Against The Herd: Lower Rates Rather Than Higher Rates In 2014

Pacific Park Financial Inc. | Jan 17, 2014 05:20AM ET

Bloomberg News surveyed banks and securities companies on where the 10-year Treasury yield would finish 2014. Economist forecasts averaged 3.41%. With 2013 closing near 3.01%, perceived strength in the underlying U.S. economy, and the Federal Reserve reining in its controversial bond buying program (”QE3″), the predictions are hardly outlandish.

On the other hand, where in the media will you find bond bulls who believe that interest rates will go significantly lower? Does anyone think that rates could tumble back towards 2%, or even 1.5%, sending bond prices surging back to record highs?

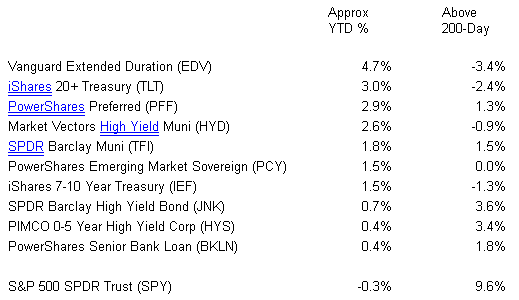

It is worth noting that gains for Treasuries in the first few weeks of January are the strongest that they’ve been in four years. In fact, income ETFs of all flavors are seeing capital appreciation and seven of ten have climbed back above respective long-term (200-day) trendlines; only the three Treasury Bond ETFs remain below respective moving averages. Could Income ETFs Be Signaling Lower Rates Ahead?

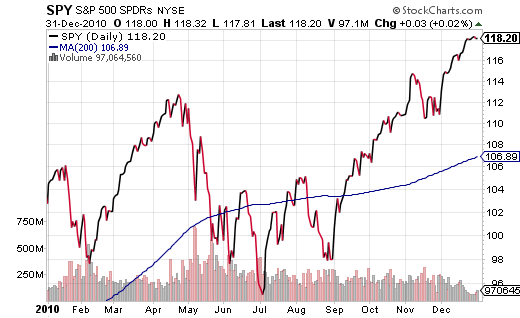

Perhaps ironically, the gains for income ETFs in the first part of 2010 is eerily reminiscent of the way that the bond markets anticipated the end of the first round of quantitative easing (”QE1″) six months in advance. At the start of 2010, it was well known that QE1 would be coming to a close in June. Yet a “soft patch” in the economy sent stocks reeling for a 15%+ correction in the summertime. Then the U.S. stock market welcomed July’s announcement of a second round of quantitative easing to commence in August (”QE2″). The news fueled stock gains throughout the 2nd half of that year.

I am not “predicting” a 1st half correction for stock assets in 2014. Nevertheless, if earnings guidance turns out to be weak, or if income ETFs continue to march higher on price gains, or if incoming jobs data are poor for several months, do not be shocked by any hesitation on the part of investors to purchase riskier assets on the dips. Instead, lower stock prices combined with higher bond prices (lower bond yields) might force Chairwoman Janet Yellen to suspend a tapering increment; if a stock correction is severe enough, Yellen’s colleagues may vote to increase its monthly bond purchasing activity.

Since I did begin this discussion with the average forecast for the 10-year yield at the close of 2014 (i.e., 3.41%), I will venture an educated guess on where it will finish. I expect a slight flattening of the yield curve to keep longer-dated treasuries (e.g., 10-year, 30-year, etc.) in check, regardless of month-to-month volatility in lengthy maturities. Couple a modest flattening of the yield curve with a historically probable shock to the “risk on” mentality, and I am offering 2.75% for the end of the year. In essence, I expect it to finish rather close to where it is right this minute.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.