An Overbought Threshold Rejects A Stock Market With Crossed Signals

Dr. Duru | May 23, 2018 04:37AM ET

AT40 = 65.8% of stocks are trading above their respective 40-day moving averages (DMAs) (hit a high at 69.7%)

AT200 = 51.5% of stocks are trading above their respective 200DMAs

VIX = 13.4

Short-term Trading Call: neutral

Commentary

The stock market keeps crossing up as headlines and macro events push the market one way and then the other.

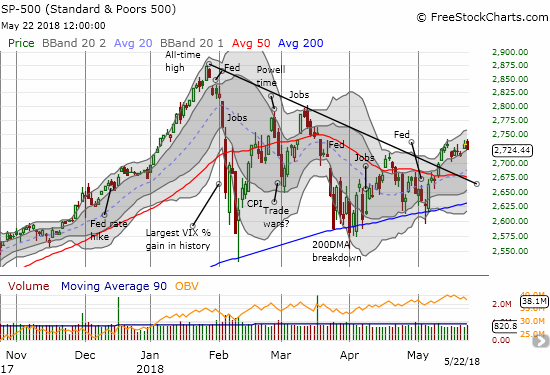

The big slam has yet to come in the form of a definitive breakout or breakdown. Since the January all-time high, the S&P 500 (via SPDR S&P 500 (NYSE:SPY)) has chopped widely and sometimes wildly. If not for the context, I would have claimed the chart below is quite encouraging. The S&P 500 has held a breakout above its 50-day moving average (DMA) for the longest period since the February swoon – now 10 days and counting. The index broke out from its short-term downtrend from the all-time high. Moreover, this latest move is the FIRST time the index has managed to trade higher than its high the day of a Fed monetary policy meeting.

Most things considered, the S&P 500 (SPY) is sneaking into a bullish posture.

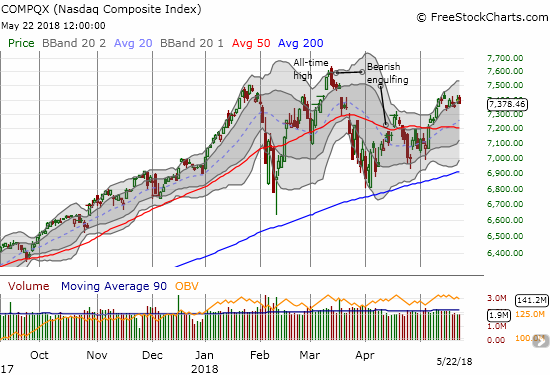

The NASDAQ and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) are also holding breakouts, granted these moves are much less impressive than their abilities to mark new all-time highs in the first bounceback from the February swoon. The iShares Russell 2000 ETF (NYSE:IWM) is still impressive despite a 0.7% pullback from an all-time high – a move that may have ended the upward momentum for May.

The NASDAQ’s 50DMA breakout has stalled out over the last 9 trading days.

The PowerShares QQQ ETF (QQQ) has stalled out similarly to the NASDAQ.

The iShares Russell 2000 ETF (IWM) is experiencing an impressive May run-up even with today’s 0.7% pullback.

Yet, here on the cusp of confirming broad bullishness, the stock market is failing. Buyers still cannot muster enough force to push the market into overbought territory as defined by AT40 (T2108), the percentage of stocks trading above their respective 40DMAs. AT40 above 70% marks an overbought market. On Tuesday, AT40 got as high as 69.7%. In the AT40 playbook , Tuesday's action is mildly bearish. A further pullback from current levels will confirm a bearish change in sentiment.

AT40 (T2108) pulled back ominously from the overbought threshold of 70%.

Laying in wait for a decision is the volatility index, the VIX. The fear gauge looks like it is finally tired of going down. It has held its ground for 8 trading days. Combined with AT40’s ominous pullback, I loaded up on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) call options.

The volatility index, the VIX, is trying to hold current low levels.

