Affirm (AFRM) Launches Solution to Ease Checkout for Customers

Zacks Investment Research | Sep 23, 2021 01:29AM ET

Affirm Holdings, Inc. SHOP , Amazon.com (NASDAQ:AMZN), Peloton (NASDAQ:PTON) and others who use its instalment plan service to offer their customers.

In May, Affirm completed the acquisition of Returnly, a leader in the online return experience and post-purchase payment space. On the merchant side, this acquisition meaningfully expanded the company’s addressable market. Affirm also extended its presence in North America by closing the buyout of the leading pay later brand PayBright in Canada, earlier in January..

This fintech company is in its early stages and is incurring losses, which may continue for some more years as it expands to get a considerable market share. Investors will be looking for its top-line growth.

Per its latest quarterly updates, active merchants surged 412% to nearly 29,000 while active consumers grew 97% to 7.1 million year over year. Transactions per active consumer increased 8% to 2.3 as of Jun 30, 2021. Another key metric, gross merchandise value (GMV), soared 79% to $8.3 billion. Growth in these metrics reflects its strong business and stickiness of its products.

Affirm also provided a strong guidance for 2022, which expects GMV in the range of $12.45-$12.75 billion, revenues between $1.16 billion and $1.19 billion and an adjusted operating loss between $145 million and $135 million. The revenue view indicates growth of 33-36% from the year-ago reported figure. GMV outlook suggests an increase between 50% and 54%.

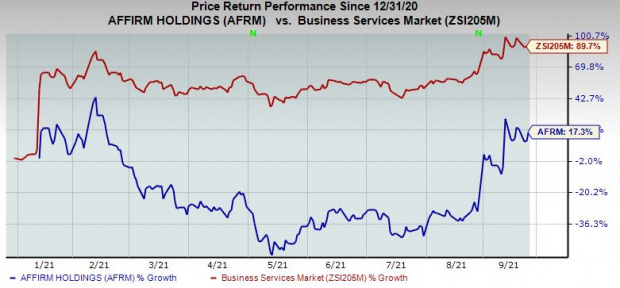

The company currently carries a Zacks Rank #3 (Hold). It should give good returns over the long term as it increases its market share and turns profitable. Since its IPO in January, the stock has gained 17.3%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.