Another Brick In The Wall

MarketPulse | Jan 29, 2017 01:54AM ET

The dollar ended the week firmer today, across most currencies, despite Friday’s weaker than expected Q4 GDP as capital goods was positive, tempering headline disappointment. The markets are less focused on backwards looking data, as President Trump has been in office for little more than a week and has yet to cement key policies involving Trade, Tax and Fiscal expenditures. Moreover, depending on the scale of the infrastructure projects, (Fiscal) U.S. GDP could push well beyond 3% this year.

The BOJ played a significant role in USD/JPY fortunes by increasing 5-10 year bond purchases to ¥450 bln from ¥410 bln on Friday. It was a big surprise to traders, as the BOJ had skipped 1-5 y purchase on Wednesday, which likely exacerbated Friday’s outsized topside move more than would otherwise have been expected. However, with the BoJ policy meeting next week, I think the Central Bank is sending a clear signal to the markets that they will be resolute in keeping the JGB 10 year yields near 0% for the foreseeable future.

The Mexican peso will remain in the limelight, and the current proceedings are being viewed cautiously around the world. U.S. trade policies directed at Mexico could be a precursor to the events to unfold in Asia. However, when trading in a market driven by the political headline, more so in a highly crowded trade, while competing with algorithms for reading “market-moving’ headlines, it is a dangerous game distinguishing chaff from reality.

Moreover, while relations between Trump and President Nieto are clearly a work in progress, it is clear the past Obama administration diplomacy is out the window in favour of boxing gloves in the ring. On a positive note, the discussions will likely continue.

Not to be outdone on the headlines, USD/TRY had a wild ride in very thinly traded markets, when comments from Turkish President Erdogan hit the news ticker.

Raising interest rate would impact both the currency and inflation in a negative direction. I especially defend removal of the top-bottom issue and maintain just the policy rate.

More or less "greenlighted" the TRY bears as the prospects of additional intervention on the interest rate front is now unlikely.

While the confluence of Credit Rating Agency warnings and downgrades added some fuel to the fire, we have come to accept these moves have little legs, but given the sheer amount of negativity in the TRY trade, it certainly didn’t help matters.

Monday Morning Regional G-10 Market Roundup

Australian Dollar

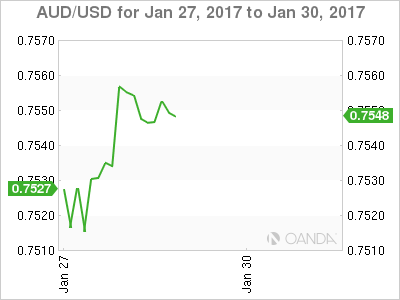

Currently trapped in the .75-76 range trade, as the confluences of Carry, China and Commodities (3 C equation) continue to shape Aussie sentiment.

The carry trade was dealt a significant blow after the miss hit on last week’s CPI. In my view, Carry is the most important factor in the 3 C equation, as the prospect of narrowing interest rate differential has hiked substantially this week. Yearly CPI has trenched in the 1.5-1.6 % region domestically, despite the uptick in global inflation. Now there is growing concern amongst investors that there is some risk of not hitting the midpoint of the RBA’s CPI forecast and will force the RBA to lower rates.

While the market is pricing a high probability of a U.S. hike in May, sentiment has shifted from a possible RBA rate hike bias to a greater chance of an interest rate cut. If a slowdown in Australian housing market unfolds as some expect, an RBA rate cut will be on the table in 2017 and as this likelihood becomes a reality look for the Aussie to move towards .7000.

I have been fairly consistent in my view of China the past few months regarding the possible adverse implications for Australia if the China-U.S. trade war escalates. However, without clarity on President Trump's Trade policy directed at China, we need to be extremely guarded on this view.The globalist in me hopes for a working agreement, but the pessimist in me is preparing for the worst.

