Absence Of Open Interest Hints At Risk-Off Market Trend Resumption

Ivan Delgado | Sep 04, 2018 03:21AM ET

Commitment of Traders – Futures & Options from Aug 21st to Aug 28th

The CoT (Commitment of Traders) report, against conventional belief, does not represent a lagging indicator. The right interpretation of the data provided, published every Friday at 3:30 p.m. ET, and reflecting the commitments of traders up to the prior Tuesday, offers comprehensive insights to gauge how the smart money is positioned. Large institutions and commercials tend to leave a trail of breadcrumbs along the way, and through the CoT, we can follow what their intentions are, therefore, it should be seen as a valuable resource.

Table of the latest legacy report : these reports are broken down by the exchange, with a futures-only report and a combined futures and options report. It is then unpacked into reportable open interest positions for non-commercial (speculators) and commercial traders (hedgers).

Table of the latest TIFF report : these reports include financial contracts, such as currencies, U.S. Treasury securities, Eurodollars, stocks, VIX and Bloomberg commodity index. These reports have a futures-only report and a combined futures and options report. The TFF report breaks down the reportable open interest positions into Dealer/Intermediary, Asset Manager/Institutional, Leveraged Funds, and Other Reportables.

Historical data : in this section of the CFTC website, any entity or individual is free to download the historical data accumulated over the years of the different classified CoT reports.

2018 comparison table : this document comprises a handy personal notebook, where I annotate the most recent changes in positioning in order to assist the analysis.

In the following article, based on the Commitment of Traders report, I unpack last week’s change in futures and options positioning.The data only provides marginal changes in positioning as many trading desks around the world took the week off. The removal of liquidity was the main theme when analyzing the CoT data, which when combined with the price movements seen, it reveals some valuable snippets of information relevant to the trading of G4 FX currencies.

First and foremost, the CoT suggests a weak recovery underway in the euro vs US dollar, and it also applies to the US dollar vs Japanese yen, both running the risk of finding exhaustion as moves higher failed to garner any new commitment (via an increase in open interest) by traders. It’s also worth noticing the added pressure by commercial shorts in the Australian dollar despite the shallow bounce. From a macro view, judging by the positions of dealers and asset managers against the US dollar, the market remains long the euro, and short sterling, the aussie, and the yen.

Main Takeaways from the Euro Contract (6E – CME)

- As price traveled further north from 1.1550 to levels beyond 1.17, the decrease in open interest tells us the move was largely driven by a removal of liquidity, which more often than not, is a sign of exhaustion, which tends to lead to a topping formation.

- The move higher had a clear absence of involvement by large specs. Both sides closed longs/shorts to the tune of 10k+ contracts.

- Commercial accounts added to short positions on the move up, a contrarian play in line with the typical dynamics seen by these type of traders, who aim to hedge the underlying asset.

- There was no interest to reinstate shorts by asset managers, despite the price recovered further, which implies the outlook by the most macro accounts remains firmly bullish.

Source:CoTbase.com

Main Takeaways from the Sterling Contract (6B – CME)

- Barely any changes in open interest as liquidity in the last month of Aug was substantially thinner-than-usual. The range-bounce in prices during the same period adds to a ‘non-event’ week.

- Both long and short positions in the large specs category were closed in about equal proportions, withdrawing further liquidity from the market and making the moves more erratic in nature.

- Same picture for the commercial account, providing null clues amid range-trading conditions.

- Dealers and asset managers revealed nothing new, with the overall positioning still overly bearish.

Source:CoTbase.com

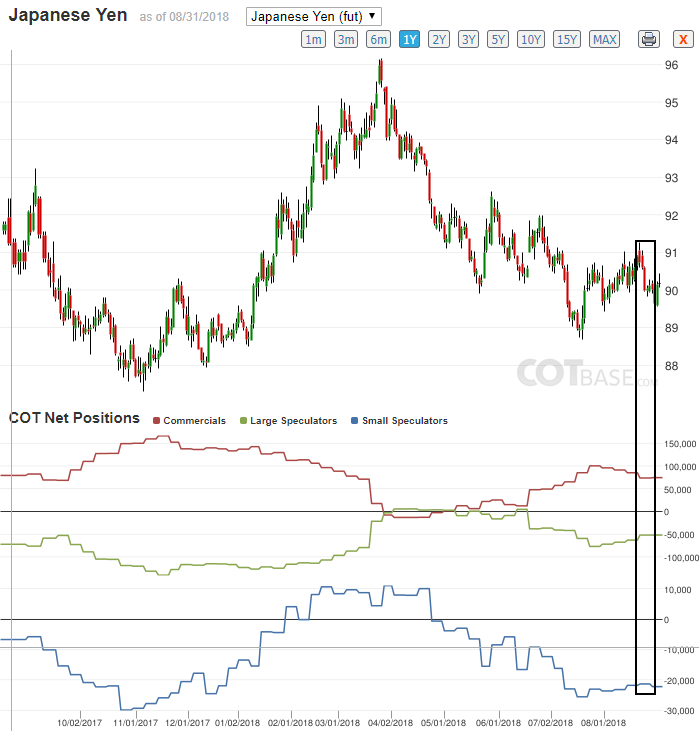

Main Takeaways from the Japanese Yen Contract (6J – CME)

- The increase in the exchange rate was not accompanied by higher open interest, which makes the recovery from 110.00 a weak one, running the risk of exhausting as long interest dries up.

