A World Of Negative Interest Rates

Admirals | Feb 16, 2016 07:41AM ET

Theory into practise

Negative interest rates were once confined to the models and thought experiments of economic academics.But in recent times this most unconventional of monetary policy tools has escaped from the classroom and appeared in the real world.

Deterring investors

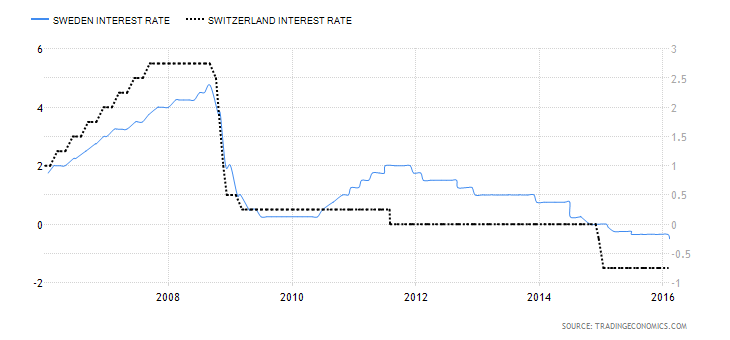

Initially negative rates were enacted by the Swiss National Bank, as they sort to discourage investors from buying Swiss francs/Swiss franc denominated assets. The demand for which, was driving the franc higher and damaging the Swiss export lead economy (the higher the value of the Swiss franc (CHF) the more expensive Swiss exports are to the outside world). Negative interest rates were also introduced in Scandinavia, firstly by Denmark and then by Sweden. As their respective central banks sort to defend the Danish krona (DKK) and its Euro Peg against speculators and to preserve the competitiveness of Swedish exports and the Swedish krona (SEK).

In both cases the thinking was that negative interest rates (under which a holder of the local currency may have to pay for the privilege of keeping their money on deposit) would deter buyers of the Scandinavian currencies. In recent weeks however the Swedish Central Bank, the Riksbank moved to push its base rates further into negative territory, cutting them to - 0.50% from the prior level of -0.35%.Suggesting that they are being forced to compete with the ECB and euro once more.

Swiss and Swedish interest rates since 2007

Going mainstream

Markets were happy to view these negative interest rate policies as anomalies, that were localised and a function of the Swiss, Swedish and Danish economies, their relationship with large trading partners and a desire to remain competitive in the world's market places.

Stories of bank loans that paid the borrower to take the banks money away were treated as quaint curiosities that would have little bearing on the wider world and its financial markets. However all that changed as both the Bank of Japan and the European Central Bank moved to enable negative rates. The Eurozone and Japanese economies are the 2nd and 4th largest economies in the world and as such could hardly regarded as simple curiosities.

Back fired?

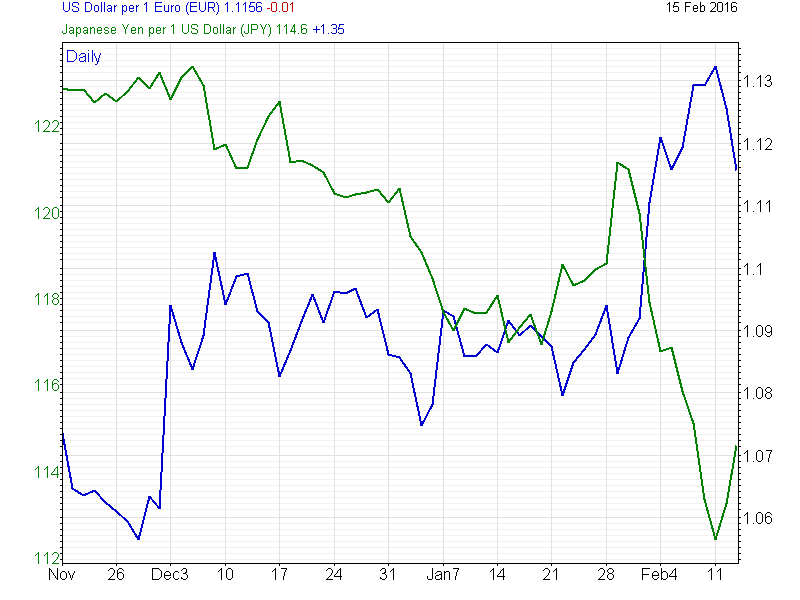

However if the central banks felt that moving to negative rates would mean that their currencies would weaken, they were mistaken. Both the yen and the euro have rallied since the introduction of NIRP (Negative Interest Rate Policy). True the yen did reverse its course in the immediate aftermath of the BOJ action. But that weakening proved to be very short-lived. USD/JPY would quickly reject the move back to Y121.69 and sell off to as low as Y 110.99 intraday, on February 10. Before the BOJ intervened to try and weaken the Yen once more but without much success.The euro for its part has rallied from lows of $1.0904 on the 3 February, posting an intraday high of 113.76 on 11 February.