Last week China's MLF(Medium-term Lending Facility) hike was a real game changer for Mainland interest rates. Even though the hike was minor, it nonetheless indicates the Pboc are clamping down on leverage and the ultra-accommodative monetary policy gauge is getting dialled down. Moreover, while it’s the SLF (short term lending facility) that sets interbank rates, there may be some feedback loop nonetheless. The onshore rate hikes will likely have negative implications for Chinese growth and demand, which could bubble over into the commodity markets, in particular, iron ore.

Keep in mind, surging iron ore prices and the prospects of rising domestic inflation have kept the Aussie dollar bears at bay since the U.S. election.

Japanese Yen

The key yen sentiment drivers put in a mixed close Friday. UST 10 year yields stumbled late in NY session dropping to 2.49 after failing to breach 2.53 levels.Stock indices, for the most part, languished in no man’s land, while WTI succumbed to profit taking. After all had been said and done, USD/JPY held above 115.00 at the NY close supported by the BoJ’s 5-10 year Rinban operations on Friday. USD/JPY has played a bit of catch up on U.S. bond yields this week, and Friday’s 115.63 high print offers the next key target, and a break above could provide clear sailing to 118.00. Support on the technical edge remains firmly entrenched around 112.50

APAC EM Roundup

Chinese Yuan

The RBM complex continues to be very much shackled to the broader U.S. dollar momentum, yet we continue to witness some extreme moves in low liquidity NY trading hours. Given we are in the midst of the Lunar New Year, China’s most important holiday, liquidity is expected to remain thin and minor headlines from the U.S. administration, especially those around trade, could produce a significantly outsized move.

Mainland policymakers' unyielding approach to both FX regulation and capital controls has greatly decreased outflow pressure. However, given just how big of a negative reception these iron-fisted policies have had from the international investor community, it is unlikely these systems can continue in perpetuity.

Domestically I do not think the RMB will receive much support from the recent MLF tightening, as it does not necessarily mean higher SLF (interbank rates). However, early January’s silly funding conditions have severely dampened investor appetite in the offshore markets.

However, the key for the yuan fortunes will be the future implications around U.S.-China trade relationships. If we thought the “Mexican Standoff” had far-reaching consequences, just wait until these two major powers enter the ring. Given the new Globalist tact from Mainland Policy makers, it is possible negotiations will commence from polar opposite sides. The negotiations will take the long road, fraught with peril, so expect a very bumpy ride. Overall, however, I expect cemented views on U.S. Trade, Tax and Fiscal policies to be the ultimate dragon slayer as broader USD appeal will ultimately weigh negatively on the RMB. However, pick your spots wisely on the short CNH trade.

ASEAN Basket

A call was scheduled between Trump and Merkel, as well as Trump and Hollande this weekend. Merkel is reported by Reuters as urging EU countries to expedite Asian trade given Trump’s policies. A leaked paper to EU finance ministers, cited 12 Asian countries as the targets: IDR, PHP, MYR, INR, CNY, SGD, JPY, THB, VND, MMK, AUD and NZD.

However, the discussion between Trump and Merkel was more focused on NATO and more specifically sharing the burdening costs among all members.

Concerning the recent strength in local currencies, I think it is more about less USD conviction in very crowded trades as investors were very much convinced local currencies would weaken in early 2017. And while we continue to see pockets of interest on selected ASEAN currencies I suspect it’s more a case of position squaring and foreign investors buying into regional undervalued equity markets on some extreme currency moves early in the year. While I continue to view the U.S. economic uptrend intact, I struggle to see a sustained regional economic uptick, especially in the face of possible U.S. trade sanctions. So buying into the current local currency rally may be little more than an exercise in folly.

Also, I think the Fed Funds Futures markets are under-priced by only factoring in two rate hikes for 2017. Factoring in the inflation aspect of Trumpenomics, the local currencies are very susceptible to a repricing of U.S. interest rates higher, especially if the next FOMC delivers a hawkish view and a March hike becomes a reality. Further pressure on regional currencies will happen if the Feds hint at the eventual balance sheet taper.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.