Zinc: Stealth Bull Market Coming

Tommy Humphreys | Sep 11, 2015 02:18AM ET

Commodity investors are always looking for the next bull market but are understandably wary of jumping on the wagon too soon — especially given the pain of the last couple of years.

China’s economic growth is slowing, its stock market seems to be melting down, and most metals have been dragged down significantly over the last several weeks.

But an oft-overlooked metal may be on the cusp of a bull market.

I attended the Sprott-Stansberry Natural Resource Symposium in Vancouver in July, and was particularly interested in hearing legendary resource investor Rick Rule discuss the current state of the markets.

Bull markets in commodities can be created in two different ways, Mr. Rule reminded investors:

1) Demand creation – when economies grow, demand for metals increases. A good example of this has been China’s rapid growth over the past 15 years.

2) Supply destruction – commodity prices below the cost of production can lead to mine closures. These closures result in less available metal for consumption.

To summarize: as the demand becomes greater than the supply, the price of the commodity rises.

Following Mr. Rule’s presentation, I began to research metals with fundamentals that could lead to a bull market.

After much study, I have concluded that this metal is zinc.

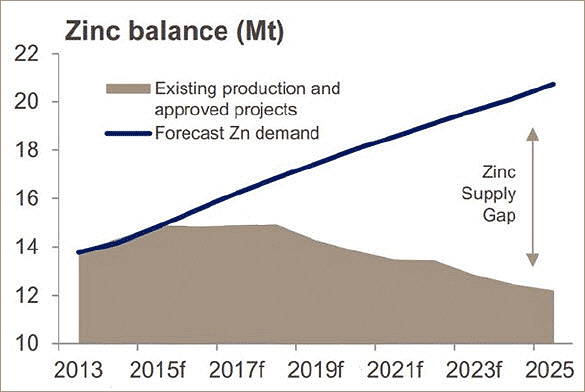

The upcoming zinc market seems to be setting up for a bull market, on both the supply and demand side. Zinc demand is currently growing at 3-4% per year. In terms of supply destruction, zinc has a unique twist. Mines are closing down not because they are unprofitable, but because they are being depleted.

In fact, the world’s third largest zinc mine, MMG’s Century mine in Australia, ceased mining operations at the end of July 2015. Stockpiles of ore will continue to be processed through the end of the year. Century produced 465,696 tonnes in 2014, about 3.6% of the world’s global supply of 13 million tonnes.

“We can’t find any more zinc of significance, which tells us even more that it’s going to be tight,” MMG CEO Andrew Michelmore said in March 2015. “We’re very bullish on zinc.” (source Bloomberg Television)

The Lisheen mine in Ireland is also expected to close in November, removing an additional 150,000 tonnes (1% of supply) from the market.

With these two closures alone removing more than 4.5% of global production, 2016 is shaping up to be a strong year for the zinc price. During the last zinc bull market, from 2005 to 2007, its price rose an astounding 179%.

Investors searching for the next hot commodity should definitely consider zinc.

Zinc’s recent past and its future

Very few companies have been focused on zinc in the past several years, meaning there has been almost no zinc exploration and very little development of zinc projects.

In the face of projected zinc supply deficits, the metal recently hit a five-year low, dipping below 80 cents as investors worried about slowing growth in China. In a July research note, the Bank of Montreal projected that demand could slow from the current 3-4% yearly growth. Economic growth is currently similar to levels seen in the 1990s when “annual zinc demand growth averaged only 2.5%,” BMO stated.

Even if zinc demand only averages a 2% increase for the next of couple years, that’s a significant spread from a 4.5% drop in supply.

Simply put, inventories will start to decline and the price of zinc should rise unless supply picks up. To pick up the slack from the closures of Century and Lisheen alone, the market will need to find an additional 615,000 tonnes.

No new major zinc mines are scheduled to open in the next few years, and very little is in the pipeline, leading us to believe there will be a very large supply gap. Scotiabank (LM:SCO) economist Patricia Mohr’s research has shown that a zinc price of $1.13 USD is needed to spur new mine development.

China is a wild card when it comes to zinc production, but analysts question whether China might be able to fill the void itself.

In a recent interview with Investing News Network, newsletter writer and analyst John Kaiser said he believes Chinese zinc supply “has peaked [and] may even decline.”

