All Is Not Well With Intel Corporation, But Things Can Get Better

InvestCorrectly | Apr 24, 2016 01:30AM ET

Intel Corporation (NASDAQ:INTC) posted largely positive 1Q2016 earnings results, driven by growth in the data-center group and cost curtailment. The company announced plans to trim its workforce by 11%, meaning eliminating some 12,000 jobs with hopes that the move would help it to keep costs low and free up resources for reinvestment in growth.

Going ahead, Intel is training its eyes on the cloud computing market whereby it’s aggressively pursuing data center and Internet of Things (IoT) opportunities. However, competition from lower-cost ARM-based technologies and shrinking PC demand stand out as serious headwinds for the company. Can Intel successfully navigate the tides of its industry? This Intel analysis article examines the company’s risks and opportunities to enable you make informed investment decision. But first, here is a brief highlight of Intel’s earnings in the last quarter.

1Q2016 highlight

Intel Corporation (NASDAQ:INTC) posted adjusted EPS of $0.54 on revenue of $13.8 billion in 1Q2016. The results were better than Wall Street estimates of $0.48 for EPS and $13.8 billion for revenue.

2Q2016 guidance

For the current quarter Intel is looking for revenue of $13.5 billion, give or take $500 million. But the guidance is narrower than analysts’ average estimate of $14.116 billion.

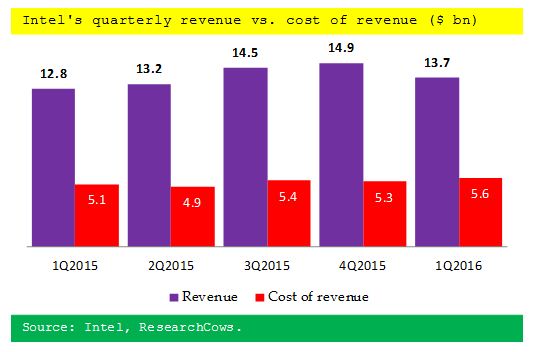

The chart below shows Intel’s revenue and cost of revenue for the last five quarters:

What’s exciting about Intel?

- Data center business remains a bright spot

Data center is a particularly important and promising segment for Intel Corporation (NASDAQ:INTC). The advent of cheap smartphones and tablets and the growing interconnection of gadgets have meant an explosion of data churned out by these devices. But that has also come with strain on existing server systems. As a result, data center operators are looking to decongest their systems and make them operate more efficiently.

The demand for more efficient data center has given rise to demand for a new breed of data center chips capable of delivering powerful compute power but still consuming less energy. Intel is on the forefront of supporting data center modernization , supplying a range of next-generation data center processors that serve a broad market, consume less energy and still exhibit powerful compute capability.

For a long time, Intel has been perceived as a provider of high-end computing calculators. As such, churning out data center chips that serve a broad market should help the company protect its market share from the raid by competitors basing their products on ARM technologies.

Intel’s data-center group sales increased 8.6% in 1Q2016 to hit $4 billion, largely driven by 13% increase in volume sales.

2.The Internet of Things (IoT)

Intel missed the mobile boat, but the company is careful not to miss the Internet of Things train. The company is hoping to not only tap into IoT to fuel future growth but also make up for what it missed in mobile. As such, Intel is taking multipronged approach in IoT whereby it is not only supplying chips but related hardware as well.

To enhance its potential in the IoT, a market that is still in the nascent stage, Intel is acquiring strategic assets. The acquisition of Altera (NASDAQ:ALTR) and Recon Technology Ltd (NASDAQ:RCON) fit nicely with its IoT agenda.

Intel generated $2.30 billion in its IoT business in 2015 and the opportunity for growth is huge. According to researchers IDC and Gartner, the next few years will be market by a strong growth in IoT market.

Given its expanding range of IoT products and partnerships, Intel is well-placed to ride the IoT growth wave.

3.Memory juice

Intel Corporation (NASDAQ:INTC) is doubling down its efforts in memory market with a special focus on non-volatile memory (NVM). Although NVM currently accounts for only a small fraction of the company’s revenue, the business is growing at double-digit rate and there is huge growth opportunity going ahead. As such, Intel should trigger more growth in its memory business when it starts producing 3D Xpoint memory products. Production of 3D Xpoint memory is expected to begin this year and increase in 2017.

4.Efficiency drive

Intel is in the process of cutting weight whereby the company will retrench thousands of employees. The layoffs and operations consolidations will both cut costs and release funds that the company can reinvest in more promising growth areas. Intel will lay off 12,000 workers or about 11% of its workforce and consolidate its operations globally. As such, the company hopes to save $750 million in 2016 and hit annual cost-savings rate of $1.4 billion by 2017. But to complete the restructuring process that include layoffs and consolidation, Intel is bracing for a $1.2 billion charge in 2Q2016.

What’s worrying about Intel?

- Decaying PC market

Windows 10 refresh did little to stem the downward spiral in PC sales. Longer replacement cycles and cannibalization of the PC market by tablets are hurting Intel’s PC business at both consumer and enterprise levels. Although pressure has been more intense in the consumer market, opportunities in the enterprise space are also shrinking as BYOD takes root at many enterprises and macroeconomic concerns hit IT budgets.

Intel has tried to respond to the decay in the traditional PC market by courting the tablet market. The company has inked deals with a number of Chinese tablet manufacturers, especially offering them its chips at subsidized costs to gain market share. However, it will take time before such efforts can offset the revenue loss in the computing devices segment.

2.Data center competition

Intel Corporation (NASDAQ:INTC) has marked data center as a key growth area, but stiff competition in server, storage and networking markets threaten the company’s data center opportunities. The part of data center business that is particularly going to be challenge for Intel is microservers. Its competitors have come up low-cost, more energy efficient and high-performance microservers with the aim of displacing it as the incumbent.

While displacing Intel in data center market is not something that can happen overnight, the company faces the risk of gradually losing its market share and pricing power, thus complicating its turnaround and growth efforts.

Takeaway

Intel Corporation (NASDAQ:INTC)’s failure to smell the smartphone coffee is a major resource for its present pressures. But there is an opportunity for the company to redeem itself by riding the IoT and cloud waves. The management can be seen aggressively pursuing the opportunities and the company stands a better chance of success. Nevertheless, competitive threat could slowdown Intel’s progress.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.