Acorn Energy Is On The Rise

Scott Matusow | Oct 29, 2013 08:22AM ET

The following small cap energy play could be a real hidden gem in terms of percentage gains in the short and longer term. While small cap stocks tend to be very speculative in nature, I feel this one offers a good opportunity for both short term and swing traders, along with investors who are attracted to taking on more risk for the longer term.

Acorn Energy ( ) subsidiaries provide technology driven solutions for energy infrastructure asset management worldwide. Collectively, they offer sonar and acoustic related solutions for energy, defense, and commercial markets with a focus on underwater site security for strategic energy installations and other acoustic systems, as well as development and production of real-time embedded hardware and software. Additionally, Acorn's subsidiaries collectively develop, market, and sell remote monitoring and control systems to electric utilities and industrial facilities.

Potentially its most attractive asset, US Seismic Systems, develops and produces fiber optic sensing systems for the energy, commercial security, and defense markets. The company’'s patented ultra-high sensitivity fiber optic sensors are designed to replace electronic sensors with fiber optic sensors.

- Technology

Acorn's most interesting asset might be its O&G geophysics services holding, US Seismic Systems. US Seismic Systems designs and manufactures industry-leading fiber optic monitoring solutions for the oil & gas industry. The sensing technology solutions manufactured and distributed by USSI have been used by oilfield service and equipment companies worldwide. Designed to replace legacy electronic-based sensor systems, USSI's oil & gas systems should offer a reliable and affordable alternative for 4D and microseismic monitoring.

The new fiber optic sensing systems should enable its users to improve efficiency, increase output, and enhance safety at a lower cost than today's electronic sensor technology. With four patents issued and ten patents pending, the USSI system is designed to replace the existing 50 year-old technology. Most importantly, the technology offers a cost-effective, viable alternative to monitoring and enhanced oil recovery in the oil and gas sector.

- Potential Benefits of the USSI Fiber Optic System

» Powered only by light

» No copper wire, electronics, or electricity at the sensor

» Inherently safe, no sparks or heat generated

» Sensor data can be transmitted for miles without degradation

» Fastest, best possible performance, at the lowest cost

US Seismic is poised to see growth from major O&G clients for use in high-temperature, unconventional basins, such as finding useable oil shale reserves at temperatures of 480 °C (900 °F) to 520 °C (970 °F.

The combination of hydraulic fracturing and horizontal drilling are the key techniques that have made recovery of shale gas economically viable. Environmental concerns regarding aquifer contamination and gas migration are now threatening to limit widespread extraction of shale gas using these techniques. Meticulous monitoring during these extraction processes could allay these concerns, however, such monitoring using today's technology is simply not affordable. At less than 1/5 the cost of conventional monitoring technology, USSI is in position to be a major winner for Acorn, and could double or triple Acorn's current market cap in a year or two.

- Recent insider buys

I always like to see insiders actually buy their own company in the open market and take a risk along with the rest of us retail investors. Acorn has had some nice insider buying lately, which is a bullish sign and has been reflected in the stock price upwards trend lately.

- Jackson Mannie Director, bought 80,000 shares at $2.85 per share for a total value of $228,000.

- Andersen James,President and CEO, bought 5,000 shares at $2.85 per share for a total value of $14,250.

- Barth Michael, CFO, bought 3,500 shares at $2.85 per share for a total value of $9,975.

- Recent financing

On October 17, Acorn announced its public offering of 3,508,771 shares of common stock at a price per share of $2.85 for gross proceeds to the Company of $10 million closed. The Company received net proceeds from the Offering of approximately $9.1 million after deducting discounts and commissions to the underwriters and estimated offering expenses.

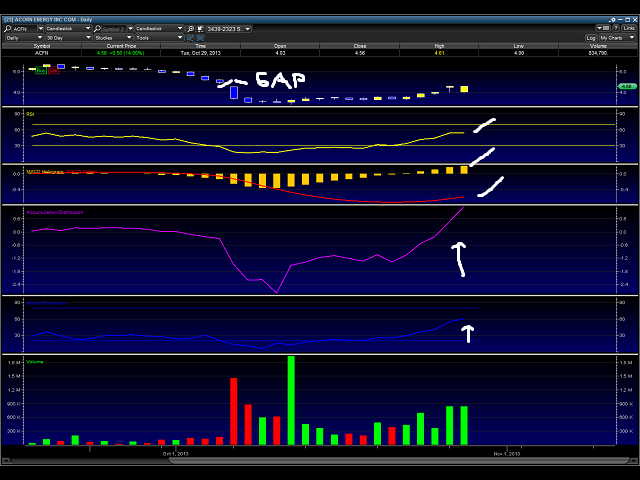

Since that time, the stock has rallied to as high as $4.61. The only warrants active are to acquire 228,070 shares of common stock at $3.135 per share, which are exercisable over five years to adhere to shareholder anti-dilution regulations. Because of so little warrant coverage, and the length of their execution, this is highly favorable towards retail shareholders. Because the company became grossly over-sold as shown in the chart below, the current entry point is very attractive.

I have drawn white lines in the chart above to show the bullish signals I see. The accumulation is very strong as noted by the purple line. The blue money flow line is charged as well, both indicating the stock could break-out in the very near-term. Additionally, I have marked where there was a gap left in the chart from investors panicking on the recent finance deal, which begins at $4.54. We can see the stock has now begun to enter the gap, and I expect it to fill it completely, which would take the stock to around $5. With such heavy accumulation and the volume yet to really break out, I believe the stock could return to the $6 level very soon.

- Conclusion

Acorn is now well financed and positioned for success. Short term chart technicals and fundamentals point to a higher stock price. Its longer term prospects are also attractive, yet carry the standard risks of a small cap energy company. With the United States slowly trying to move away from its dependence on foreign energy, many of these small cap energy companies should come into stronger focus for more risk based investors and funds. Additionally, with no end in sight for the Federal Reserve's quantitative easing program, I expect higher risk asset classes to do very well over the next year or so.

This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.