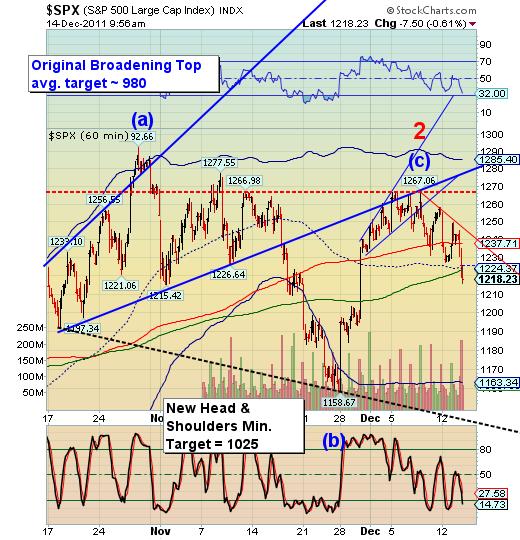

A Possible 50 Point Drop?

Anthony M. Cherniawski | Dec 14, 2011 10:49AM ET

The SPX has broken through its supports and is ready to reach escape velocity. The next target is cycle bottom support at 1163.34, but that is a soft target and may only produce a small bounce, if at all. The real targets are either the new Head And Shoulders minimum target of 1025.00 or the original Broadening Top average target of 980.00.

The euro is now in its second day below the Head and Shoulders neckline at 132.00. The mainstream press finally realizes that something is wrong the euro, but offers no course of action. Meanwhile, we have been short the euro since it slipped below the broadening wedge trendline at 137.42.

Meanwhile the US dollar is now popping its head above its head and shoulders neckline at 22.62. The new minimum head shoulders target of 24.40 lends credence and support to the broadening bottom average target of 28.50. In the meantime, the strengthening in the dollar will hasten the unwind of the US dollar carry trade and the massive leverage in the markets.

Depending on how you wish to drive necklines, GLD has slipped through a more bearish, down sloping neckline near 161.00. The minimum target on both necklines is the same, 128.68. The daily and weekly charts support this claim as you will see below.

The weekly chart GLD shows that to the half year trendline being broken this week. As you can see, the head and shoulders target of 128.68 is pretty insignificant in the greater scheme of things. Elliott Wave guidelines suggest that a minimum decline could take GLD down to its wave four low as a more probable target.

I hope your seatbelts are buckled.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.