Acceleration Mode For Bull Train

Ricky Wen | Jan 14, 2020 11:26AM ET

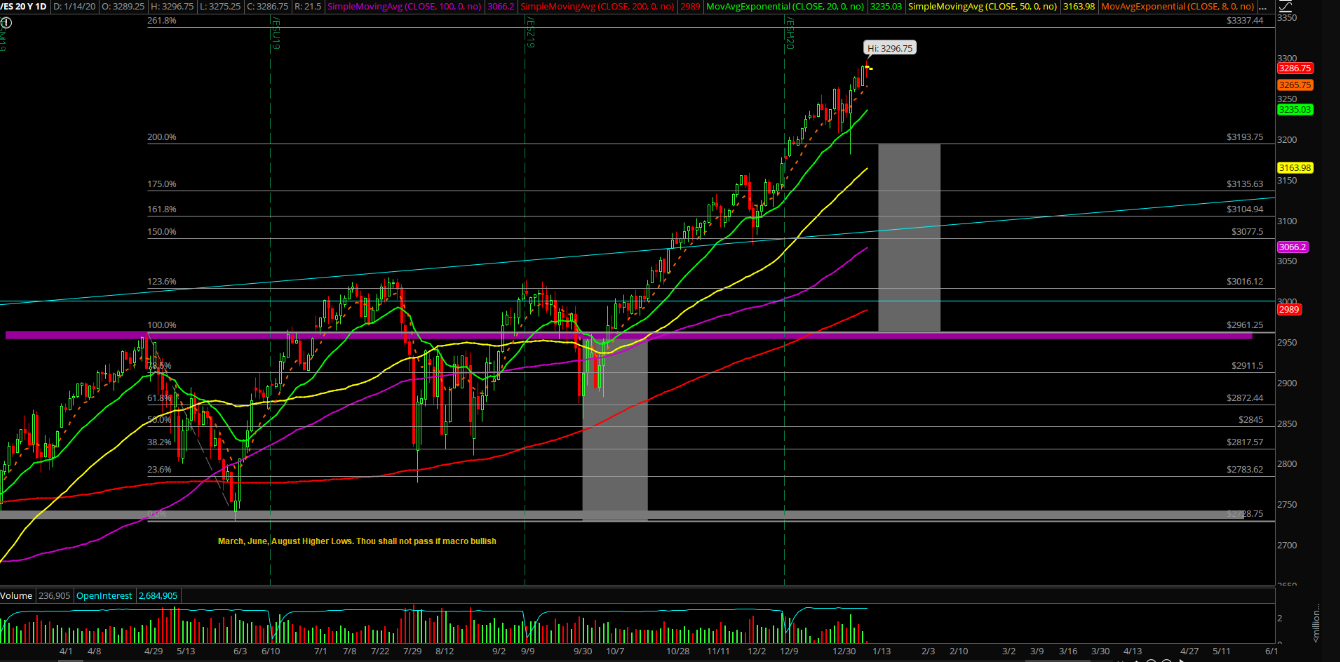

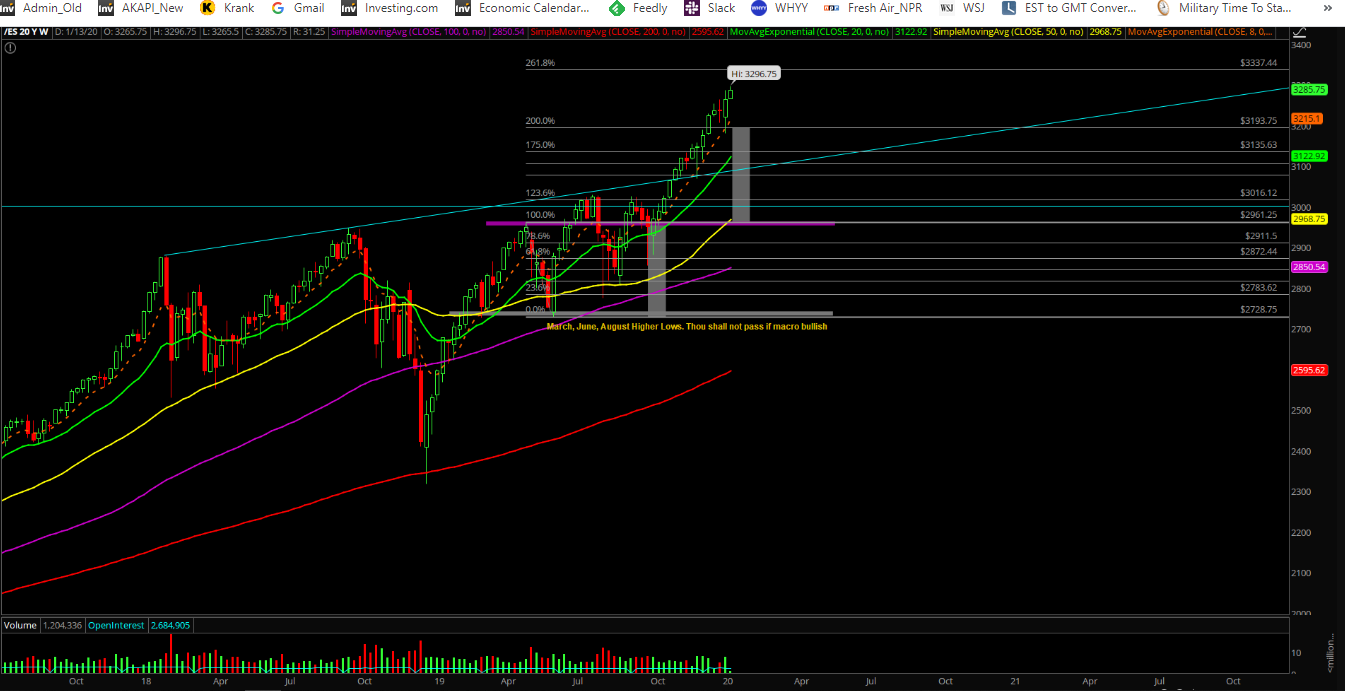

Monday’s session played out as a grind-up during the regular trading hours. Price action confirmed it was finished with the high-level consolidation structure, breaking out above last week’s high of around 3287. This meant acceleration mode for the bull train per our projections of 3280/3300 and beyond. The methodical upside grind closed at the dead highs signifying resilient strength and the same old higher lows and higher highs pattern on the micro.

The main takeaway from this session is that nothing has changed. The bull train remains quite resilient and doing everything in its power to uphold the ongoing daily8/20EMA momentum trend since October 11, 2019. Until price action actually closes below the moving averages in a decisive manner followed by at least 3 sessions below it to maintain momentum, then it’s really just déjà vu again and again. Essentially, it’s been the same old grind up structure and game plan every week now with just different levels.

What’s Next?

Monday closed at 3289 on the Emini S&P 500 as a bull bar above the prior all-time highs. As discussed in our ES trading room, one of our algo/mech systems picked up some short-term longs at the overnight lows 3270s per expectations and it looks like today is only showcasing two high probability scenarios given what occurred yesterday.

Here's a portion of our premarket ES game plan report:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.