APAC Currency Corner: Another Financial Meltdown On The Cards?

MarketPulse | Jun 27, 2016 01:08AM ET

Post-Brexit vote, the debate has centred on whether it will be the catalyst for another Lehman Brothers-style meltdown. While there’s a lot of dust still to settle, central bankers are ready and willing to use whatever tools necessary to calm investor’s nerves and avoid a global meltdown. While markets were extremely volatile on Friday, trading was extremely fluid and liquidity was better than anticipated.

It is important to keep in mind that the Brexit fallout isn’t over. We are likely to feel aftershocks for weeks, perhaps months, to come. The difficulty lies in anticipating the frequency and scale of these markets aftershocks. We should expect more waves of risk-off sentiment to hit the market as the Brexit fallout intensifies. I think investors should brace themselves for nasty periods of non-selective waves of selling in global equity markets. Right now the only certainty is Brexit itself.

The British pound – Our views on Sterling

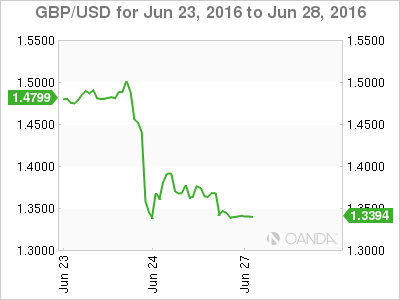

The pound suffered a drop of historic proportions. However, a significant percentage of the drop and the ensuing volatility was a result of the massive appreciation of the Pound in the days preceding the Brexit vote. On June 17, the market was trading at 1.400, so a Friday close 1.3700 was quite a bit better than I had anticipated. However, the pound is trading closer to 1.3400 this morning, down more than 200 points.

The main issues:

From a structural perspective, the Pound is extremely vulnerable. The UK invests more income abroad than it takes in and imports far more goods and services than it exports. The economy depends on its ratings to attract foreign capital to cover the deficit. If the UK’s rating comes under fire and investors’ appetite for the UK turns negative, the Pound will suffer and the UK will struggle to fund the shortfall. Fortunately only 25 % of UK bonds are foreign owned. While the drop in value may provide a silver lining for the exports, it’s unlikely to outweigh the mounting negatives.

I fully expect the Bank of England (BOE) to cut interest rates at its August meeting. From an interest rate perspective, it will weigh negatively on the Pound.

There’s a huge concern that London’s status as the global financial capital will crumble if the UK loses its “passporting” rights. These rights permit banks to locate themselves in the UK while offering products and services in the EU.

Given this doom and gloom outlook, it’s not hard to envision the Pound trading between 1.15-1.20 by the year end.

Yen – Intervention on the way?

Not to be outdone on the volatility scale, the dollar fell to JPY99.00 in panicky market conditions when it became apparent the Leave camp was winning. There was a sharp bounce off the inter-day low, with some pointing to intervention. However, the move was more likely due to a large GBP/JPY order hitting the market when the pair gapped through 145 in thin liquidity.

We are still on full intervention watch on USD/JPY, especially if the market takes on the 100 level again. Given the magnitude of the JPY market movement on Friday, I suspect the risk of intervention has increased immensely. This threat should keep USD/JPY downside supported in the near term, while risk-off should attract opportunistic selling, as the JPY is the chief haven currency for investors.

Gold – Scramble for the shiny metal

Bullion dealers struggled for physical gold when a gold rush ensued post-Brexit. Investors cleaned out stock of gold coins, one-ounce bars and rushed to establish gold positions to hedge against further Brexit fall-out. Gold had its best day since the 2008 crisis.

AUD – Under pressure

The Australian dollar was swept away in the Brexit tsunami before recovering to pre-Brexit levels later in the day. However, the AUD is again under the pressure of a salacious level of uncertainty in financial markets, which is weighing negatively on risk sentiment in early APAC trade.

With US rate hikes all but ruled out, and once the market finds some equilibrium, we could possibly see the Aussie dollar begin to appreciate; for no reason other than that a 1.75% yield is attractive during these uncertain times.

Ultimately, as the RBA is focused on returning to a 3% inflation, the weaker currency will likely have to do the heavy lifting. The Brexit may offer the opportunity for the RBA to slash interest rates more aggressively than market expectations.

Outside of gold, I expect the stronger dollar-weaker commodity price relationship to take hold. So we should see additional pressure on hard commodity prices especially if the Brexit adds further pressure to the fragile global economic growth outlook. These negative should continue to weigh on the long-term outlook for the Australian dollar.

CNH

The Yuan continues to weaken in the face of a stronger USD following the Brexit vote. The fear is that this may revive concerns of further devaluation, which could be in the offing.

The Yuan fell to its lowest levels in five years on Friday, as investors scurried for haven assets. I anticipate the risk theme to continue driving the investor sentiment, with the Yuan trading off its back foot.

MYR

Currencies like the MYR, which carry hefty USD currency debt burdens, are susceptible to the stronger USD on this current flight to safe-haven assets. Malaysia public sector debt is at nearly 55% of GDP, making it one of the most burdensome in the EM-Asia basket.

The stronger dollar’s relationship with commodity prices will weigh negatively on oil prices. Given that the MYR is extremely sensitive to the adverse fallout from risk sentiment, coupled with a high level of uncertainty in global markets, this should continue to weigh negatively on the MYR and regional currencies over the short term.

Keep in mind that central banks have been preparing for the Brexit “playbook” by keeping policy tools ready for action if needed. I expect that calm will return to the markets sooner rather than later.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.