Agnico Eagle Mines: Imminent Return To Free Cash-Flow Generation

Edison | Sep 09, 2019 07:38AM ET

Agnico Eagle Mines Limited (NYSE:AEM) (AEM or the Company) is a senior gold producer that operates in low political risk jurisdictions with a quality mineral reserve base. The Company has a track record of strong operational performance and has beaten production and cost guidance for seven consecutive years. AEM is nearing completion of a large Nunavut expansion (the Meliadine mine and Amaruq project), which is expected to drive growth in gold production from 1.75Moz in 2019 to 2.0Moz in 2020. A return to free cash flow generation is anticipated in H219 with capex expected to decline significantly as AEM moves to “harvest mode”.

Production and cost guidance maintained

AEM has reiterated its full-year production guidance of 1.75Moz, which we believe it is likely to achieve with a contribution of c 230koz from Meliadine (including c 47.3oz of pre-commercial production) and c 130koz from Amaruq. In addition, the company expects total cash costs and all-in sustaining costs (AISC) for FY19 of US$620–670/oz and US$875–925/oz, respectively, albeit the guidance for total capital costs has increased from c US$660m to US$750m, mainly as a result of lower pre-commercial production gold sales credited against capital at Meliadine, the advancement of underground development at Amaruq in the wake of positive exploration results and modifications to the Meliadine saline water treatment system (owing to the earlier than expected receipt of a discharge permit).

H219 a cash-flow inflection point for AEM

The current year marks an inflection point for Agnico, as capital expenditure falls away sharply at the same time as production increases, resulting in a return to free cash-flow generation from H219 onwards. Once production of 2.0Moz is achieved in FY20, moderate growth to an annualised production rate of 2.2–2.3Moz is expected, bringing with it the potential for increases in the dividend from the current level of c US$0.125 per quarter. Even with an increased dividend, we would expect AEM to repay its US$1.7bn in net debt (equating to 26.6% gearing or 36.3% leverage) at end-June 2019 by FY22.

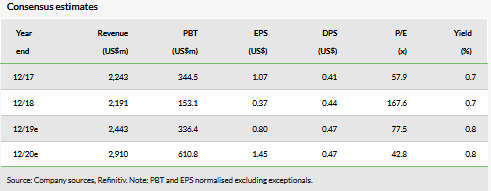

Consensus estimates

At the current gold price, we estimate AEM will achieve the lower half of its consensus forecast EPS range for FY19 of US$0.68–1.08/sh, with some of the operational improvements in H219 offset by higher financing and amortisation charges. All other things being equal, however, we expect it to achieve close to the consensus EPS estimate of US$1.45/sh in FY20 (range US$0.82–2.27/sh).

Business description

Agnico Eagle operates eight mines in Canada, Finland and Mexico and is among the top 15 largest gold mining companies in the world. It seeks to build a high-quality business that generates superior long-term returns for shareholders and contributes to the communities in which it operates.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.