How To Get 11% Dividends And A Lifetime Of Wealth

Contrarian Outlook | Oct 22, 2020 05:17AM ET

It’s the most common rule in investing: if you want to cut your risk (and protect your dividends!), you need to diversify.

Yes, we’ve all heard it before, but what most people don’t get is just how much you can damage your finances by not sticking with it—or, conversely, how much you can reap in gains (and safe dividends) by following a smart diversification strategy.

From $0 to $1 Million in Assets … and Back to $0

I’ve seen this play out firsthand; a friend was an early employee at a social media startup that got a big investment from a tech billionaire. Instantly, his net worth shot up to nearly $1 million. The only problem was that his net worth was tied up in equity with his employer, which meant that when the company folded a couple years later, his net worth dropped by a million bucks!

I feel bad for my buddy; he didn’t have a way to avoid his fate, since he couldn’t sell his shares in the still-private company. He learned his lesson; now he negotiates for a bigger salary and saves a lot more of his income, paid in real cash, by putting it to work in the stock market.

The lesson he learned is something most people don’t think enough about: diversifying doesn’t just mean investing in a portfolio that’s balanced across economic sectors—it also means buying assets that aren’t connected to your employer.

Consider this hypothetical: imagine an Exxon Mobil (NYSE:XOM) executive given two offers: the first is a $150,000 annual income with zero equity; alternatively, she can take $200,000 annually, but half of that would come as shares given to her at the end of every year. After five years, which option would make her richer?

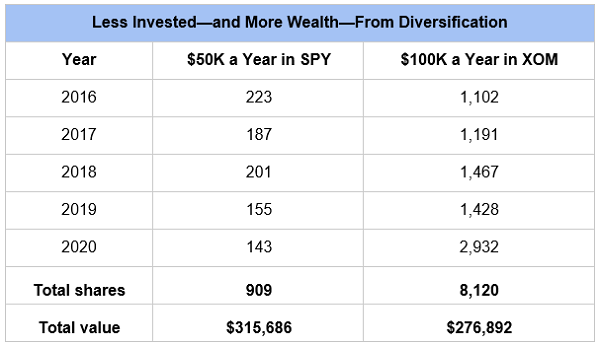

Let’s assume that our hypothetical executive uses $100,000 on taxes and living expenses in either case, leaving $50,000 to put into, say, the SPDR S&P 500 ETF (NYSE:SPY), which has representation from across the S&P 500 index, for the diversified strategy and $150K total income. Our $200K earner would put $100K in Exxon shares yearly. Who would have more money at the end of five years (for this exercise, we’ll use today’s prices as stand-ins for the end of 2020)?

After five years, the diversified portfolio is worth nearly $39,000 more, even though this investor has saved $50,000 less per year! Diversification has made her richer and put this portfolio in a much safer position.

Of course, this doesn’t apply to every executive at every company; some firms have outperformed the S&P 500 for a long time. But we know that now, not before it happened.

While Amazon (NASDAQ:AMZN) might crush the market for the next five years, it might not—and since there’s no way to know, the safer bet would be for Amazon executives to put their eggs in many non-Amazon baskets, especially if the specter of regulation and antitrust breakups keeps hanging over the company’s head.

Executive or Not: Divest From Your Work

This principle doesn’t just go for high-paid executives; everyone needs to diversify from their jobs to make sure they aren’t dependent on a single cash flow from a single source, especially with the spike in unemployment we’ve seen in 2020.

Just as you should invest in assets beyond your employer to protect your net worth in case your employer’s shares flat-line or drop (or, as happened to my friend, go to zero), you also should invest in other cash flows to protect your income.

Let me explain.

Imagine a restaurant manager earning $45,000 a year after tax whose employer will lay him off as of the end of this year. The manager is then faced with a precarious job market where millions of other laid-off workers are competing for still fewer jobs than we had before the pandemic hit.

That’s obviously a dangerous position to be in.

But the manager who diversified his cash flow by investing in a high-yielding diversified closed-end fund (CEF) like the Gabelli Equity Trust Closed Fund (NYSE:GAB) would be in a much better position.

If we imagine that employee buying $15,000 worth of GAB every year for the preceding five years (so a third of his after-tax earnings), he’ll have $78,604 in assets (again using today’s prices as stand-ins for the end of 2020). Even more importantly, those assets will get him a $741 monthly income stream, thanks to GAB’s 11.3% current yield.

Granted, this savings plan is pretty aggressive. But it means that, in just five years, the laid-off restaurant manager has gone from zero wealth to replacing nearly a third of his income by investing a third of his after-tax income.

GAB makes this possible with a diversified portfolio including large caps like Rollins (NYSE:ROL), Mastercard (NYSE:MA) and Berkshire Hathaway (NYSE:BRKa), not through high-risk bets in weird derivatives or companies you’ve never heard of. And GAB is just one of many CEFs that does this—getting us closer to financial independence through a diversified basket of assets that generates wealth and a bigger income stream over time.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.