A Brexit Break, Yuan Headwinds Are Coming

MarketPulse | Jun 29, 2016 01:24AM ET

Markets continue to stabilise post-Brexit with global equities and commodities tentatively holding onto gains. A welcome distraction from the Brexit fallout were headlines that Japanese policymakers are preparing to unleash a massive stimulus package in the region of ¥20 trillion (more than $200 billion).

The fiscal stimulus rumours saw risk appetite back on cue after suffering two consecutive distressing days. Overnight, emerging market currencies firmed and commodity currencies continue to see supportive flows.

This relative calm is unnerving, given how fragile investor sentiment is, and the likelihood of renewed GBP volatility. As a result, FX markets should remain a hot spot for the foreseeable future. Liquidity is gradually improving and appears to have weathered the initial Brexit sell off.

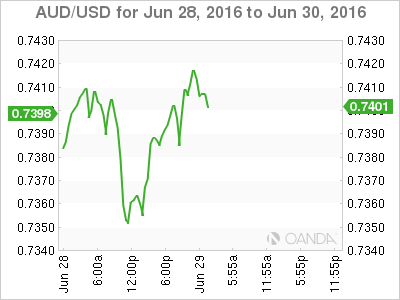

AUD – Yield Appeal

Neither the progressively weaker yuan peg, nor the fragile risk-on sentiment has inspired Aussie bears and, for now, the Australian dollar remains supported. While surging iron ore prices are a factor, there is also a more upbeat attitude from the ANZ-Roy Morgan consumer confidence index conducted over the post-Brexit weekend. This fell just 0.7% to 116.8. Although not one of the bigger releases, it may still provide the RBA some food for thought to remain on hold in July

Let’s not forget that after the UK debt rating downgrade, there’s one less member of the exclusive AAA debt rating fraternity. So from a bond flow perspective, Australia’s 1.95% 10-Year Triple A bond yield is looking attractive as an oasis of calm in a sea of turbulence.

Finally, the stability in oil prices may have investors looking at commodity currencies, especially high yielding currencies like the Australian dollar as safe haven bets. Futures are up, so expect a good day in the Australian markets.

On the data front, Australian New Home sales came in at -4.4% vs -4.7% expected, a second straight decline, which may temporarily abate the Aussie tail winds.

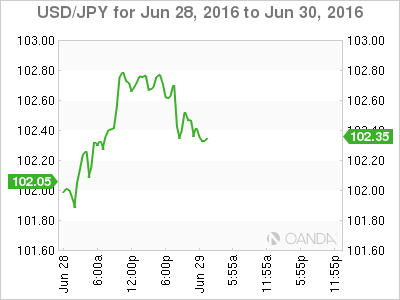

JPY – The Waiting Game

There has certainly been no shortage of headlines and noise out of Tokyo. Speculation is that the BoJ may call an emergency meeting to roll out new monetary easing steps to counter the yen’s gains instead of waiting for a scheduled policy meeting in late July. However, this has only translated into small gains in USD/JPY. The market remains very cautious with traders stepping aside as liquidity continues to run thin. Traders are skeptical about a policy move, and would prefer to see some policy action before they react.

Yuan – headwinds are coming

Are we about to enter the vicious vortex where further yuan weakness accelerates capital outflows as mainland investor’s scurried to invest abroad? The PBOC has so far elected to allow all of the dollar repricing plus waning risk sentiment to influence its RMB fixing.

Further negative headwinds are coming from lower Chinese GDP growth expectations in the wake of Brexit. However, at current USD/CNH levels, we could see a reversal lower if risk-on sentiment prevails as some overextended long positions clear out. The USD has played a significant safe haven role, so all eyes will be on risk sentiment and a possible reversal of long USD safe haven hedges.

There may be some distortions in Offshore market as the gap between onshore and offshore has widened to 300, with tom next flush, as half year-end distortions take hold, so tread nimbly.

MYR – Bargain hunting in Asian FX

Asian FX has weathered the Brexit storm better than the broader EM space. However, USD Asia is not really at the epicentre of much of the Brexit fallout. There were a few wobbles with the massive waves of risk-off. But overall, commodities have been stabilising and oil prices are supportive in a consolidative pattern and near yearly highs. So investors are taking advantage of the overextended Brexit sell-off by bargain hunting in Asia FX. The ringgit is seeing support on the back of risk-on sentiment and we have definitely seen better USD sellers stepping up, especially with MYR feeling the benefits of the dovish Fed repricing.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.