8 Value Plays to Fortify Your Portfolio as Profit-Taking Sparks Market Correction

Investing.com | May 30, 2024 02:55AM ET

- Value stocks are coveted by investors and there has been a strong increase in demand this year.

- There are multiple ways to gain exposure to some quality value stocks.

- Let's take a look at how you can invest in them, both by buying shares and investing in dedicated ETFs.

- If you want to invest by taking advantage of market opportunities, don't hesitate to try InvestingPro. Sign up HERE and get almost 40% off for a limited time on your 1-year plan!

- Oakmark Fund Investor Class: 12.20%

- Bny Mellon Dynamic Value Fund Class A: 11% (one of the cheapest large-cap value funds with 30% exposure to financials)

- Homestead Funds Value Fund: 11.3% (one of the cheapest funds at 0.62%, with several banks among its top holdings)

Value investing, a strategy pioneered by Benjamin Graham (Warren Buffett's mentor) and David Dodd, focuses on identifying stocks trading below their true worth.

This approach involves seeking companies with strong fundamentals – think profitability, healthy balance sheets, and sustainable competitive advantages – but whose stock prices haven't yet caught up.

By buying these undervalued stocks, investors aim to lock in a margin of safety, the difference between the current price and the stock's true potential.

This margin helps cushion potential downside and amplifies gains when the market corrects and recognizes the stock's true worth. Generally, value investors seek a minimum 33% discount to intrinsic value.

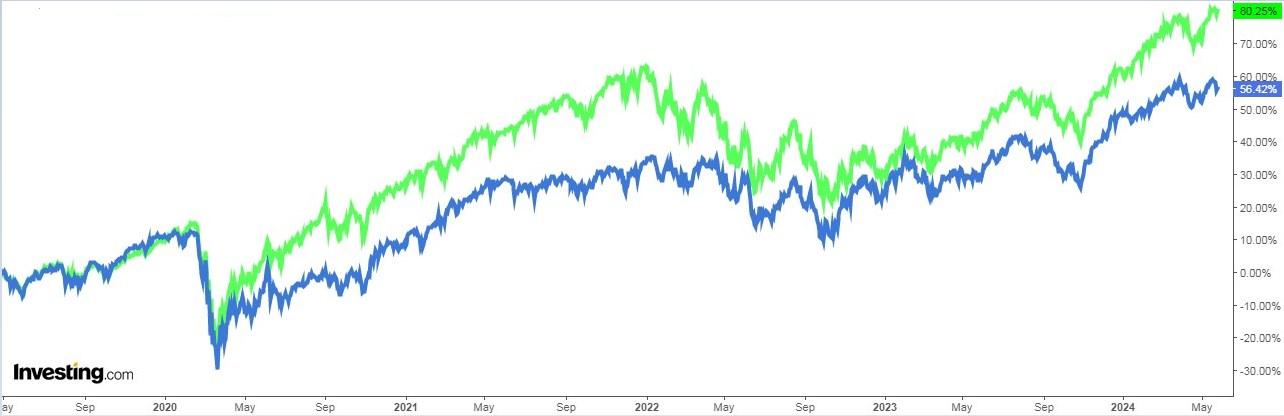

The good news is, there are plenty of attractive value plays out there. For instance, the S&P 500 Value ETF (NYSE:SPYV) (up 6% in 2024 and currently at all-time highs) offers a convenient way to gain exposure to a basket of value stocks.

However, it's worth noting that the broader S&P 500 has been outperforming this value ETF so far this year:

So, how can you invest in undervalued stocks? You have two main options:

1. Exchange-Traded Funds (ETFs): These offer a diversified basket of value stocks, allowing you to spread your risk across multiple companies. Here are a few examples with their average annual returns over the past decade:

2. Individual Stocks: If you prefer a more hands-on approach, you can research and invest in specific companies trading below their intrinsic value by double-digit margins. We'll explore some interesting options in the article below.

1. NRG Energy (NRG)

NRG Energy (NYSE:NRG) operates as an energy and utilities company for the United States and Canada. It was founded in 1989 and is headquartered in Houston, Texas.

It has a dividend yield of 1.90%.

On August 7 it will present results and for 2024, it expects EPS growth of 16.6% and revenues of 7.5%.

It has 10 ratings, of which 6 are buy, 3 are hold and 1 is sell.

Its fair value or intrinsic value by fundamentals is at $98.72, up 14.8% before Tuesday's open.

2. Kroger (KR)

Kroger Company (NYSE:KR) manufactures and processes food for sale in supermarkets and is based in Cincinnati, USA.

Its dividend yield is 2.19%.

It will report its accounts on June 13. In the previous report, it beat forecasts by 18.3%.

A few days ago it signed an agreement with GoodRx, a leading US discount provider.

Its intrinsic price is at $61.41, 15.9% above the price before Tuesday's open.

3. Target (TGT)

Target (NYSE:TGT) is a department store chain, founded in Minneapolis, United States, in 1962. It is the sixth-largest retail company in the country.

Its dividend yield is 3.03%.

It publishes its accounts on August 14, and EPS is expected to rise by almost 5%.

The market gives it an average potential of $175.77 and the intrinsic price to fundamentals is at $164.76, up 13.4% before Tuesday's open.

4. Mohawk Industries (MHK)

Mohawk Industries (NYSE:MHK) produces residential home and commercial siding products in the United States and Europe. The company was incorporated as Shuttleworth Brothers Company in 1902.

Results will be known on July 25 and the expectation is for EPS growth of 4.3%.

The P/E from the first quarter is expected to be 13.55. It has 16 ratings, of which 5 are buy, 11 are hold and 1 is sell.

Its intrinsic price is at $141.93, 21.9% above the price before Tuesday's open.

5. Travelers (TRV)

Travelers Companies (NYSE:TRV) is the second-largest marketer of home insurance in the United States and the third-largest in life insurance.

It is headquartered in New York and was founded as St. Paul Fire & Marina in 1853, merging in 2004 with Travelers Property Casualty.

On June 28 it pays a dividend of $1.05 per share and yields 1.97%.

On July 18, it will report results and is forecasting an EPS increase of 39.3% and revenue of 11.4%.

It has 26 ratings, of which 9 are buy, 15 are hold and 2 are sell.

Its intrinsic value by fundamentals is 17.6% above its price before Tuesday's open, at $250.93.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount .

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.