A Prescription For Portfolio Success – Introducing Our Newest Equity Model

Portfolio Cafe | Apr 19, 2012 01:31AM ET

Wish you could discover an investment strategy that was defensive against down markets but carried an incredible upside during bull markets? The Herculean Healthcare model attempts to do just that. Why might this be a good strategy to use and what sort of gains are we talking about?

The Healthcare Sector is Defensive

The beauty about sectors, or the market in general, is that it moves in packs. When enough stocks rise a vacuum is created pulling up other stocks that have no real reason to go up other than a ‘me too’ response. A bear market will typically punish all stocks regardless of their fundamental differences. You may have a winning stock in a depressed sector but no amount of yelling will bring investors to the table. Industries, sectors and markets move like mobs.

This is good news for those investing in the healthcare industry as you can take advantage of its defensive properties. People need doctors and medicine in all economies thus smoothing out the earnings volatility as it relates to market cycles. The perk here is that by focusing on healthcare stocks, you should benefit – at least partially – from the defensive nature of this entire sector. Sometimes it is good not to stand out as different.

The Healthcare Sector has High Growth

Not all healthcare stocks are big, lumbering defensive giants. Within this broad category are smaller companies developing novel therapies, niche markets such as pet diagnostics with a large untapped market potential and other companies that are ripe for a lucrative buyout. Within the broad field of defensive healthcare you can also find tiny rockets that really soar.

Just how do you go about finding suitable healthcare companies with these properties? Isn’t this like finding needles in a haystack? True enough, it can be challenging to comb through hundreds of small-cap stocks to find suitable candidates. But by purchasing a basket of 10 stocks through a rigorous mechanical screening process you can save time and increase your odds of having multiple winners in the portfolio.

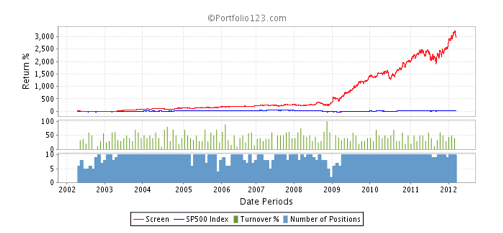

The screening rules I use in the Herculean Healthcare model includes looking for deep value metrics, American companies, and small market-cap. Simply investing in small healthcare companies over the past 10 years would have resulted in a compound annual growth rate of over 15%, which is more than 13% higher than the S&P 500. Once you add in the value ranking rules the annual return pops over 24%.

But aren’t these tiny stocks carrying higher risk, especially in light of recent healthcare reforms? Is this still a sound strategy in light of new developments? This leads me to my final trading rule that will protect you against a sector with souring sentiments.

Buying Stocks in the Recovery Room

Nobody likes to buy a stock with a terminal illness that is one step away from the delisting graveyard. What preventative medicine can you take when the entire sector is coming down with a severe case of the chills? The answer lies in singling out companies with a high chance of recovery – upgraded earnings.

My final rule looks for firms that have improved their financial outlook. If the firm goes 8 weeks and no further earnings upgrades are released – the company is cut free. How will this help keep your portfolio healthy?

The negative sentiment in healthcare stocks helps create and maintain deep value. If a firm is expected to suffer due to the healthcare reforms, this will be reflected in the analyst estimate. You will not be buying stocks that have a bad prognosis which lowers your risk. Companies with upwards revised earnings have some sort of competitive edge and a reason for prices to go up as well. Or it could be that a healthcare stock slashes its forecast (you are not invested in it) and prices drop hard. After a while analysts realize that the situation is not as dire as first thought. This firm with deep value is upgraded and this is your entry signal. It all sounds good in theory but how has it turned out in the past in our clinical trials?

Over the past 10 years this strategic investment style with rebalancing every 4 weeks has resulted in a 41% compound annual growth rate!

Get Your Check-up Now

The bottom line is that the nervousness over the healthcare sector is once again creating a great opportunity for investors. We are not marrying these companies or forecasting years down the road. Instead we look for small firms with large upside potential in a defensive sector that have just received a clean bill of health. We hold these companies as long as they keep improving and get stronger still. The Herculean Healthcare strategy is an incredibly robust system that takes the best of defensive and high-growth firms in a potion that tastes good and keeps your portfolio growing healthy and strong.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.