Given the headlines and macro events, I recognize that the technicals could all change again in a flash. However, given the market’s record on pullbacks from the overbought threshold, I am putting the buyers and the bulls in the “show me” box.

The currency market confirmed new yellow flags. The Swiss franc (NYSE:FXF) suddenly keeps getting stronger. The Australian dollar versus the Japanese yen (AUD/JPY) dropped sharply on the day. At the time of writing, this important indicator of sentiment is still selling off vigorously.

AUD/JPY is flashing fresh caution signs as the jump from May lows comes to an abrupt end.

CHART REVIEWS

Boeing (NYSE:BA)

BA is right back in the hotseat. After the stock gapped up and gained 3.6% on news that the U.S. and China hit the pause button on trade war tariffs, BA appeared to confirm the bullish tidings I described in the last AT40 post. The trade fairies giveth, and they taketh away. With President Trump refreshing the specter of trade disagreements, BA went into freefall. I was quick to jump on a put option ahead of BA’s close and a loss of 2.5% on the day…Monday’s gap is almost filled.

Boeing (BA) not only plunged back into its impressive gap up but also it pulled back sharply from a test of all-time highs.

Toll Brothers (NYSE:TOL)

Perhaps the most disappointing news on the day was the market’s reaction to TOL’s earnings. The stock lost an incredible 9.6% to close at an 8-month low. TOL’s big breakout in September is completely gone now. The bearish sentiment and trading action made me very relieved that, as planned, I finally gave up on most of my home builder positions on Monday. I will write more about the fresh carnage in home builders in my next Housing Market Review (Five Point Holdings (NYSE:FPH) is my last home builder, and I even ADDED to it).

The chart says it all – Toll Brothers (TOL) has imploded as investors and traders can’t seem to sell fast enough.

Autozone (NYSE:AZO)

AZO was a whirlwind. I missed out on the call spread that I wanted to buy ahead of earnings. I kicked myself a second time when I saw the first reaction to AZO’s earnings: the stock soared right to and then past my $490 target on its way to a quick $710 intraday high! If I had a position, I would have had to sell quickly. After the conference call got underway, sellers overwhelmed the stock almost all the way to the close. AZO finished the day at its low and $602: a head-spinning 100 point swing. I decided to speculate on a call spread into the teeth of the carnage. I just need a recovery back to 50 or 200DMA resistance…

Autozone (AZO) had one of the most vicious post-earnings fades I can imagine. The market took the stock from “pole to pole” on its way to a massive bearish engulfing post-earnings pattern.

Monro (NASDAQ:MNRO)

MNRO was another post-earnings loser. The stock is not only below its 200DMA support, but also it made a fresh post Amazon (NASDAQ:AMZN) panic low. I am NOT looking to buy the dip again just yet.

Monro (MNRO) lost 8.4% in a post-earnings move that put right it below 200DMA support.

Best Buy (NYSE:BBY)

Perhaps it was just a very bad day for retail with too many earnings reports for the market to properly digest. BBY was dumped for a 3.6% loss on no ostensible news. With volume picking up on the last 5 days of down trading, BBY looks like it has brought to an end the steady momentum that dominated its trading since the March low. I will be watching earnings before market on Thursday, May 24th.

Best Buy (BBY) lost 3.6% on high volume in a move that looks like topping action.

Ulta Beauty (NASDAQ:ULTA)

Given the poor showing in retail, it was probably appropriate that I decided to take profits in ULTA. I have not liked the trading action ever since I triumphantly pointed out the breakout that I thought confirmed ULTA’s comeback. I finally got impatient with the choppy topping action and took profits here ahead of earnings on May 31st next week.

Since its primary upward momentum ended, Ulta Beauty (ULTA) has chopped a lot and traded down more days than traded up.

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by T2108 Resource Page . AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #67 over 20%, Day #36 over 30%, Day #31 over 40%, Day #13 over 50%, Day #5 over 60% (overperiod), Day #81 under 70%

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Be careful out there!

Additional disclosure: long UVXY calls, long BA put, long AZO call spread

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.