Against A Currency War, The USD Holds On Even On Downbeat Data

Anthony Wu | Mar 02, 2015 06:06PM ET

US data released last night all missed market expectations. The ISD February manufacturing PMI fell for the fourth consecutive month to 53, showing the US manufacturing expansion is slowing. Also, personal spending has contracted by 0.2% implying that US families are still careful on consumption even when job market has been improving and oil prices have fallen significantly. The January PCE price index remains lower than the Fed’s target rising by 1.3% YoY, pared to USD intraday gains and supported US stocks.

However, the major peers have yet to take opportunity to bounce against the Dollar. This is most probably due to China’s rate cut reminding the market of the monetary policy discrepancy between the US and other economies.

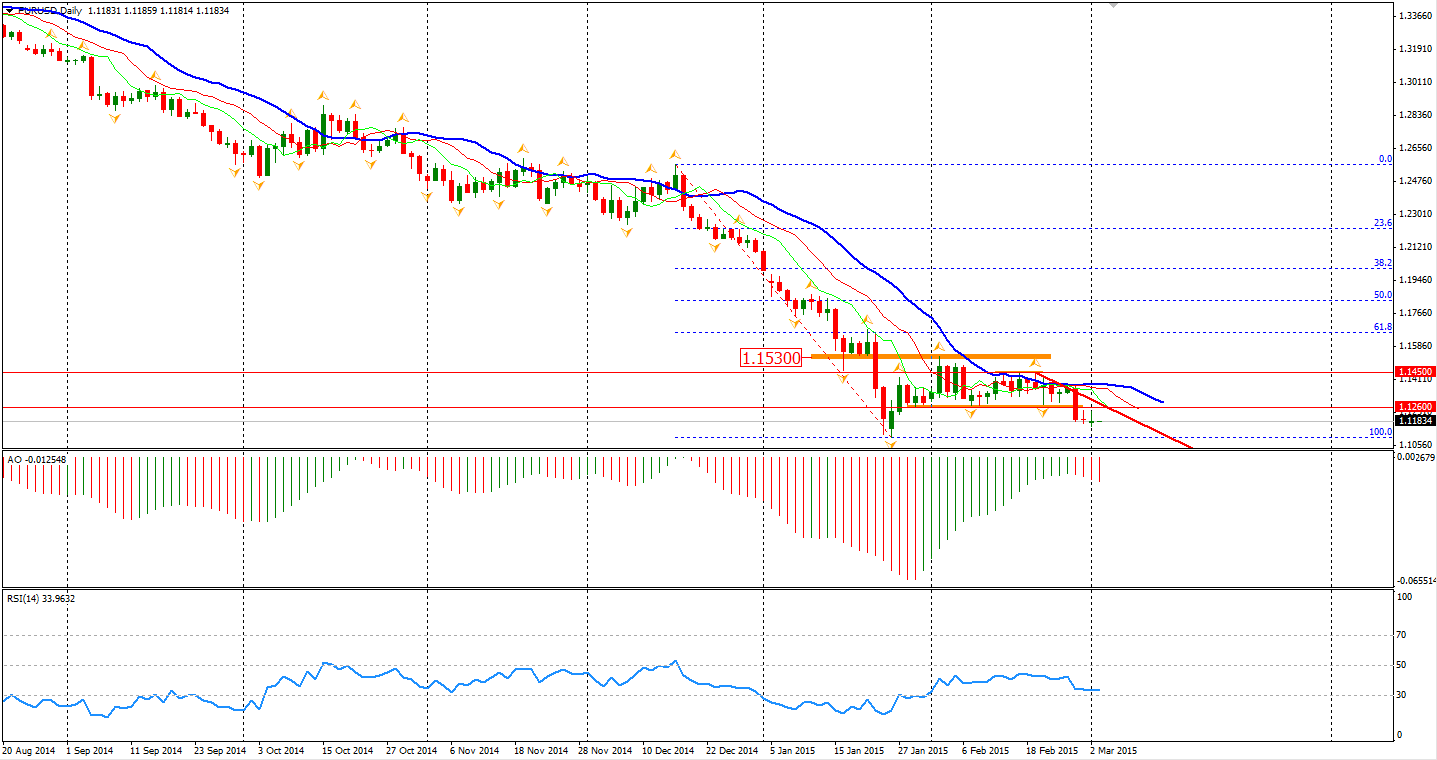

Looking across the seas, the EUR/USD fluctuated around the 1.12 level yesterday on improving Euro-area data. Unemployment rate fell to 11.2% and deflation slowed to 0.3%. However, if 1.1260 cannot be retaken within the next trading days, the Euro will probably hit a new low in the short term.

