Storage Debate, Tehran Talks Hit Oil

Dailyfx | Mar 16, 2015 01:02PM ET

Talking Points

- Spread between Brent and WTI increases in this month’s STEO report

- Crude stocks increase in Oklahoma, as nuclear talks with Iran progress

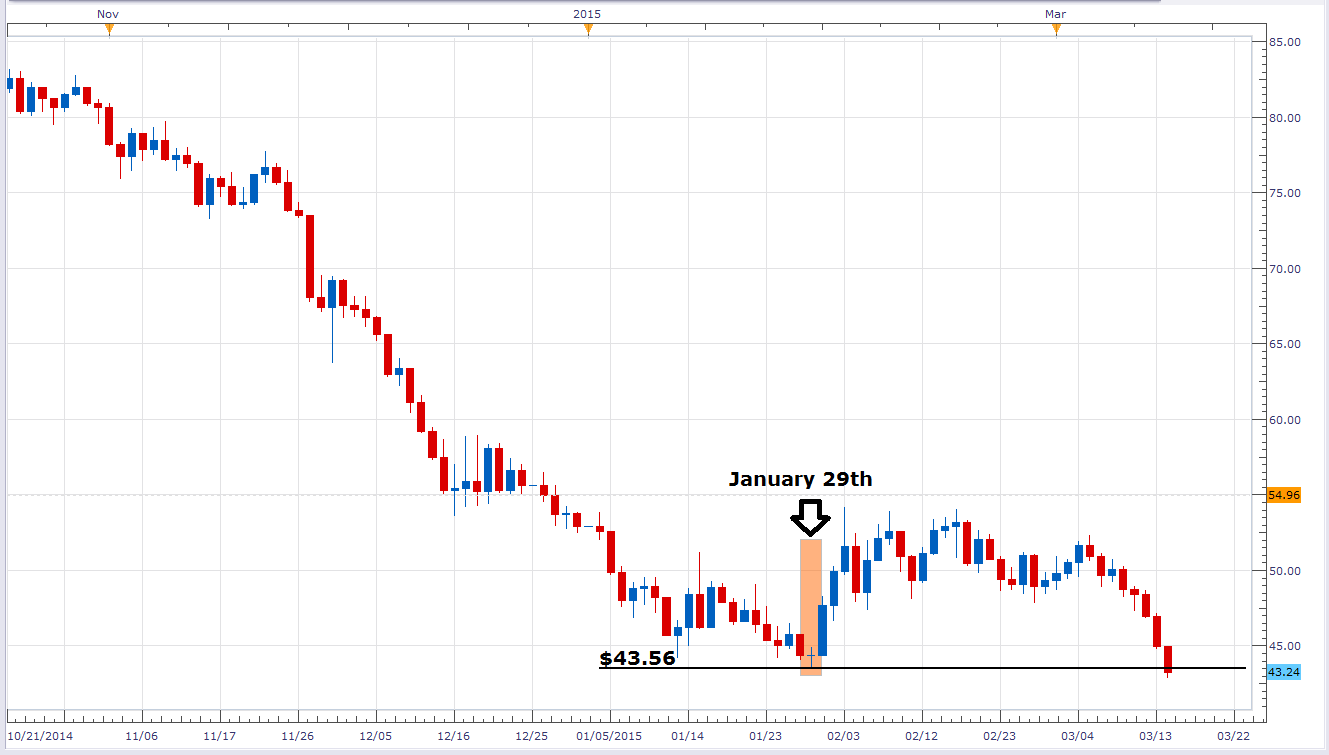

- In surpassing the January 29th low, oil trades at $42.84/barrel

During Monday’s New York trading session, US Oil traded as low as $42.84/b, surpassing the low from January 29. The energy commodity continues its slide as the debate between crude production and storage capacity heightens and nuclear talks with Tehran grow in prominence. Concurrently, price forecasts remain mixed as the spread between Brent and WTI widens.

In their most recent Short-Term Energy Outlook, the EIA forecasts that Brent Crude will average $59/barrel in 2015, which is $2/barrel higher than their projection in last month’s STEO release. Simultaneously, WTI is to average $52/barrel, doubling the spread reported in February. This phenomenon, where domestic prices lag behind the international benchmark, may be explained in part by the continued increase in U.S. commercial inventories, particularly at the site in Cushing, Oklahoma.

As a delivery point and one of the world’s largest oil storage facilities, activity in Cushing is notable to investors. For the week ending March 6th, total U.S. crude inventories increased by 4.5 m/b with a substantial contribution stemming from the Oklahoma facility; crude stocks in Cushing rose to 51.4M barrels from the previous week’s 49.22M barrels. The addition, up 67% from a year ago, brings the volume to 72%. The question now arises, what happens to prices if capacity is reached?

Compounding this week’s question of a supply glut, nuclear talks with Tehran. As negotiators look to reach an agreement on Iran’s nuclear program, investors question the effects on the price of oil. If a satisfactory agreement can be established, previously imposed sanctions may be lifted, allowing for additional oil exports originating in Iran. Since 2012 daily petroleum exports have been halved sending Iran down from 3rd to 9th in terms of the OPEC rankings for value of petroleum exports. Thus, any change in political stances could alter the supply structure and consequently prices.

Chart Created Using MarketScope2.0

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.