- A familiar theme, with large specs long/short closing positions by about 6k contracts each, reinforcing the notion of a less substantive retracement in prices.

- There were no changes of note in commercial accounts, as the market traded in a fairly confined range, and as a result, not attracting sufficient interest to hedge positions.

- Dealers and asset managers saw flat changes in positioning during the last week of August.

Main Takeaways from the Australian Dollar Contract (6A – CME)

- Open interest saw a decline of about 4k contracts in a week that saw the aussie form a V-shape type of structure from 7350 to 7250 only to be snapped back up again.

- Specs shorts closed over 6k contracts, while longs barely badged.

- The addition of commercial shorts in a marginally down week is a negative input for the Australian dollar, as perception grows that 7350 is now an area expensive enough to scale up their exposure.

- Dealers and asset managers remain overwhelmingly bearish the aussie, with some asset manager shorts taking the opportunity to liquidate positions during the last month of August.

How to Be Positioned Going Forward?

Judging by the break down of the latest changes in market positioning, the risk of renewed US dollar and Japanese yen strength, which implies a return of risk-off conditions, looks set to be an outcome the market is preparing for. The significant absence of interest to engage in the latest ‘risk-on’-led movements as reflected by the removal of liquidity means that that leg of risk faces the prospects of being faded as exhaustion ensues. The subsequent heavy buying in the US dollar but most notably in the Japanese yen late last week as risk aversion came back, should be perceived as further evidence in line with the latest readings in the CoT report, and argues for the risk of a yen, US dollar trend resumption against the aussie and sterling as the most favourable scenario, less so against the euro, as the macro positioning remains more supportive.

Important Footnotes:

- Volume & OI: Open interest represents the total number of contracts, including both buy and sell positions, outstanding between all market participants. We should think of open interest as new business (additional liquidity). Open interest is closely linked to liquidity. Generally, to gain conviction over a potentially developing bullish market, we could analyze whether or not open interest increases, new buyers coming in, which fuels the continuation higher on renewed commitment, ideally replicated by volume increasing or at least maintaining a steady measure. If on a bullish market, the open interest is decreasing, it has a different meaning all together, suggesting shorts covering, players stopped out, and hence money is leaving the market. This information to understand move dynamics is key.

- Large Specs:The Net Non-Commercial Positions, often referred as Large Specs, comprise contracts held by large speculators, mainly hedge funds and banks trading currency futures for speculation purposes. Speculators, for the most part, have no need to use the futures market as hedging, with the sole intention being speculative in nature, buy or sell at a profit, before the contract becomes due. This category tends to carry large positions and are often guided by fundamental developments. Historically, they are characterized by being trend-followers and tend to get the right directional bias

- Commercials:Entities that are commercially engaged in business activities hedged by the use of the futures or option markets. The main characteristic of this group is that their activity orbits around the need to buy or sell the underlying contract to minimize the risk of exchange rate variations in the future. Like the large specs, this group also tends to carry large positions at times and due to the hedging nature of its activity, act as contrarian traders, best buying when prices are low and vice versa.

- Dealers: These participants are typically described as the “sell side” of the market or net hedgers. They don’t take positions to speculate for profits, but instead design various financial strategies to allocate assets to institutional clients. They help us understand supply and demand dynamics and act as liquidity providers and tend to have matched books or offset their risk across markets and clients. Futures contracts are part of the pricing and balancing of risk associated with the products they sell and their activities. These include large banks (U.S. and non-U.S.) and dealers in securities, swaps and other derivatives. These participants track very closely the open interest.

- Asset Managers: These are institutional investors who tend to act slowly in established trends, which include pension funds, endowments, academic institutions, insurance companies, mutual funds and those portfolio/investment managers who predominantly represent institutional clients. Their performance is based on the average of the industry, not in the business of taking contrarian positions and/or changing their macro view that often.

- Leveraged Funds: These are typically hedge funds and various types of money managers, including registered commodity trading advisors (CTAs); registered commodity pool operators (CPOs) or unregistered funds identified by CFTC. The strategies may involve taking outright positions or arbitrage within and across markets. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.