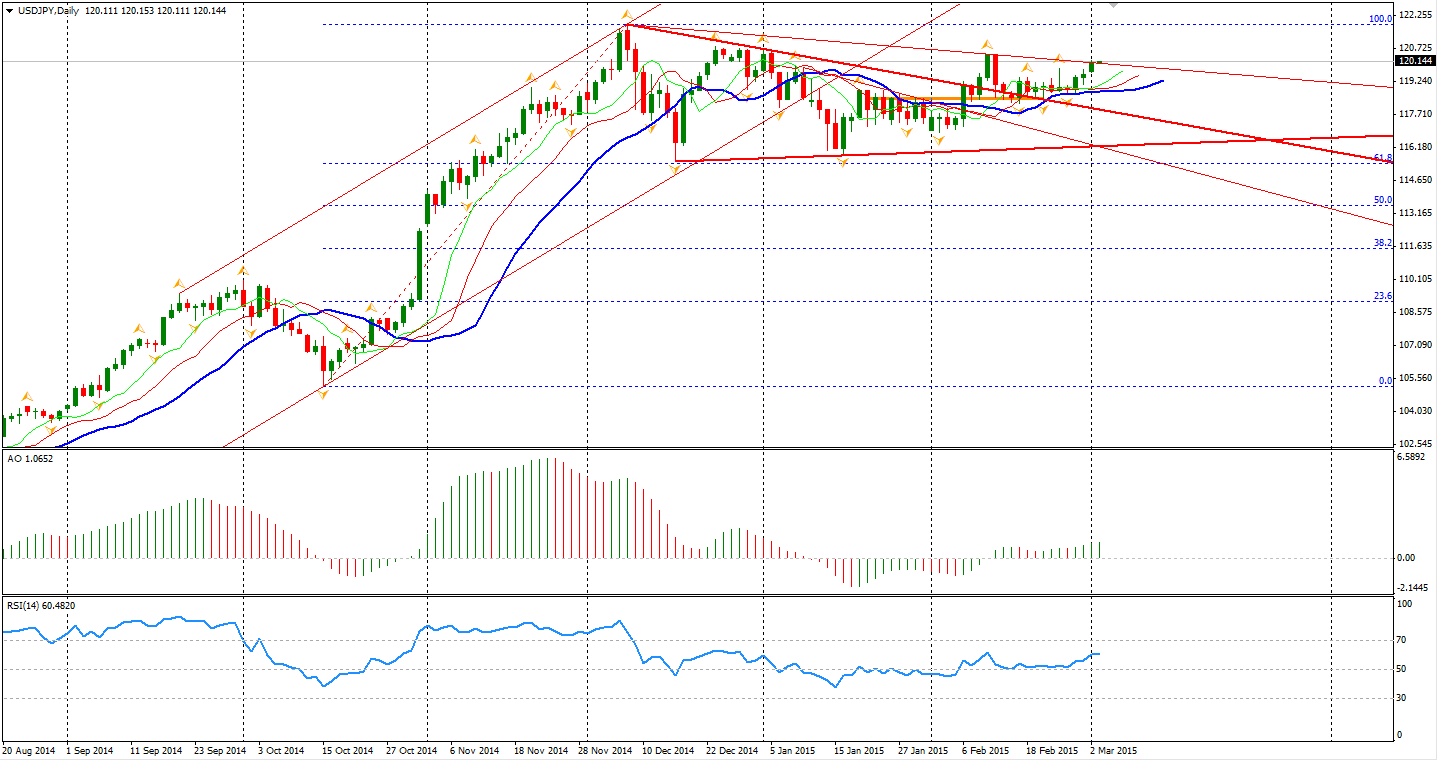

The USD/JPY rose above the 120 mark as participants again increased their speculations on further easing coming from the Bank of Japan. Japanese economist Yuji Shimanaka, who successfully predicted BOJ’s easing in last October, warned that BOJ may surprise the market again in April as inflation level falls to zero. A confirmed breakout of the 3-month consolidation wedge will imply a significant rise of USD/JPY. Former highs of 120.50 will be watched.

As to the stock markets, Shanghai Composite rose by 0.78% on rate cut. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rebounded by 0.51% to 5959. In European markets, the UK FTSE 100 was down 0.1%, the German DAX climbed 0.1% and the French CAC 40 Index lost 0.69%. The US stock indices gained as inflation level was lower than expected with NASDAQ hitting 5000 for the first time since March 2000. The S&P 500 closed 0.6% higher at 2117. The Dow rose by 0.86% to 18289, and the Nasdaq Composite Index climbed 0.9% to 5008.

On the data front, Australia Building Approvals and Current Account will be released at 11:30 AEDST. The most focused event during the Asian session will be the RBA rate decision at 14:30 AEDST – the market has priced it for another rate cut. Canada GDP will be out at 0:30 AEDST after midnight.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.