“That is not what’s being factored into people’s expectations for stronger zinc prices, which is based on a depletion of several western mines with no western mines coming on stream to replace that supply,” Kaiser commented.

A company to keep an eye on: Canada Zinc Metals (TO:CZX)

My research also involved examining every zinc-focused exploration and development company listed on Canadian markets.

One of the companies with the most leverage to zinc is Canada Zinc Metals (CZX:TSXV).

Canada Zinc Metals has several advantages over its peers, as many of them are challenged by one or more of the following issues: permitting, infrastructure problems, high capex, low-grade deposits, or stressed balance sheets.

Canada Zinc Metals has an indicated resource of 12.7 million tonnes containing 2.35 billion pounds of zinc (8.38% grade), 470 million pounds of lead (1.68% grade), and 5.6 million ounces of silver (13.7 g/t). An additional inferred resource of 16.3 million tonnes adds 2.65 billion pounds of zinc (7.38% grade), 480 million pounds of lead (1.34% grade), and 6 million pounds of silver.

The stock is currently trading at a market cap of $32 million and has about $8 million in the bank, for an enterprise value of $24 million.

A quick calculation results in an enterprise value per pound of zinc of $0.0048 cents per pound – among the lowest in the peer group.

Canada Zinc Metals’ resource estimate is based on drilling data inclusive to 2011. Since then the company has systematically drilled holes that have expanded the deposit down-dip as well as confirming the continuity of the overall resource and high-grade nature of the deposit.

The 2015 eight-hole summer program is currently in progress. On Sept. 2, Canada Zinc Metals released one of the highest-grade drill results ever on hole A-15-121.

- Drill hole A-15-121 targeted the high-grade core of the Cardiac Creek deposit with the intended pierce point located approximately 75 metres down-dip of the high-grade holes A-05-32, A-07-50 and A-07-53. The entire mineralized interval extending from 419.16 to 531.00 metres returned 7.34 per cent combined Zn-Pb and 14.24 g/t Ag over a true width of 64.29 metres. Included in this interval was 17.06% Zn+Pb over 12.98 metres.

Peeyush Varshney, Chairman and CEO of Canada Zinc Metals, stated, “The results from hole A-15-121 continue to expand the known high-grade mineralization within the core of the deposit by approximately 70 metres down-dip of the current limits.”

Canada Zinc Metals already has one of the highest-grade undeveloped zinc projects in the world.

Producing zinc mines are seeing declines in average head grades – they have declined from about 7% in the year 2000 to about 5.5% now. Canada Zinc Metals deposit, with an average grade of close to 8%, is well above the global average grade of 5.5% being mined.

Having a high-grade project has tremendous advantages – namely, higher profits if the mine goes into production and an increase in the likelihood of a takeover from another mining company.

Canada Zinc Metals’ shareholder base is among the strongest of any publicly traded junior company and includes Tongling Nonferrous Metals Group (SZ:000630), Lundin Mining (TO:LUN), Teck Resources (NYSE:TCK) and Korea Zinc (KS:010130).

Management feels the stock is undervalued at current prices and has arranged for a share buyback program of up to 7,620,721 shares.

Share price catalysts:

- Upcoming drill assays on the final six holes of the 2015 exploration program, which is expected to wrap up in the third week of September. Current plans include the release of two holes at a time as assays come in, which will result in steady news flow throughout year’s end.

- The fundamentals for a zinc price increase are robust. As zinc enters a supply/demand deficit we will see inventories drawn down.

In essence, investors early to the zinc game could be rewarded.

The name of the game is to buy low and sell high, and 2016 could be the year we see zinc reach a tipping point.

Add Canada Zinc Metals to your radar as a call option on zinc: CZX on the TSXV.

Disclaimer and Information on Forward Looking Statements: Please read carefully before proceeding. All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this article. In addition, with respect to any particular company, a number of risks relate to any statement of projection or forward statement.

Cautionary Note Concerning Estimates of Inferred Resources: This article may use the term “Inferred Resources”. U.S. investors are advised that while this term is recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize it. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of “Inferred Resources” may not form the basis of feasibility or other economic studies. U.S. investors are also cautioned not to assume that all or any part of an “Inferred Mineral Resource” exists, or is economically or legally mineable. Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

by James Fraser

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.