A Note On The Purchase Of Heinz

David Merkel | Feb 20, 2013 05:14AM ET

I need to correct one thing that I wrote yesterday: 3G and Berkshire Hathaway each own 50% of Heinz, once the transaction is done. I mistakenly thought that both sides were putting up equal amounts of capital, when they are only putting up equal amounts of common equity.

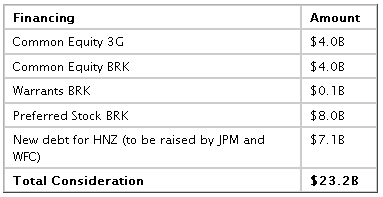

So when you look at the financing of the $23 billion purchase price for Heinz it should look like this:

The equity interest of BRK is equal to that of 3G, and if things go well with Heinz, whatever the form of the warrants are, Buffett can add to his equity interest by paying a fixed price. We don’t know the terms of the warrants — how much stock it covers, what is the strike price, how long does it last, and any other provisions. What we do know is that though Berkshire claims to be the passive investor here, it possesses the right to become the dominant investor economically, even if it does not take control as a result. This is a major reason to reject the thesis that BRK is 3G’s banker. Far better to say that 3G is Buffett’s highly paid servant. They will do the dirty work, the grunt work, and Buffett will benefit more under most scenarios.

Also, Wells Fargo & JP Morgan will be raising the debt portion of this offering. I see it looking something like this: an entity allied with Berkshire and 3G floats bonds and raises cash. The cash goes to shareholders, along with the cash from BRK and 3G, paying off HNZ shareholders at $72.50/share. The debt attaches to Heinz and not BRK or 3G. Another way would be a bridge loan prior to the merger that gets paid off by a debt offering and special dividend after the merger.

This of course makes the bond market jumpy. The long debt of Heinz has sold off, whereas the shorter debt has not.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.