ADP Miss Sparks Caution but Job Openings Signal Recovery Ahead

FxPro Financial Services Ltd | Jul 03, 2025 12:09AM ET

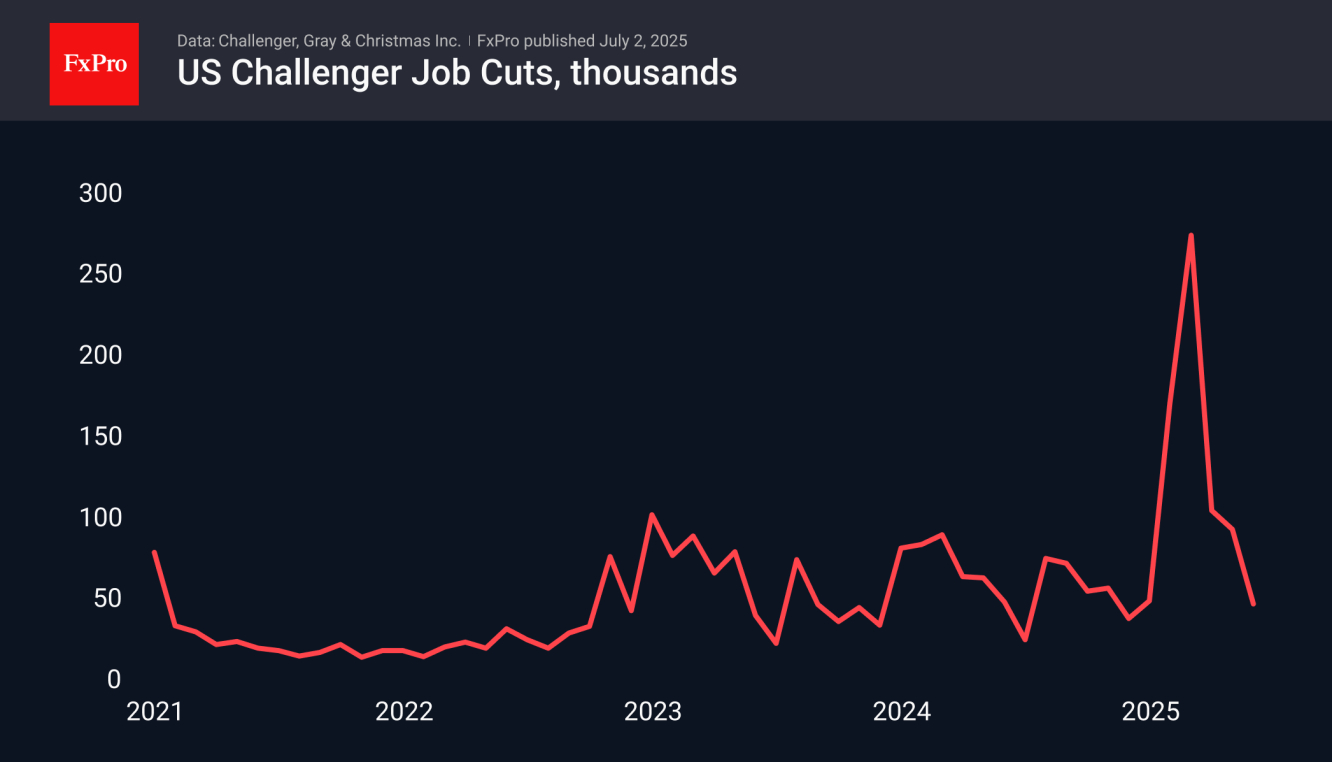

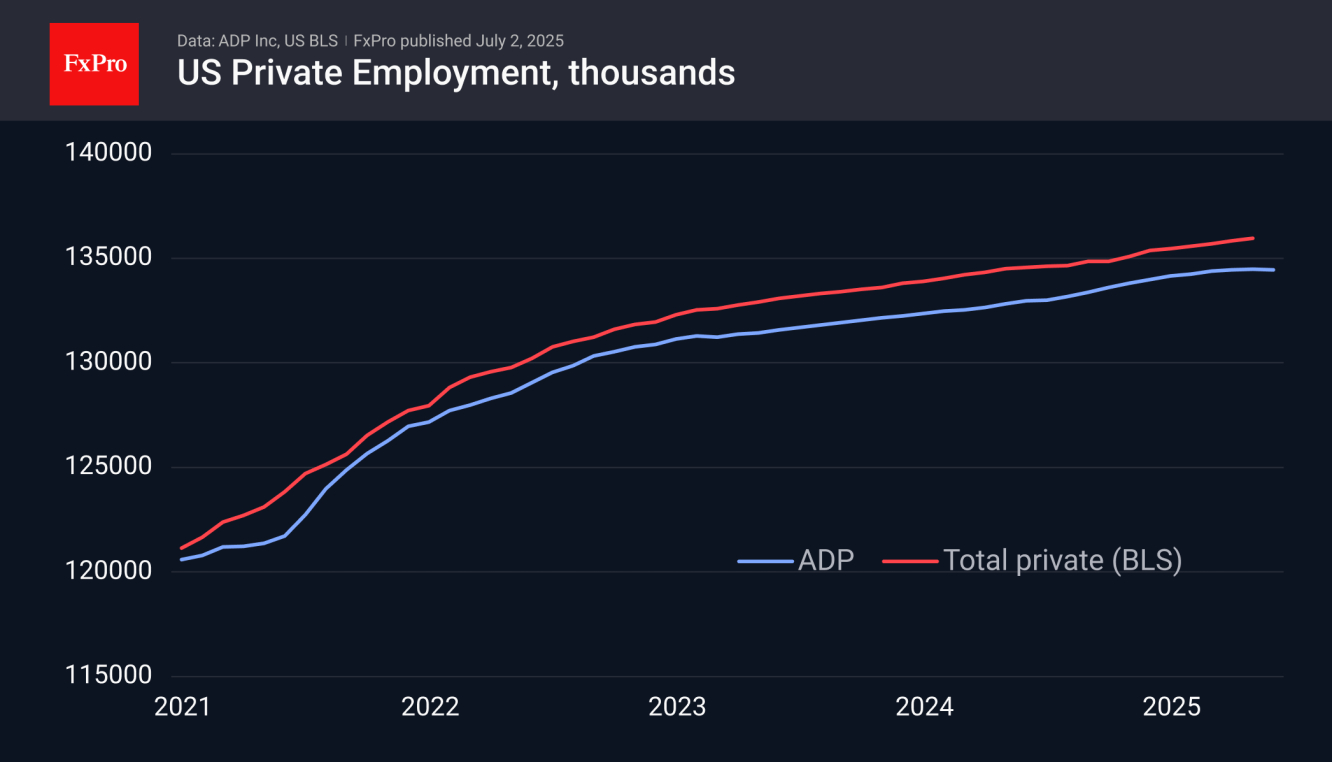

ADP data for June showed a decline in US private sector employment of 33,000, the first decline since March 2023. However, as was the case then, this may be a temporary setback, as the indicator of planned layoffs showed a decline from nearly 94,000 to 48,000 last month, which is 1.6% less than a year earlier. Planned layoffs peaked in April, when companies were shocked by the severity of tariffs, but the situation has stabilised in recent months.

The publication of ADP figures could cause increased market nervousness, reducing risk appetite, as it showed a steady decline in labour market activity from a peak of +221,000 in October, with a gradual decline and a shift to contraction in the month just ended. The official figures released on Thursday show the same overall trend, but can vary significantly from month to month. Last October was the first month of decline by 1,000 between two strong months.

The influential new job openings indicator released on Tuesday showed growth for the second month in a row, rebounding from local lows. This is an additional indicator that the economy is recovering from the shock, avoiding a further slide into recession. These are good signals for the stock market. They may also prove to be moderately neutral for the dollar if there are no further signs of accelerating inflation.

The FxPro Analyst Team

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.