Amid Global Uncertainty, Pay Attention to this Manufacturing Index

Frank Holmes | Apr 10, 2017 03:04PM ET

Last week I returned from Zurich, where I spoke at the European Gold Forum. Investor sentiment for the yellow metal was particularly strong on negative real interest rates and heightened geopolitical uncertainty in the U.S., Europe, Middle East and South Africa. A poll taken during the conference showed that 85 percent of attendees were bullish on gold, with a forecast of $1,495 an ounce by the end of the year.

The upcoming presidential election in France is certainly raising concerns among many international investors. On one end of the political spectrum is Marie Le Pen, the far-right National Front candidate who, if elected, might very well pursue a “Frexit.” On the other end is Jean-Luc Mélenchon, a socialist of such extreme views that he makes Bernie Sanders look like Ronald Reagan. I was shocked to read that Mélenchon has pledged to implement a top tax rate of 100 percent—and even more shocked to learn that he’s moving up in the polls. An insane 100 percent tax rate would surely return the country to medieval-era feudalism, which is just another name for slavery. All the wealth naturally goes to the very top, and corruption thrives.

It’s important to recognize that in civil law countries such as France, hard line socialism is much more likely to take hold. Just look at South Africa. While in Zurich, I had the pleasure to speak with Tim Wood, executive director of the Denver Gold Group and former associate of South Africa’s Chamber of Mines. According to Tim, the poor government policies of South Africa’s socialist president, Jacob Zuma, is driving business out of the country and has led to the resignations of several members of parliament. Tens of thousands of protestors have taken to the streets of Johannesburg demanding Zuma to step down, especially following his firing of Finance Minister Pravin Gordhan. The rand, meanwhile, has plummeted and the country was recently downgraded to “junk” status.

One of the consequences of a weaker rand has been stronger gold priced in the local currency and higher South African gold mining stocks, as measured by the FTSE/JSE Africa Gold Mining Index. Among the gold companies that have seen some huge daily moves in recent days are Sibanye Gold Limited (NYSE:SBGL) and Harmony Gold Mining Company Limited (NYSE:HMY).

South African gold stocks look very attractive in the short term. Over the long term, however, producers might find it increasingly difficult to operate efficiently and profitably in such a mismanaged jurisdiction.

PMIs Show Impressive Manufacturing Growth

It was an eventful week, to say the least. The U.S., for the first time, became directly involved militarily in Syria’s years-long civil war. Senate Republicans invoked the “nuclear option” to prevent a Democratic filibuster, allowing federal judge Neil Gorsuch to obtain Supreme Court confirmation. President Donald Trump met with Chinese leader Xi Jinping at Mar-a-Lago, the so-called “Winter White House,” to discuss trade and North Korea, among other issues.

And on Friday we learned the U.S. added only 98,000 jobs in March, down spectacularly from the 235,000 that came online in February. In response to this and the Syrian air strike, gold jumped more than 1 percent, touching $1,272 in intraday trading, its highest level in five months.

Fresh purchasing manager’s index (PMI) readings for the month of March were also released, showing continued manufacturing sector expansion in the world’s largest economies, including the U.S., China and the eurozone. All of Zurich was under construction, it seemed, with cranes filling the skyline in every direction. And when I flew back into San Antonio, sections of the international airport were also under heavy construction. This all reflects strong local and national economic growth in Switzerland and the U.S.

I especially like the Zurich Airport. I travel a lot, and it’s the only airport I know of where you can sit out on an open deck and watch and listen to the jets take off and land.

The official China PMI rose to 51.8, the fastest pace in nearly five years.

Because the PMI is a forward-looking tool, this bodes well for industrial metals, as measured by the London Metal Exchange Index (LMEX). The Asian giant, as I’ve pointed out before, consistently ranks among the top importers of copper, aluminum, steel and more.

The U.S. Manufacturing ISM cooled slightly to 57.2, down from 57.7 in February. This still remains high on a historical basis. Because the U.S. is the number three producer of crude, following Russia and Saudi Arabia, oil prices have tended to track the country’s manufacturing index.

“striking similarities” between the two men. Among other commonalities, they’re both nationalists; they’re both populists and have expressed a desire to fight corruption; they both have a rocky relationship with the press and intellectual community; and they both prioritize domestic affairs over foreign affairs.

None of this stopped Trump from being very critical of China on the campaign trail. He threatened to name the country as a currency manipulator and raise tariffs as much as 35 percent. It will be interesting to see what agreements, if any, can come out of this meeting between the two leaders.

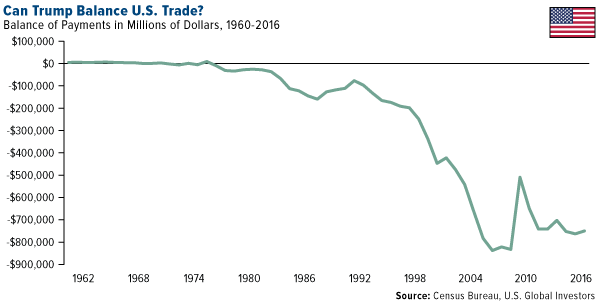

Trump is not wrong to raise the alarm over U.S.-China trade. In 2016, the U.S. trade deficit with China stood at a whopping $347 billion. This is down slightly from $367 billion in 2015, but still a huge number. If you look at the total U.S. balance of payments since 1960, you get an even greater sense of the imbalance.

At the same time, world trade volume growth has improved in recent months, especially in emerging markets and Asia.

It’s important that Trump put ample thought into improvements on international trade. I’m not convinced tariffs and border adjustment taxes (BATs) are the solution. Look at what happened in the 1930s with the Smoot-Hawley Tariff Act. In an effort to “protect American jobs,” the U.S. raised tariffs on more than 20,000 goods coming into the country, many of them as high as 59 percent. Once the act went into effect in June 1930, a trade war promptly ensued and global trade all but dried up.

Today, historians almost unanimously agree that the policy, which President Franklin Roosevelt later overturned, only exacerbated the effects of the Great Depression.

One of the biggest reasons why the U.S. has such a trade deficit is due to its abnormally high corporate tax rate. The country’s largest export is intellectual and human capital. Think Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOGL), which are designs and ideas. The problem is that the dollars received in exchange for these goods and services are sitting in Ireland, or elsewhere, and are thus not counted in the official trade balance. Should the corporate tax rate decline to an average of around 18 to 20 percent, which is consistent with other developed countries, U.S. multinational companies would likely be more inclined to repatriate those profits and tilt the balance back in America’s favor.

Tax reform, therefore, is key in making sure the U.S. remains competitive on the world stage.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every invest. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/16: Sibanye Gold Ltd., Harmony Gold Mining Co. Ltd.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. The ISM manufacturing composite index is a diffusion index calculated from five of the eight sub-components of a monthly survey of purchasing managers at roughly 300 manufacturing firms from 21 industries in all 50 states.

The London Metals Exchange Index (LMEX) is an index on the six designated LME primary metals contracts denominated in US dollars. Weightings of the six metals are derived from global production volume and trade liquidity averaged over the preceding five-year period. The index value is calculated as the sum of the prices for the three qualifying months multiplies by the corresponding weights, multiplied by a constant. The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals.

The FTSE/JSE African Gold Mining Index is a market capitalization weighted index.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.