7 Best Dividend Stocks For July 2013

Shailesh Kumar | Jul 11, 2013 03:11AM ET

In this period of low interest rates, investors have been chasing yield. Dividend stocks therefore have been in great demand. The best dividend stocks not only offer a great yield, the companies also have a history of responsibly managing the dividend payout and rewarding the shareholders with a consistently increasing dividend. The following 7 dividend paying stocks offer great yields, some of the best dividend growth rates in their respective industries, as well as reasonably low payout ratio indicating dividend increases in the future are likely. Here they are in no particular order.

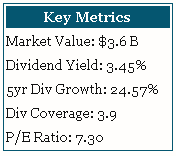

1. Validus Holdings Ltd (VR)

You want your reinsurer to understand and manage risk prudently and at the same time reward the shareholders. Validus Holdings is a Bermuda based reinsurer offering products and services in property, marine and specialty lines markets worldwide. Started in 2005, initial backers included private equity firms of Acquiline Capital Partners, Goldman Sachs Capital Partners, Vestar Capital Partners, New Mountain Capital and Merrill Lynch Global Private Equity. The company has consistently raised its dividend since its IPO in 2007 and currently offers an yield of 3.45%. Capital appreciation has been reasonable, if not spectacular. The current fear of potential clients shunning traditional reinsurance in favor of catastrophe bonds has pressured the stock to attractive levels and could be a great opportunity to take a meaningful position.

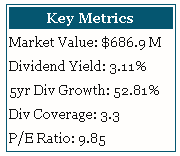

2. American Railcar Industries Ind (ARII)

American Railcar Industries manufactures hopper and tank railcars in North America and in India through a joint venture. These railcars are used to transport grains, mineral ores and other commodities including petroleum, ethanol, chemicals, etc. The company also makes parts. Carl Icahn owns 55.60% of the stock through Icahn Enterprises L.P. Between 2010 and 2012, the company has increased its revenues by 2.6 times (160%) and delivered a dividend growth of 53% on average over the past 5 years. If you are bullish on rail transportation in the US due to increased NAFTA trade as well as shale oil boom, it may make sense to buy a picks and shovel stock for the industry like ARII. At a P/E below 10, the price is right.

3. Western Union Co (WU)

Western Union provides money movement and payment services worldwide through its network of 510,000 agent locations. The stock is reasonable cheap at 10.25 times earnings and the company offers a solid dividend of 2.93% yield. Sales growth has not been spectacular but the company has an abundant cash flow with Return on Equity exceeding 100%. Private Equity firms such as Carlyle and TPG group are circling MoneyGram, Western Union’s largest competitor, so there is great interest in this segment from well qualified buyers. A solid boring company with a solid dividend in a business that is to a large extent immune from the economic ups and downs. What is not to like?

4. Safeway Inc (SWY)

Safeway is a grocery store operator in the US with over 1600 locations. The company has been steady growing. With the recent acquisition of Harris Teeter by Kroger, there is a sense of consolidation sweeping through the grocery segment in the United States. However, the bigger creator of value for Safeway is this. It has recently entered into an agreement to sell its Canadian outlets to Empire Company Limited of Canada (Sobey’s chain) for $5.8 Billion in cash. Compare this to Safeway’s current market cap which is $5.8 Billion. The deal is being reviewed by Canada’s competition board, and if approved, it means that the market is valuing Safeway’s US assets at a big fat zero. The Canadian deal includes 300 standalone stores, compared to Safeway’s US store count of 1600+.

For your reference, Safeway is the 2nd largest grocery store operator in US after Kroger.

The value here should be simple to see. While you wait for this to play out, the stock pays you a 3.3% yield for twiddling your thumbs.

5. Ford Motor Co (F)

Ford Motor Company has shown tremendous resilience during the auto downturn and seems to have found the sweet spot in the market with its offering of small and fuel efficient cars as well as its dominance of the US pickup truck market. June 2013 sales were up 13% and while the stock is up 77% in the last 52 weeks, currently trading at close to its 52 week highs, the valuation still remains reasonable at 11.32 times earnings. The company reinstated its dividend in 2012 after a break of 6 years and in a measure of its confidence going forward, doubled it to $0.10/share per quarter in 2013. The payout ratio is at 17% so there is further scope for an increase. There is a lot to look forward with Ford and it remains an American icon.

6. Norfolk Southern Corp (NSC)

Norfolk Southern is a rail transportation company operating 20,000 miles of route in 22 US states and District of Columbia. It mostly takes commercial freight, transporting raw materials, commodities and finished goods. While the dividend growth has not been significant, the company pays a solid 2.77% dividend supported by a business that is a critical part of the country’s economic infrastructure. The stock is reasonably valued and if you are looking for a long term dividend stock for income, this stock can be a great option. One of the reasons to follow rail stocks is that they are often leading indicators of a broader economic recovery (or growth).

Of the 6 stocks mentioned above, I am adding 2 of them to the Value Stock Guide Premium Watch List purely for valuation reasons. If your goal is dividend income, any and all of these 6 stocks should be a great addition to your portfolio if they pass your own due diligence.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.