These moves directly contradict what the central banks are trying to achieve. Both the BOJ and the ECB want to maintain export growth through the medium of a weak currency and at the same time stimulate flagging domestic demand. The ECB must also wrestle with high levels of unemployment political unrest and perceived financial instability in both the core (Italy & Italian Banks) and the periphery (Greece with its unresolved bail out issues, Portugal with its rising debt burden). A strong currency makes a countries exports dearer in the global market place. Stock market indices such as the DAX and the Nikkei 225 are full of exporters, which goes some way to explaining the sharp falls we have seen in both during 2016. On Monday we saw both indices regain some composure but I note the Nikkei had fallen by 15.8% year to date before Mondays 7% rally.

The chart shows recent yen and euro strength vs the US dollar.

Deep liquidity

The yen has a history of safe haven flows, which I have mentioned in prior articles. The drivers are complicated but in summary this tendency can be thought of as a function of the yens deep liquidity, even in times of crisis. Or if you prefer, investors like the yen because they believe they will get their money back, as and when they want it. There is also a deep pool of liquidity in EUR/USD and so investors feel similarly secure trading in this pair as well.The yen began to strengthen in December 2015, as we discussed in the perpetual learning curve published in mid-January.

Sea change

To my mind there has been a sea change however, because the second round of yen strength (post the Bank of Japans rate cut) bares all the hall marks of Hedge Funds and others pushing on, what they perceive to be, an open door.Negative interest rates become effective in Japan as of today (16 Feb.2016) there is much debate about what the consequences will be.

Respected economist & adviser Yukio Noguchi told the Nikkei Asian review, in a recent interview, that in the worst case negative interest rates will:

"Push down already low interest rates (that) would undermine fiscal discipline and put a burden on future generations as the government issues yet more JGBs. The BOJ should not continue gobbling up JGBs from the market after it introduces negative interest rates."

Mr Noguchi makes a valid point, if the Bank of Japan continues to buy Japanese Government Bonds (JGBs) at negative yields, through its QE program. Then they are effectively buying these bonds at a loss, if they are held to their maturity. 10-Year JGBs moved to negative yields shortly after the BOJ cut rates. Though they have moved back into positive territory subsequently.

Defeating deflation

The thinking behind the introduction of negative interest rates on the part of the ECB and the BOJ is to try and encourage businesses and consumers alike to spend money, rather than save it. For the moment at least these two groups will be shielded from charges for keeping money on deposit. As the Japanese and European central banks have adopted a tiered approach to the application of sub-zero deposit rates. To date commercial banks around the world have largely been reluctant to pass on the charges that negative rates imply. But that may change in the future as bank earnings are increasingly constrained.If consumers and businesses spend their money, the thinking goes, then that will stimulate demand in the domestic economy.Which in turn should drive up prices and squeeze deflation out of the system.

Easier said than done

However the downward pressure on prices imposed by a combination of falling commodities, global competition, the internet and the more for less expectations of consumers may not easily be dislodged. If deflation or its precursor's low-flation / disinflation remain entrenched, then we could end up in a situation where we have falling prices and negative interest rates running in tandem. Potentially the worst of both worlds. That worst case scenario may be more applicable to Japan than the Eurozone as things stand. But many commentators (myself included) have previously talked about the "Japanification" of Europe and they do seem to be headed along very similar paths once more.

Limits of monetary policy

The use of unconventional monetary policy (quantitative easing and low interest rates) spared the world from the worst aftershocks of the Global Financial Crisis and the possibility of a 1930s style depression. However monetary policy is now at the boundary of what it can achieve.Its extended use may in fact just be storing up problems that could create the next crisis.In which central banks would have few policy options available to them. To avoid this happening politicians must step up to the plate and make the significant structural changes required to create competitiveness and embrace fiscal stimulus.Both in the form of government spending & tax cuts. For the moment however these policies do not seem to be on the table in Europe or Japan.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.