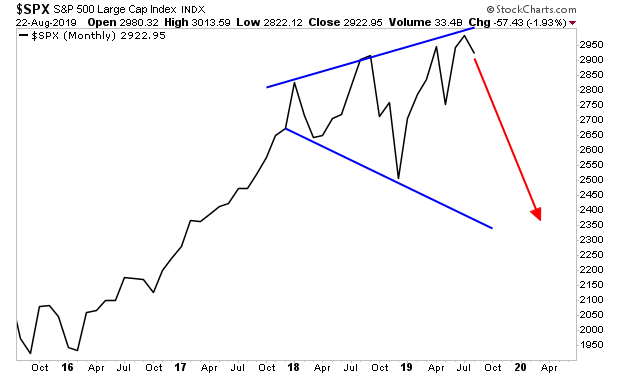

This is what the stock market has been seeing for the last 12 months. It’s why stocks are struggling to hit new highs, despite the Fed cutting rates for the first time since 2008.

THAT is the ultimate End Game here. The second largest economy, China, in the world is on the verge of massive devaluation.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.