April 2013 Sea Container Counts Are Still Contracting

Econintersect LLC | May 16, 2013 06:11AM ET

For the second month in a row, both import and export container counts are contracting year-over-year – comparing same months in 2012 and 2013.

- Economically intuitive imports however are “less bad” (but are still growing year-to-date);

- exports are also “less bad” in April but continues to contract year-to-date.

For the month of April 2013, the economically intuitive imports are down 17.2% (after being up a massive 34.4% in February and down 17.2% in March) year-over-year, and up 16.1% month-over-month. There is a direct linkage between imports and USA economic activity – and growth in imports foretells real economic growth. Imports are on a negative growth trend line.

Exports (which are an indicator of competitiveness and global economic growth) are down 3.3% year-over-year (versus last month’s -6.9%) – and up 3.7% month-over-month. Exports are on a negative growth trend line.

There is reasonable correlation between the container counts and the US Census historically is a recession marker, as consumers and businesses start to hunker down. Main Street and Wall Street are not necessarily in phase and imports can reflect the direction for Main Street when Wall Street may be saying something different. During some recessions, consumers and businesses hunkered down before the Wall Street recession hit – and in the 2007 recession the contraction began 10 months into the recession.

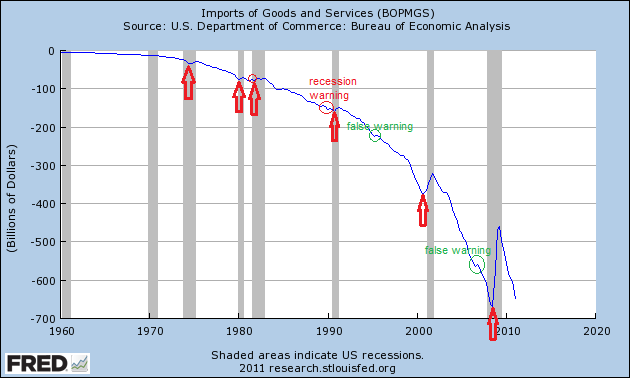

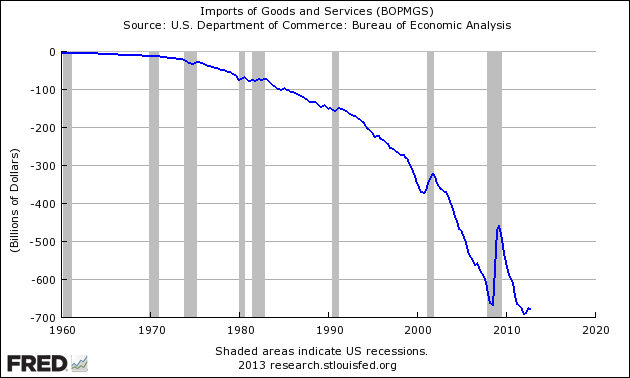

Above graph with current data:

Imports of Goods and Services

Econintersect

determines the month-over-month change by subtracting the current month’s year-over-year change from the previous month’s year-over-year change. This is the best of the bad options available to determine month-over-month trends – as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.